Deferred Rent is a Liability account for the business.

There is a deferment of recognizing the Rent even though the payments are received.

Why does such a scenario happen?

Here’s an example for you.

False Company leases a building from True Company with a monthly rental payment of $5,000. The False Company offered a 5-year Lease agreement with a condition of the free rental period for the first three months.

Considering the long-term benefits and lucrative offer, True Company agrees to this deal.

We will understand how to record this transaction as below.

Table of contents

Now, let’s see what are the inputs for recording a transaction.

Annual Rent = $5,000*12 = $60,000

5 Year Rental Amount = $60,000 * 5 = $300,000

5 Year Rentals after deducting 3 months free rental period = $300,000-$15,000 = $285,000

Accounting follows certain established rules and regulations called accounting standards. So, Lessee (False) must consider the total rental amount as an expense for the entire lease tenure, irrespective of the free rentals offered.

So, we need straight line the rental expense over the 5 Years or 60 months.

Therefore, the Rental Expense per month = $285,000/60 = $4,750 per month

We have all the groundwork completed. Let’s switch to the accounting part.

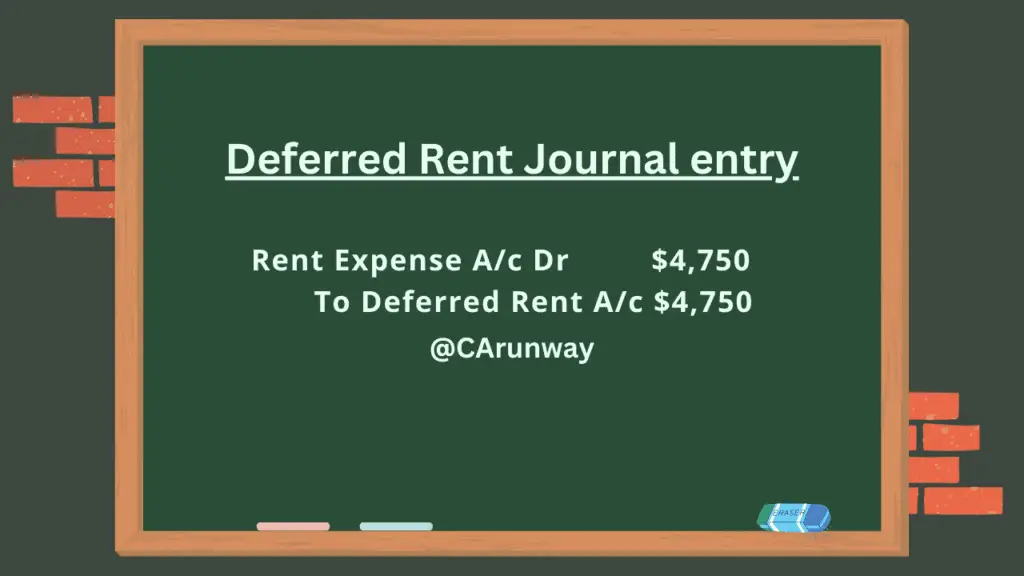

What’s the deferred rental Journal entry?

No cash payments for lease rentals during the first three months.

The above entry is applicable till 3rd month. Now, we will see how to record this transaction after the free rental period.

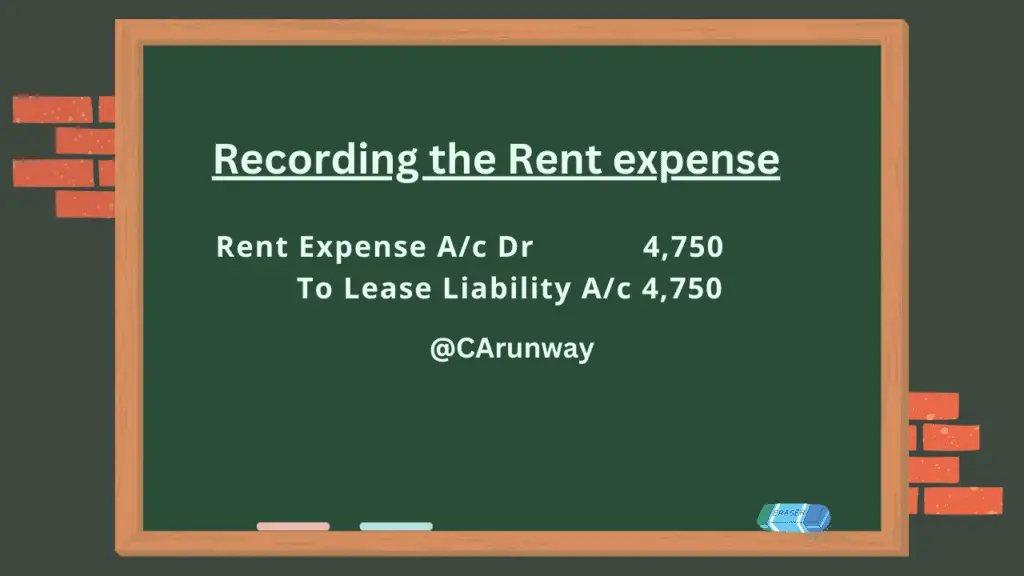

Recording the Rent expense

Here, there is no deferment of liability as the payments happen immediately. So, we will not hit the transaction to Deferred Rent. Further, lease liability is a parking account that offsets while recording the payment.

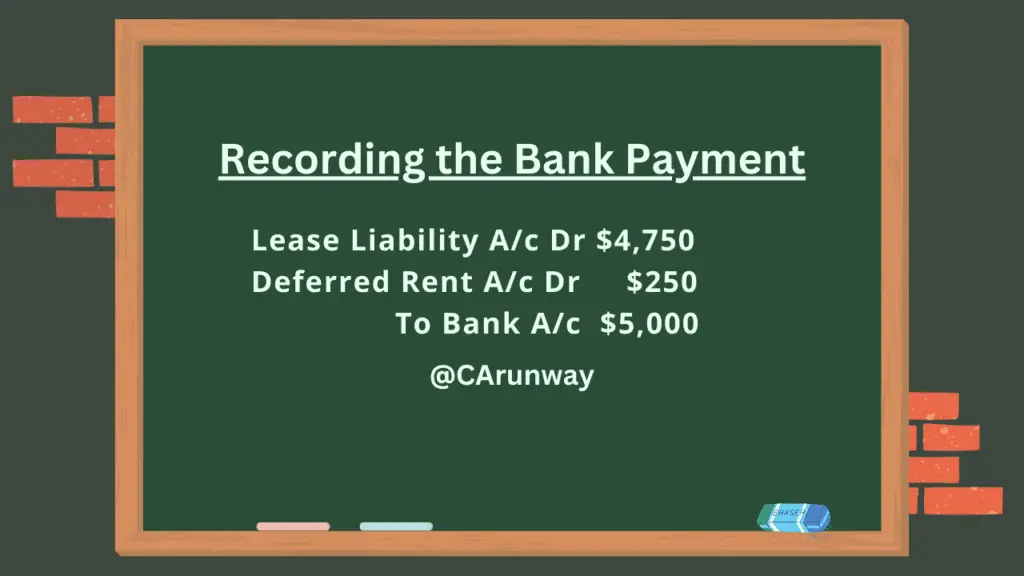

Recording the Bank Payment

The above entry offsets the Lease liability to the extent of its record in the first month. We will apply the excess payment to decrease the deferred Rent.

What’s the logic here?

We recognize the deferred Rent when there is no requirement to pay for the lease owing to the straight-line concept. So, we need to reduce it when payment is over and above the average lease amount.

In other words, we need to zero out the Deferred rent liability by the end of the lease tenure.

FAQ’s

What does Deferred Rent mean?

Deferred Rent is a concept that occurs when rent expenses exceed the actual payment. It’s like enjoying the lease benefit without payment or fewer payments. However, the entity needs to honour the rental payment at a later point due to the application of the Straight-Line lease theory. Read the above examples for a better understanding.

How to record the Deferred Rent Journal Entry?

Deferred Rent is recorded by crediting it against the rental expenses. However, it gets offset when excess payments are made over and above the average lease rent amount.

What are the examples of deferred rent journal entries in different scenarios?

Deferred Rent occurs when the

- Lessor offers a free rental period to Lessee. For example, the Lessee incurs rental expenditure after the 3rd month. So, Lessor doesn’t charge Rent on the initial two months.

- The lease agreement requires an escalation clause once a year or half-yearly. It results in fluctuating lease rents throughout the tenure. So, Lessee straight-lines the rental payments by doing an average calculation.

- Lease can be with assets such as buildings, Machinery, vehicles, etc. Considering the asset being leased, rental varies with usage—for example, a 1% increase in Rent for cars for more than 3000 Km. Lessee estimates the excess use for the upcoming periods/months/year and calculates the total amount that needs to be straight-lined. However, the Lessee revisits the straight-line rental amount if there is any significant variance in the rent estimate vs. actuals. It, in turn, changes the deferred rent balance.

Why do the vehicle owner and Lessee agree to such variable payments?

The vehicle needs periodic maintenance. An increase in usage might result in more frequent overhaul charges. So, the owner should ask for an escalation clause as they have to take care of the maintenance.

What’s the impact of deferred Rent on financial statements?

Deferred Rent is a current or non-current liability considering the lease term. The double-entry effect will be to reduce the net profits available to the shareholders or owner as rent expenses increase because of these transactions.

Critical takeaways for understanding and recording deferred rent journal entry

Deferred Rent means liability recognized as per applicable accounting standards.

We will try to spread the business costs over the period for which the benefits lasts. That’s done by estimating the total lease expenses for the full tenure and then expense it on a straight line basis. This ensures no distortion of the profits/Losses in the Statement of Profit and Loss. However, the catch is that the balance moves to zero by the end of the lease tenure.