Paid Cash for Telephone bill is to record an expense transaction with payments happening in physical currency.

So, the business forgoes Cash to gain the telephone services.

Nowadays, there are no cash transactions. I agree 100% with you all.

It mostly happens online.

But to understand the accounting process, let’s learn how to record the cash payment for telephone charges.

Table of contents

How do you record the “Paid Cash for telephone bill” transaction?

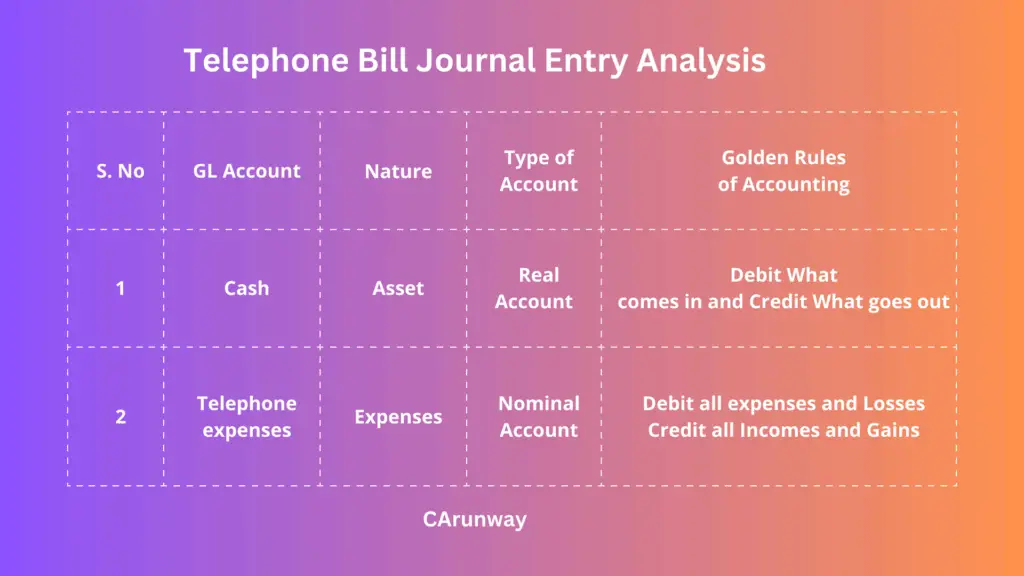

Telephone bill and Cash are the two subjects of this transaction.

Accounting rules require recording the incurred expense by debiting it and crediting the Cash if it results in payment.

So, there isn’t much rocket science here.

First, understand the accounting rules, figure out the nature of the accounts and apply the rules.

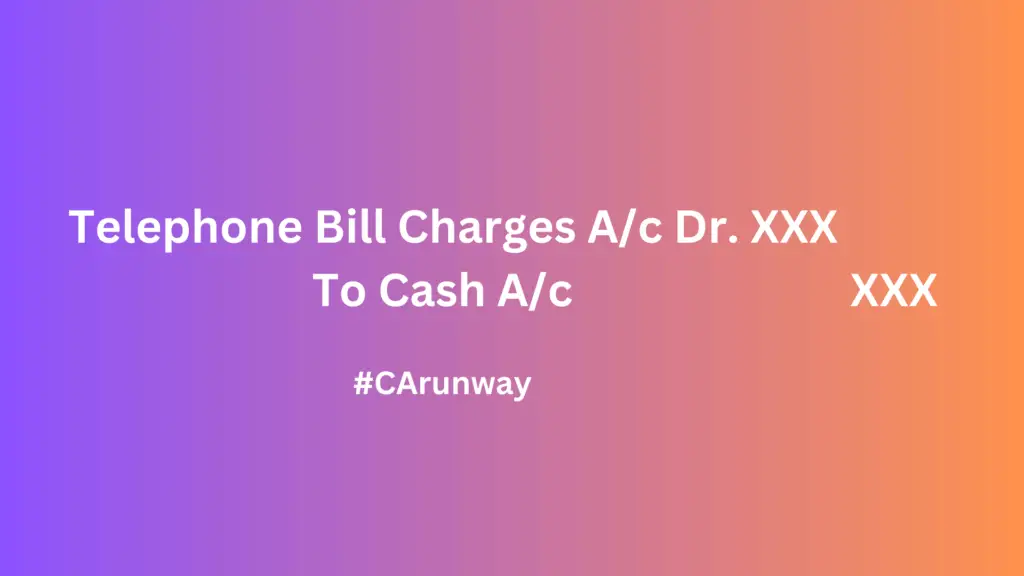

Here’s the Paid Cash for telephone bill Journal entry.

How do you record the transaction that happens through online mode?

Then, we can replace Cash GL with Bank GL.

Have you heard of the term Petty Cash?

It’s a common practice to maintain petty Cash. It’s a small amount of Cash kept with the cashier/accountant to meet daily needs such as labor charges, cleaning charges, snacks and refreshments, postal expenses, stationery, periodicals etc.

Therefore, businesses meet their regular telephone expenses through petty Cash as the telephone expenses are negligible. Further, the communication medium is more aligned with email.

How about an example?

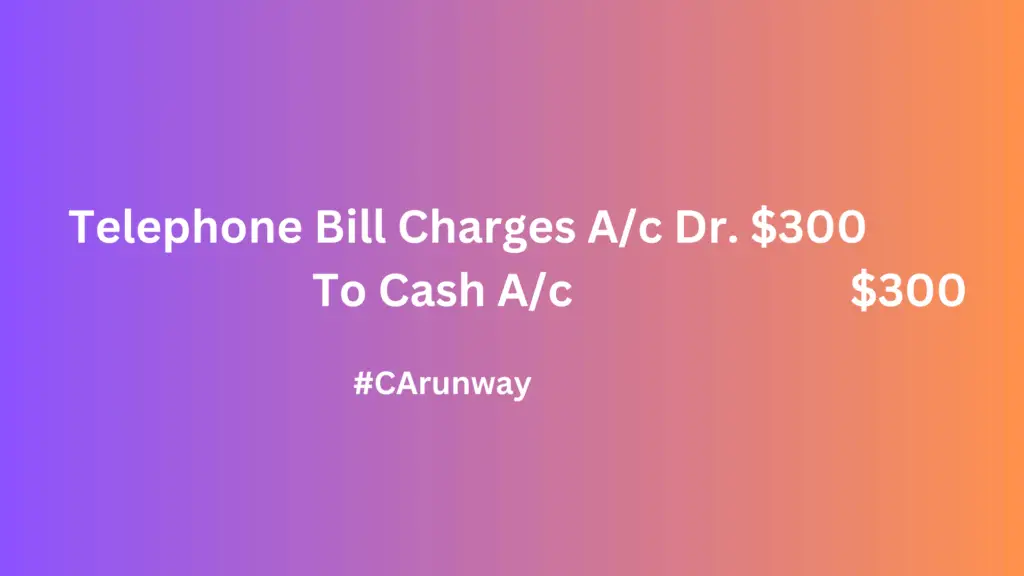

Peter bought a new postpaid telephone connection for his home. So, he needs to pay bills before the 10th of next month. The First Month’s Telephone bill amounts to $300 and is paid in Cash.

Peter needs some accounting help to record this transaction.

Accounting Solution

Peter needn’t record his residential bills as it’s not a business expense.

Accounting is journaling the business transaction to determine a period’s profit or loss. So, Peter needn’t record this personal expense.

However, if he wants to understand the total of his household expenses, then all the costs can be listed in Excel without recording the transaction in an accounting application. It might give him a good idea to analyze the unnecessary expenses.

What if this Telephone bill transaction is a business expense?

Key Note:

Ensure we record amounts accurately and choose appropriate GL accounts to journalize the transactions.

Paid Cash for Telephone Bill Summary

Paid Cash for Telephone bill is to record the regular business communication expenses. The mode of payment here will be Cash. So, we need to debit all the fees per the Nominal account rule and credit it with Cash as per the Real Account Rules.

Telephone bill is an indirect expense. However, it doesn’t form part of non-operating activities. The primary step in recording transactions is to familiarize yourself with the business and the nature of the trade and learn the accounting rules to apply for a specific transaction.