Rent Receivable is an asset to the business

It Falls under the current asset group.

What’s the Purpose of Recording Rent Receivable Entry?

Accountants needs to capture every financial transaction precisely in the books of accounts. This is a driving step for building up a reliable financial statement. The stakeholders will be able to get a true picture of business operations. So they can reflect on their decisions to invest in or exit the business.

What are the prerequisites for recording an entry?

Journal Entry requires at least two GL accounts.

Think of See-Saw.

Does it get balanced with weight on just one side?

That’s an obvious “No.”

So, we need to have a minimum two GL accounts.

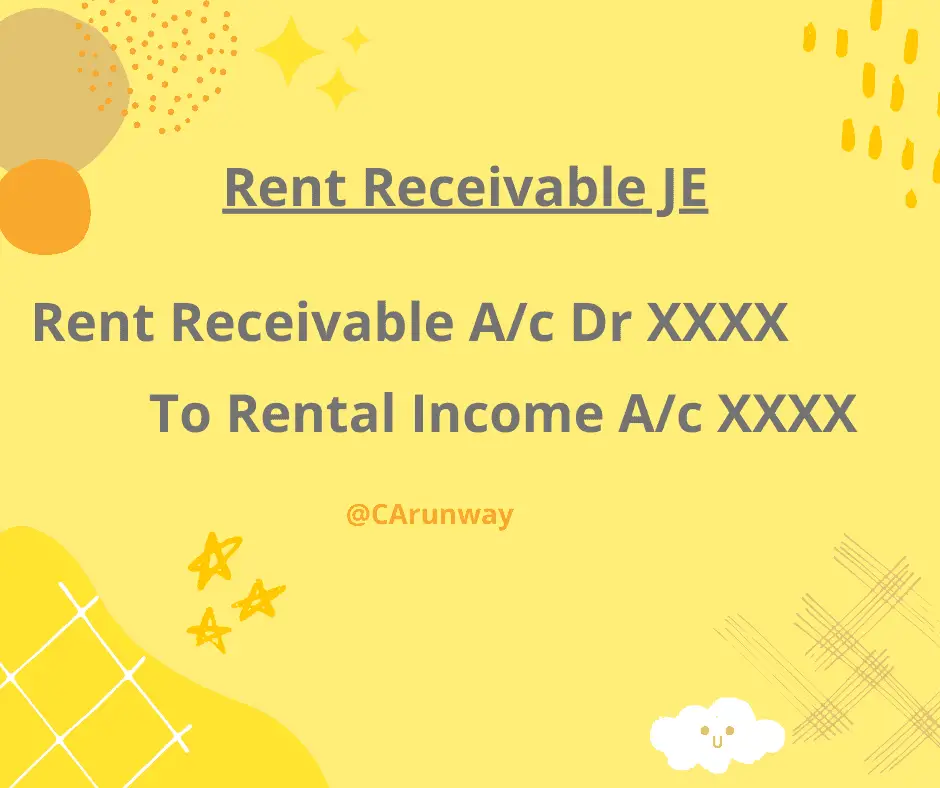

The foremost step is to identify the Ledgers in this financial. Those Ledgers are Rent Receivable and Rental Income.

Table of contents

How to record the Rent Receivable Journal entry?

We are good with the GLs.

The next step is to identify the nature of these Ledgers.

Rent Receivable is an asset (which has a default Debit balance), and Rental Income falls under the revenue group (with Credit balance).

Per Accounting rules,

- Recording an asset requires debiting the GL account. Assets will have a debit balance. So, we can increase the debit balance GL by recording it under the debit side of the Journal entry.

- When you record an income, you must credit the GL account. Revenue GL will have a credit balance. Therefore, we can increase it by recording it under the credit side of the journal entry.

Now that we have all the inputs ready, we can move on to the core step of recording the rent receivable transaction.

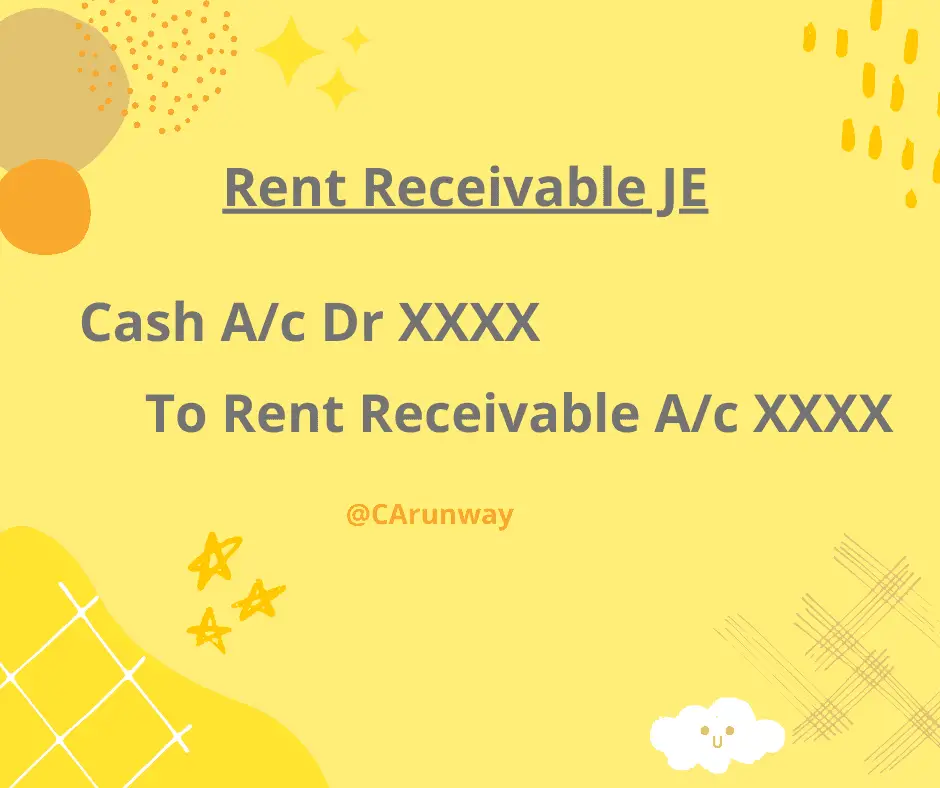

What’s the subsequent journal entry here?

Rent Receivable is a substitute GL for Cash.

In other words, it’s a parking account till the business receives Cash.

We call the period of converting a Debtor balance to Cash as credit period allowed to the tenant.

Let’s see the what’s the journal entry to record after the credit period is complete.

The above two entries result in the following outcome:

- Rent Receivable gets offset

- Cash will be on debit side and Rental Income on credit side of the journal entry

Example

Ms. Buddy Bear owns a Commercial Property in Ding Dong City. The property comprises 4 Floors, each with five shops available for lease. Below are the rental amount details.

Any Leased shop requires a non-refundable security deposit of $100,000 with a minimum lease term of 2 years. The Lease Cost is $15,000 per shop for each month. An advance amount of $30,000 is to be paid just after entering into the Lease agreement. This advance will be adjusted against the Lease rent payable towards the end of the Lease term. Rental amount increases by 10% every year from the Lease agreement date.

Mr. Minion is a new Cloth Merchandise businessman in the city. He is looking for a well-established property in a prime location in the city. Per his research, he learned about the Ms. Buddy Bear Commercial property. So, he gave an advance of $50,000 to book a shop for lease. However, the agreement happened after the close of the current financial year.

Ms. Buddy Bear is worried about how to account for this transaction and needs the help of an expert accountant. So, she is asking for our help.

Further, she entered a lease agreement for seven shops this year.

Solution

Let’s Calculate the numbers involved here

1) 7 Shops

Non-Refundable Security Deposit = $100,000*7=$700,000

Lease cost = $15,000*7=$105,000

Advance received = $30,000*7 = $210,000

2) Advance received for new shop = $50,000

Now that we understand numbers, we can record the journal entries.

Entry is to record the Non-Refundable Security Deposit.

There’s an inflow of Cash.

We can consider this as Lease income, as there is no obligation to repay or adjust it against future Lease rentals.

Cash and Income GL accounts will increase with this transaction. As Cash and Income GL accounts have a Debit and Credit balance, we must debit the Cash and credit the deposit account in a journal entry.

Rapid FAQ’s

What is rent receivable in accounting?

It’s a Current Asset similar to Debtors.

Where is rent receivable recorded?

Debit side of Journal entry when it’s first recorded. Later, it’s credited on receiving the rent amount.

Is rent payable a debit or credit?

Credit Side of Journal Entry to record the liability

What is the rent receivable?

Rent Receivable is an amount due from the tenant as a consideration against the leasing of building or equipment.

Summary of Rent Receivable Journal entry

Rent Receivable is one of the highly liquid current assets against renting service provided. Recording such transactions is a simple accounting formula. If you know how to record a sales transaction, you are sorted. We need to replace the Debtors with Rent Receivable on the debit side of the Journal entry and Sales revenue with Rental revenue on the credit side of the Journal entry.

In Accounting, there is a proper linkage for everything. Recording of the transaction runs parallel to others. If you have accounting fundamentals at your fingertips, you are good to go. We hope this article added value to your knowledge base. Spread the Love by sharing this article!!