True up Journal Entry are recorded to ensure that an Entity’s financial statements accurately reflect its actual financial position.

A true-up is a process of updating the incorrect or out of date Journal entries to reflect their current balances. Adjusting depreciation amounts, inventory costs, or other assets or liabilities falls into these category.

To ensure accuracy, true-ups are often required to be done regularly, usually at the end of each fiscal year.

How about an example here?

Let’s assume an entity, Friends and Enemies wants to prepare quarterly financial statements and wants to finalize the books. So, the entity records the following expenses on the historical period estimate.

Electricity Expenses and Sewerage Charges are $50,000 and $40,000, respectively.

But the entity missed considering the two invoices from its offshore branches. So, it needs your help in recording those.

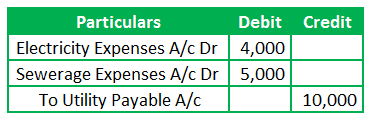

Details are below.

Offshore Branch#1 Electricity Expense – $4,000

Offshore Branch#2 Sewerage Expenses – $5,000

What’s the solution here?

A True up journal entry needs to be recorded similarly to a typical entry, just that we are increasing the expenses by passing a true-up entry.

By performing true-ups, businesses can ensure that their financial statements are up-to-date and accurate, which is essential for maintaining trust from investors and creditors.

Making true up journal entry can provide several benefits to a business. Lets learn those.

Benefits of recording True up Journal entry

- It ensures proper matching of expenses and revenues, as they should be per the matching principle.

- It also helps to reconcile discrepancies between past and current periods, providing an accurate account of all financial activity.

- True-up entries can automate creating and managing adjusting journal entries, streamlining the accounting process, and freeing up time for other tasks.

- Lastly, it provides an integrated system for tracking and managing corporate accounts, enabling a business to ensure more accurate reporting and reliable financial statements.

Common Mistakes to avoid while recording true up journal entry

- Ensure there are no Data entry errors by self-reviewing all the entries before posting.

- Document every entry to avoid confusion down the line.

- Follow a regular accounting schedule to ensure accuracy and consistency.

- Also, double-checking the entries’ accuracy and ensuring usage of correct general ledger accounts is essential.

Conclusion

A true-up is an excellent way to ensure that you have made the correct entries and recorded the right information. Thus, enhancing the credibility of the financial statement.

Said differently, we record the omitted, incorrect, or accounting adjustments through true-up journal entries.

We hope you’ve better understood true-up journal entries and their importance in keeping accurate records. If you have any questions or comments, please feel free to contact us through the contact us page.

We love to answer those! Thank you for reading!