Trying to understand the accounting of repair and maintenance journal entry?

Pat yourself on the back. You’ve found the ideal blog.

The definition of repairs and maintenance will be covered first (of course with an example), followed by journal entry, provision for repairs, frequently asked questions, and key takeaways. Without further ado, let’s get right to the point.

Table of contents

- What counts as repairs and Maintenance?

- Example

- Accounting for Repair and Maintenance Journal Entry

- Provision for Accounting for repair and Maintenance journal entry:

- Frequently Asked Questions

- Key Takeaways from the topic – Accounting for Repair and Maintenance Journal entry:

What counts as repairs and Maintenance?

Repairs and Maintenance GL account is to record

1) All the cost of repairs, such as

- Materials,

- Labour and all incidental expenses

And

2) Maintenance charges to keep Plant & Machinery (or any Fixed Asset) in working condition.

Note: Maintenance ensures that assets function properly and outputs do not deviate from expectations.

Example

Here’s an example of Maintenance charges.

ABC Company owns a quite large data centre. It hired a technical agency team to ensure that the data centre’s operation would not be disrupted. The agency team’s responsibility is to ensure that there are no potential issues with backing up resources and that the data centre operates normally.

Each week, the agency team conducts a test check. It uses electricity and causes the entire office location to stop working for an hour. So, 1 percent of monthly revenue is lost due to this hour of disruption.

Here, all the following expenditure falls under Maintenance costs –

- Technical Agency team AMC Contract Charges

- Electricity Charges

- Percentage of Revenue Loss

Runners Insight

Entities may not be able to accurately assess the revenue loss. So, it may be a necessity to seek the assistance from the professionals in the relevant field (Experts).

The consideration of the above fundamentals is helpful in determining whether or not the transaction fits into this category.

The consideration of the above fundamentals helps determine whether or not the transaction fits into this category.

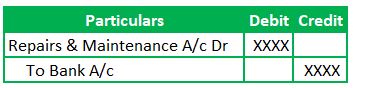

Accounting for Repair and Maintenance Journal Entry

Why do we need to debit Repairs and Maintenance Account?

In General, the repairs and Maintenance account falls under the indirect expenditure category. However, it can fall under the operating expense group as per the nature of business operations.

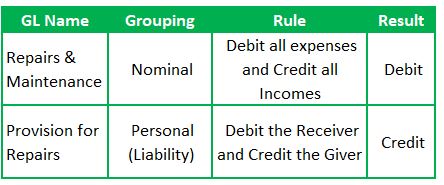

Accounting follows certain rules to record journal entries. Rules are applicable as per the applicable account grouping. We have three groups – Personal, Real, and Nominal Account groups.

Refer to the Journal Entry article for understanding these with examples.

For quick reference, we can count all expenditures under Nominal Account. The Nominal Account rule is “Debit all Expenses and Losses and Credit all Incomes & Gains.“

So, we chose to debit the expenditure account to record the maintenance transaction.

Next Read: Accounting for Sale of Machinery

Why do we need to credit the Bank Account?

Bank Account falls under the Real Account grouping. So, the applicable rule here is “Debit what comes in, and Credit Goes out.”

Here, the entity spending amount for repairs results in an outflow of funds. Hence, we credit the bank account as per the rule.

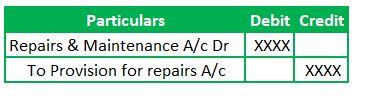

Provision for Accounting for repair and Maintenance journal entry:

Even though there isn’t an invoice or other paperwork confirming the completion of the repair or Maintenance, we need to document the expenditure through a provisional journal entry. That’s how accounting should be done.

The main justification for this approach is to document the transaction if the business incurs it. Therefore, there cannot be a delay because an invoice has not been received.

How about an example?

For instance, we have not recorded the electricity expenses because there isn’t a bill receipt. Then, it will result in recording 11 months bill for the current year. That’s not appropriate.

Journal Entries for this transaction is

We need to record the Provision for Repairs entry at the end of the month/period. We record an estimate of the expenditure. So, it’s not 100% accurate.

The thumb rule here is to arrive at estimation with the help of historic data.

We reverse the entry on the first day of the following month or period. We need to account for the actual expenditure based on the bill received.

Accounting Analysis:

Frequently Asked Questions

1) When should repairs and Maintenance be capitalized?

Replacement of specific spare components for the plant and machinery will be a part of repairs and Maintenance. Therefore, entities need to be aware of whether those additions fall under the category of capital.

How can we figure out whether that’s a capital addition or not?

The thumb rule is to consider the value of additions. We can classify it as a maintenance expense if there is no improvement in how the Asset operates. If not, it will be a new asset, and we must decide the depreciation life.

Expenses for major repairs alter the Asset’s entire state and are enormous in proportion to the Asset’s value.

2) How to do accounting for Repair and Maintenance Journal entry?

We will debit the repairs and maintenance journal entry and credit the bank account.

3) Is repair the same as Maintenance?

We often use the terms Repairs and Maintenance as synonyms. That is incorrect. There is a distinction between the two.

Performing repairs helps in restoring an asset’s original functionality.

In contrast, there is no faulty machine function in the case of Maintenance, but we do not want any variation in the working. In other words, Maintenance is similar to a preventive measure.

How about a real-life example here?

Let me illustrate this with an example from the medical field.

Surgery is a repair cost, and an annual health check up falls under the maintenance expense category.

4) What type of expense is repair and Maintenance?

Repairs and Maintenance is an operational expenditure. Those are direct expenses to ensure the smooth functioning of fixed assets.

5) Is repair and Maintenance an operating expense?

Yes, repairs and maintenance expenses will be part of the operating expense. The only condition here is to check whether such expenses result in capital additions. If it is not the case, then we are good to call it an expense. Else, it will be part of Asset.

Key Takeaways from the topic – Accounting for Repair and Maintenance Journal entry:

- Repairs and Maintenance GL account and Bank GL account are debited and credited, respectively, to record this transaction

- Entities need to check if the expenditure falls under revenue or capital nature.

- Repairs cost falls under operating expense

- Like any other provisional expenses, we will debit the repairs and credit the Provision.

- Repairs and Maintenance are two different terms. For ease in accounting, we grouped those two terms as one GL.

- Repairs and Maintenance improves the operation of Asset.