Machinery is a Fixed Asset that assists in achieving the primary objective of the business, such as Manufacturing goods, Processing raw materials, etc. So, the Purchase of those Machinery will involve high costs, and the size of such Machinery will be so huge that it might take a couple of days to install it. We need to account for all the following charges incurred by the entity to record the installation of machinery journal entry.

- Purchase Cost

- Taxes, if any

- Freight charges, if any

- All the Costs incurred till the asset is placed in service.

- Installation Charges and related Electricity expenses

Table of contents

Why do we need to Capitalize on all these expenses?

All the above expenses relate to Machinery. If there is no purchase of such Machinery, the entity will not incur these charges.

Said differently, the benefits arising from such Machinery will not be just for a year or two. It reaps benefits throughout its useful life. So, we need to Capitalize on all these expenses. It results in Matching the revenues with costs in the form of depreciation throughout machinery usage.

That’s the Logic behind adding all these costs to the Machinery Cost.

Also Read: Contingent Assets

What about the Trial Run Expenses?

Conducting the trial Runs is to verify the functioning and output of a Plant & Machinery. So, there might be revenue generation from the sale of such output. Its general practice is to capitalize on all such expenses after reducing its revenue.

If there is any malfunction, vibrations, or faults in operation, then corrections are possible before it worsens. So, a trial run is a crucial step in installing Machinery.

Installation of Machinery Journal Entry

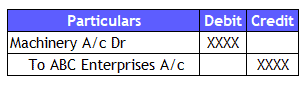

1) Entry to record the Purchase of Machinery

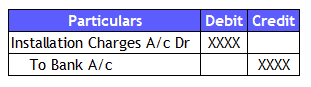

2) Capitalizing on the Machinery installation Charges

Installation charges incurred

We will incur the installation expenses and then we need to verify and confirm the expenses that needs to be capitalized. Lets record the Capitalization entry.

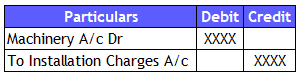

Capitalizing the installation Charges

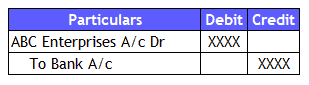

3) Payment entry

Frequently Asked Questions

Is installation an expense?

Installation is an expense, and we can capitalize the same as an asset. The expense directly relates to the Fixed Asset, and it’s inappropriate to charge it as normal expenses in the statement of profit and loss. Imagine installation as a foundation for the building. So, it’s a base for the asset to function.

Next Read: Machinery Sale Accounting

Is installation of Machinery a capital expenditure?

All expenses incurred to bring the asset to its working condition are eligible for capitalization, and the asset will not be available for use if such expenses are not incurred.

What are installation costs?

Installation costs are the expenses necessary to put the asset to use. All the assets will not be plug-and-play. For example, smartphones do not require any installation or demos. However, we need to have the installation done for the Air conditioners. These installation costs include the Customization Charges, Labour expenses, Expenses incurred for checking the Machinery (Like Electricity), etc. The List is very huge and not exclusive of these examples. So, the type of costs that can feature as installation expense depends on the nature of asset.

Are installation fees capitalized or expensed?

Installation is a prerequisite for any asset to be put to use. So, we shall capitalize it as an asset.

Summary – Installation of Machinery Journal entry

Installation of Machinery Journal entry records the machinery purchases costs and expenses relating to the installation such as transport expenses, financing costs, taxes, etc. So, we will add up all installation costs to the asset and will capitalize it.

To Sum up, we will account for the fixed asset by debiting the Machinery and crediting the bank account or non-current creditors for invoice amount and installation expenses.

Recommended Articles

- Purchased Computer Journal Entry

- Furniture Purchase JE