An outstanding Subscription account can be

- An Asset or

- Liability

Confused?

Let’s drill down.

Well, the answer depends on context.

How about a brief example?

Outstanding Subscription Example

Consider a Social Club named “Dislike.”

Social Club is a place where individuals with mutual interests interact with each other.

It offers various services such as Games, Fun activities, SPA services etc.

These services are provided to members on payment of Subscription fees.

So, those subscription fees are the primary income of the Club.

Usually, some of the members pay their fees in advance, and some might remain unsettled.

Such unpaid monthly subscription fees by its members for the current month are called outstanding subscriptions, which is a receivable under the assets group for the Social Club – Dislike.

Table of contents

How about the accounting on the other side?

Now, let’s understand accounting at the Member’s End.

A subscription is an expense to the Member.

So, an Outstanding Subscription is a Liability to the Member.

Therefore, we need to understand the nature of the transaction well before concluding on the GL group.

To Avoid Confusion, it’s advisable to associate the term Outstanding with Liability and Receivable for Assets.

Therefore, we can call

- Subscription Receivable as an Asset

- Outstanding Subscription as a Liability

Note: The above tip is not widely used. Still, accountants prefer to call outstanding subscription as asset for Clubs and liability for Members. So, we need to understand the context before grouping the GL accounts.

Accounting Slice

What is the journal entry for an outstanding subscription?

Now that we understand the term “Outstanding Subscription” from the above section let’s learn how to record the Journal entries in both scenarios (in the books of Club and Members).

Accounting In the books of Club

Here, Members owe Subscription fees to Club. So, it’s an Asset to Club.

Consider the transaction similar to how we record the accounts receivable journal entry.

Yes, what you are thinking is correct.

We need to treat the subscription fees, which are outstanding from members, as Debtors balance or account receivable, and Subscription income as the Sales GL.

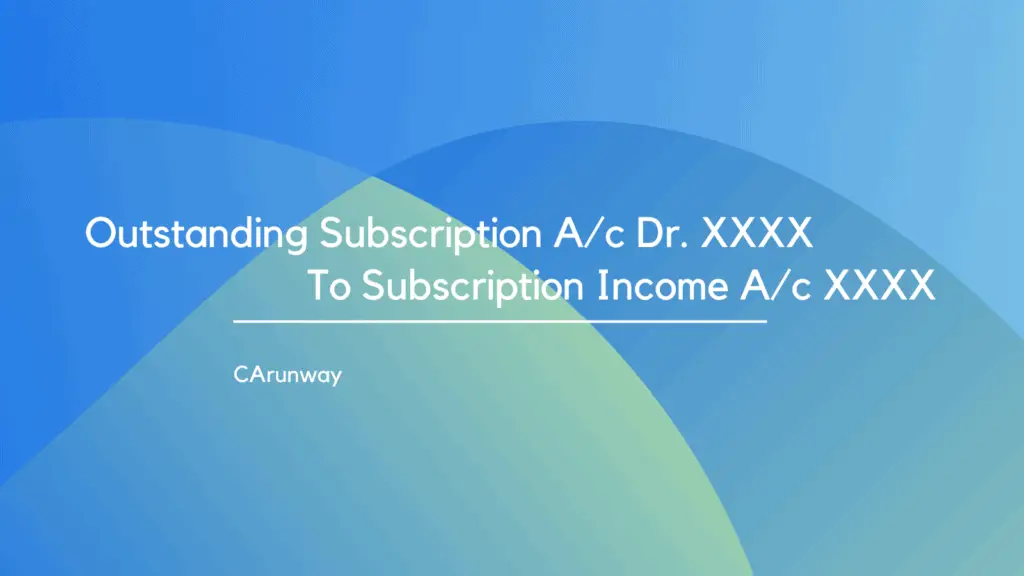

Now, let’s see the journal entry

The above applies to the Accrual basis of accounting. However, this might not apply to Clubs’ whose purpose is not to generate profits but to provide services to their members or the public in general.

Clubs generally follow the Cash basis of accounting. So, there will not be any entry recorded for subscriptions that are due from members as no inflow or outflow of cash occurs for this particular transaction.

Accounting In the Books of Members

Now, we will move into the second section of this sub-topic – Recording the books in the members’ books.

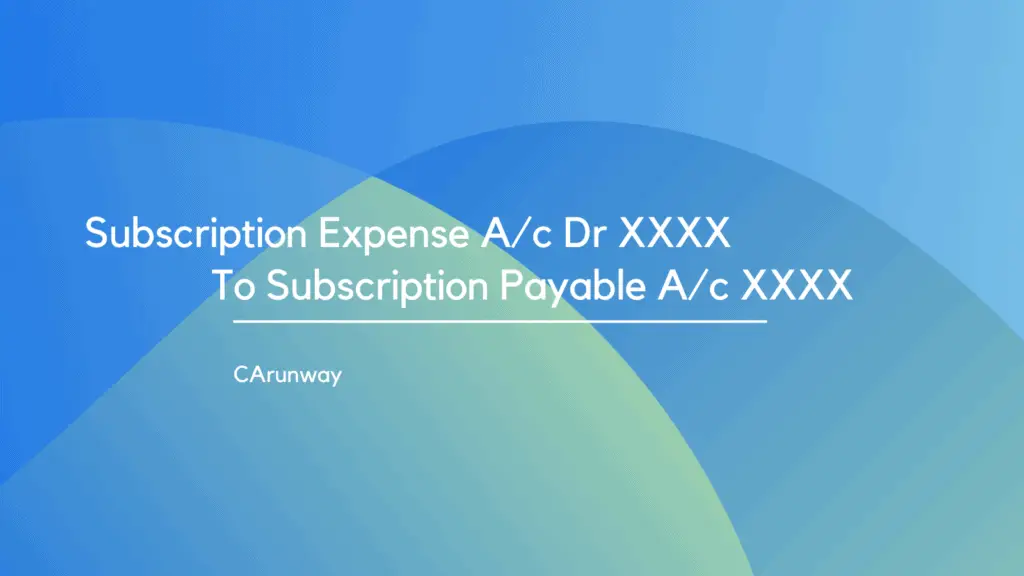

A subscription is an expenditure, and the due amounts fall into the category of Liability.

Per Modern rules of accounting,

We need to debit the expense and Credit the Liability to increase it.

Thus, the entry looks like this

Frequently Asked Questions

Is an outstanding subscription an income?

Outstanding Subscription falls into the asset category for Clubs and Liability to members. Said differently, it belongs to Balance Sheet Accounts Category. It’s nowhere related to the income statement items.

Is a subscription account a real account?

We group accounts as Real, Personal and Nominal Accounts under the Golden accounting rules. Per the Rules, we group assets under Real Accounts and incomes/expenses under Nominal Accounts. So, an outstanding subscription is a real account, and subscription income is a nominal one.

Is an outstanding subscription an asset?

An outstanding subscription is an asset to the clubs and a liability to the members. Thus, the classification depends on the entity for which accounting is performed.

How to record the Subscription received in advance?

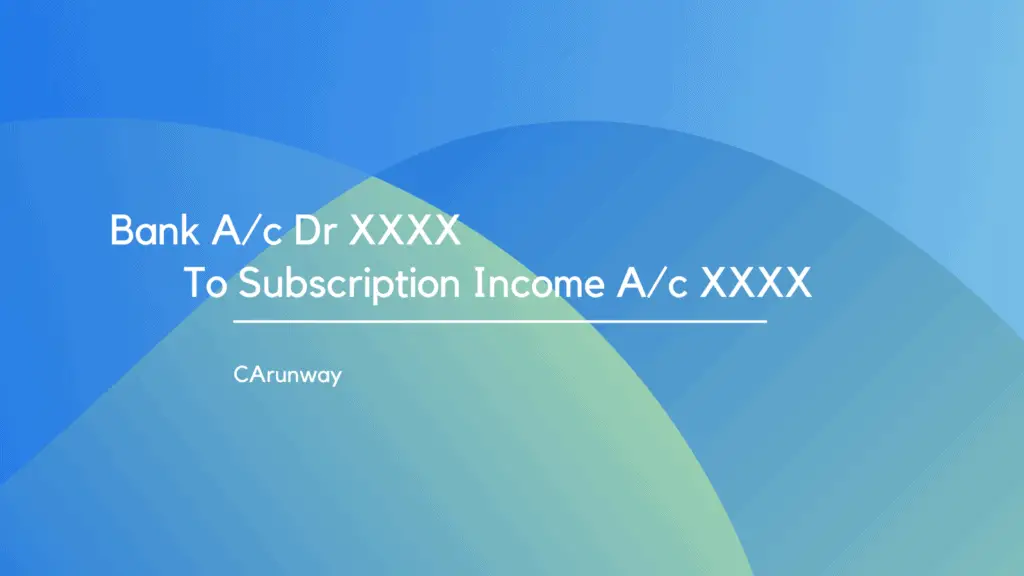

If the accounting is for any club which exists for not making profits, then the cash basis of accounting is to be followed. So, the entry will be

Let’s think through the different sides.

What if the Club exists to make profits (hypothetical)?

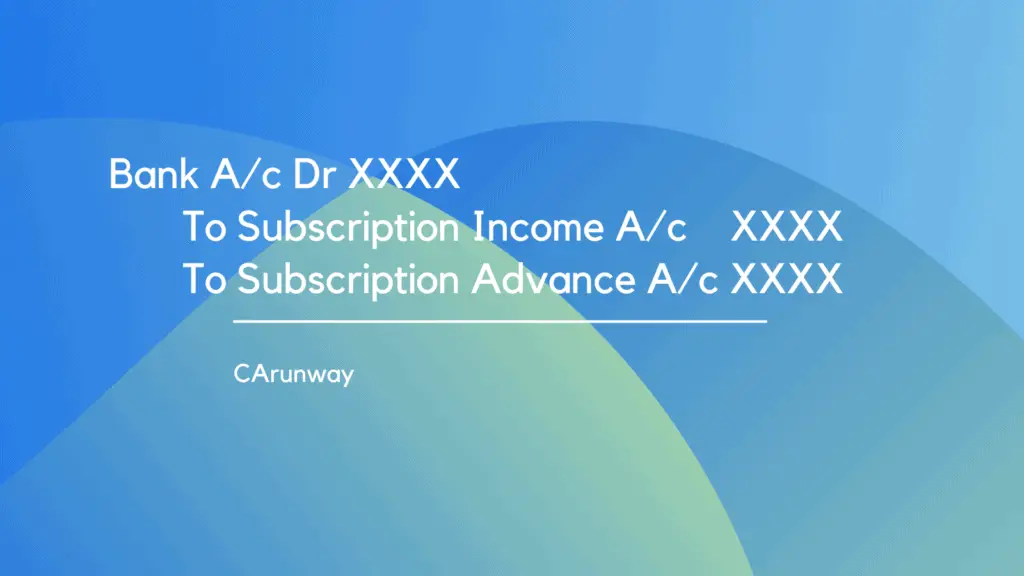

Then, the accrual basis of accounting is applicable.

So, we need to recognize only the current year’s income and balance as a Liability.

Summary

An outstanding Subscription can be either an asset or a Liability, depending on the context. An outstanding subscription is an asset for the receiving entity and a liability for the paying entity. As these amounts are due but not received, we call them outstanding.

For example, consider an entity, “Worry Operations,” opted for a magazine subscription from a Newspaper company. So, an Outstanding Subscription is an asset for a Newspaper company and a Liability for Worry Operations.

We hope the above information adds value to your knowledge base. Keep spreading these articles!