Unbilled accounts receivable is also an accounts receivable which is not invoiced to the customers. So, it’s a revenue where there is a postponement of billing.

This GL forms part of the current asset in the Balance Sheet.

Table of contents

How do Unbilled accounts receivable occur?

Specific terms between the buyer and seller or parties under a contract require invoicing on completion of an event. For example, a buyer of house pays 75% of the sale price to the contractor only on completion of the construction structure, excluding the interiors. So, the contractor can only account for the revenue as Accounts Receivable on happening of the milestone event.

Let’s understand this with another example.

Certain POs/Sale agreements require the buyer to approve the goods purchased after their quality checks. As such, the seller sends a proforma invoice and records unbilled receivables during the transfer of goods. Post approval by buyer, Seller records the trade receivables.

So, it depends on the context.

Accounting Insights:

- Periodical Reconciliation of these balances helps to ensure appropriate accounting and invoicing of revenue.

- By properly managing unbilled receivables, businesses can ensure that their financial statements accurately reflect their financial position.

- Keeping track of unbilled receivables can lead to better cash flow management and a more profitable business. So pay attention to this critical aspect of your finances, and stay on top of your unbilled accounts receivable.

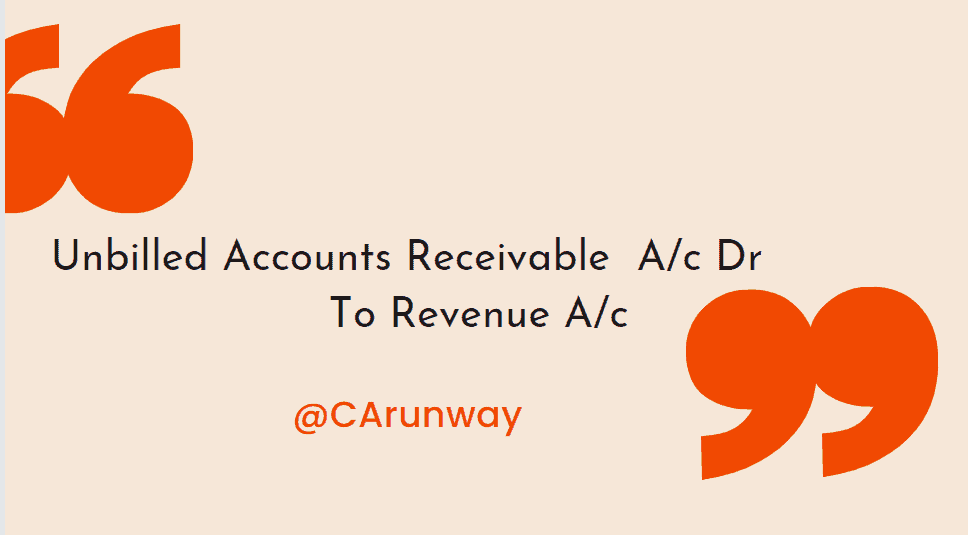

What’s the Journal Entry for Unbilled accounts receivable?

1)To Recognize the Unbilled Receivables

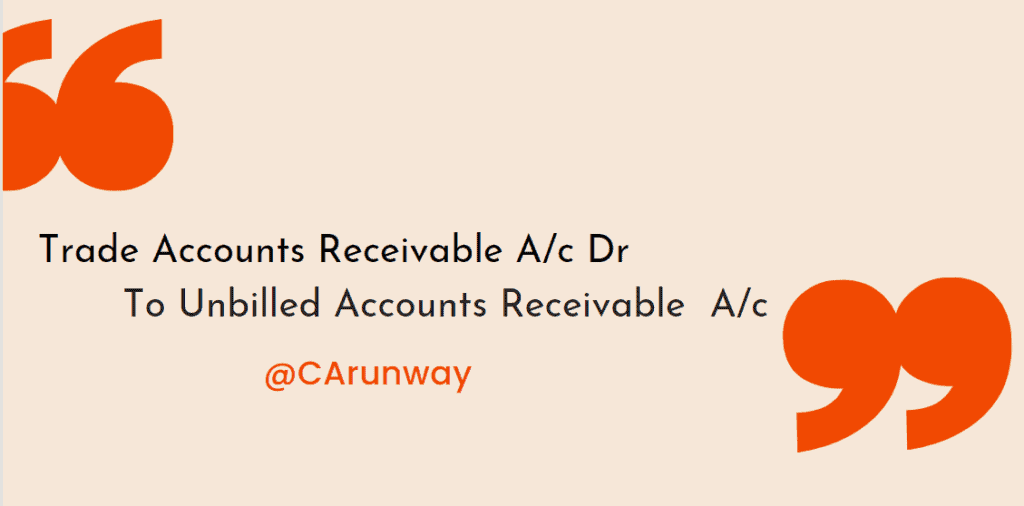

2) To Recognize the Receivables post raising of invoice

We need to reverse the unbilled AR and then post the invoiced amount.

3) What’s the net Journal entry?

Unbilled Accounts receivable nullifies leaving the following GL affect in a Journal entry:

- Debit to the Trade Accounts Receivable GL

- Credit to the Revenue GL

Frequently Asked Questions

How does Unbilled AR affect a company’s balance sheet?

This receivable falls under the Current assets group of the company’s balance sheet. So, it improves the asset position of the company.

Are unbilled receivables considered accounts receivable?

Yes, those are part of the accounts receivable. Just that Seller has not billed its buyers. Understand the term Net Accounts Receivable to be more clear on concepts.

Is unbilled receivable a debit or credit?

It will be on the debit side of the Journal entry. Being asset, it will have a debit balance.

What is the difference between Unbilled Receivables and Deferred Revenue?

Unbilled Receivables represent revenue recognized but not invoiced, while Deferred Revenue represents money received in advance for goods or services that still need to be provided.

Conclusions

Unbilled Accounts receivable are the receivables that are not billed and invoiced to the customer. So, entities need a proper tracking system to ensure that these receivables turn up as trade AR. Thus, it improves the profitability and financial position of the entity.