Asset Disposal Journal Entry is to record the removal of an asset from the business books.

Disposal doesn’t necessarily mean that there is an asset demolishment or retirement due to unusable state.

Table of contents

The disposal of assets can happen due to any of the following reasons

Retiring the assets after the end of useful life

Retirement of assets is a common variety of disposal of assets after the end of useful life. Business can’t get any more economic benefits after its life. So, there is a need for replacement.

Think of a mobile phone.

Now a days, there is no more than 2-4 years of a smart phone.

That doesn’t necessarily mean that we can’t use it.

But there might not be any real value addition from it. There can be touch issue, battery draining complaints, obsolescence of technology etc.

So, the users need to retire their phones and will replace it with other phones.

Assets are no longer required due to discontinued operations

Discontinuing Operations needn’t fall under the category of the entity having going concern issue. There can be other good reasons as well.

How about an example to understand this?

Entities can have business reorganization to improve their financial position. This requires the closure of business units to reduce the burden of operational and maintenance costs. Thus, the management focus will shift to the more profit-generating units.

The best example is Eicher Motors. The company has to divest its capital from other business units and focus on the Royal Enfield business to improve their financial performance.

What’s the outcome here?

A successful motorbike company.

So, there can also be reasons other than deteriorating going concern for the disposal of business and its assets.

Transfer of Assets to the subsidiary entities

Generally, Group companies will have a robust capital structure. So, they will be responsible for building assets and then pushing those fully functional assets to their subsidiaries.

Want to see an example?

Consider entities into Power generating business.

Its not feasible to have one plant to generate the electricity for all its customers/channels. So, companies prefers to scatter plants to meet the increasing demands over the nation/state.

However, the new projects will not have necessary technology and infrastructure support to build assets. So, Group companies takes the ownership to build assets and then transfer to the project companies.

I hope we all gained a solid understanding of the reasons for the disposal of assets. Now, let’s jump into the Key topic of recording the asset disposal journal entry.

How to record Asset Disposal Journal Entry?

Assets will have a debit balance.

So, we need to record the asset on the credit side of a journal entry to remove it from books.

Let’s consider this as a Sale at book value.

Every business transaction involves either a profit or loss element.

That’s one of the primary purposes of carrying out a business.

What if there is a profit or loss when the asset is disposed of?

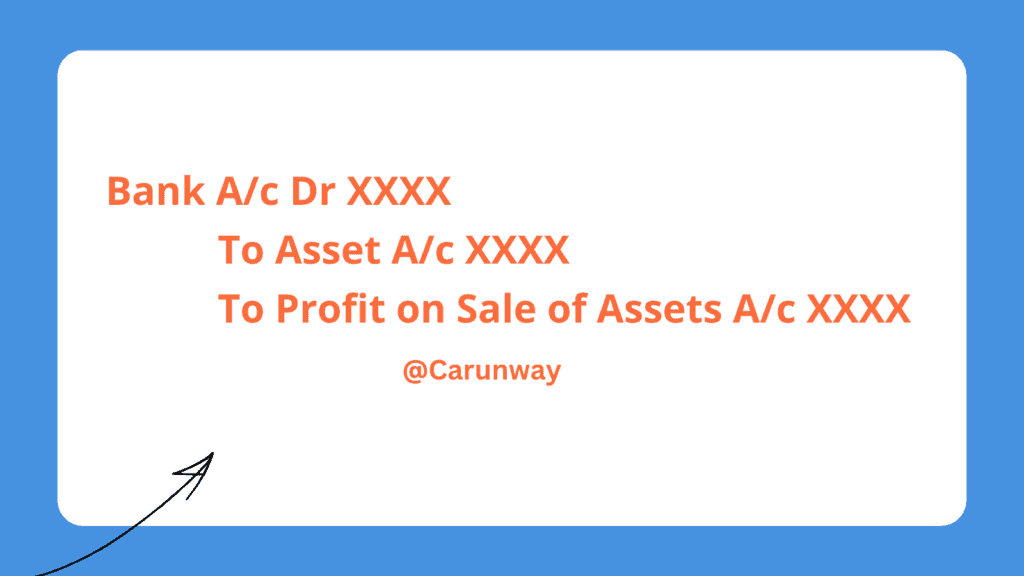

Said differently, the proceeds from the sale exceed its book value. So, the journal entry will be

Here, we record the asset on the credit side at book value, and excess proceeds over the book value are the profit amount.

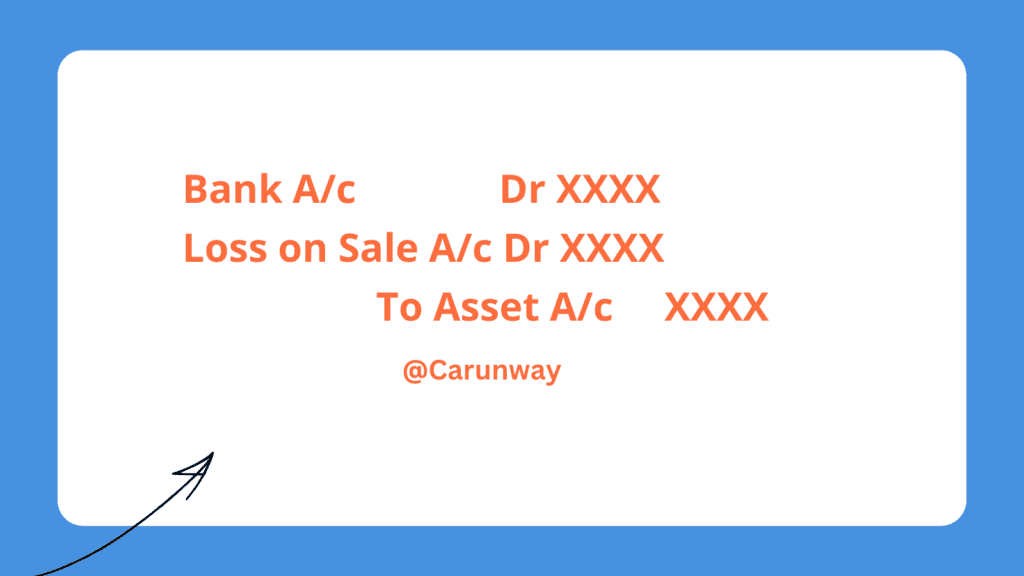

Now, let’s understand the journal entry for Loss on Sale

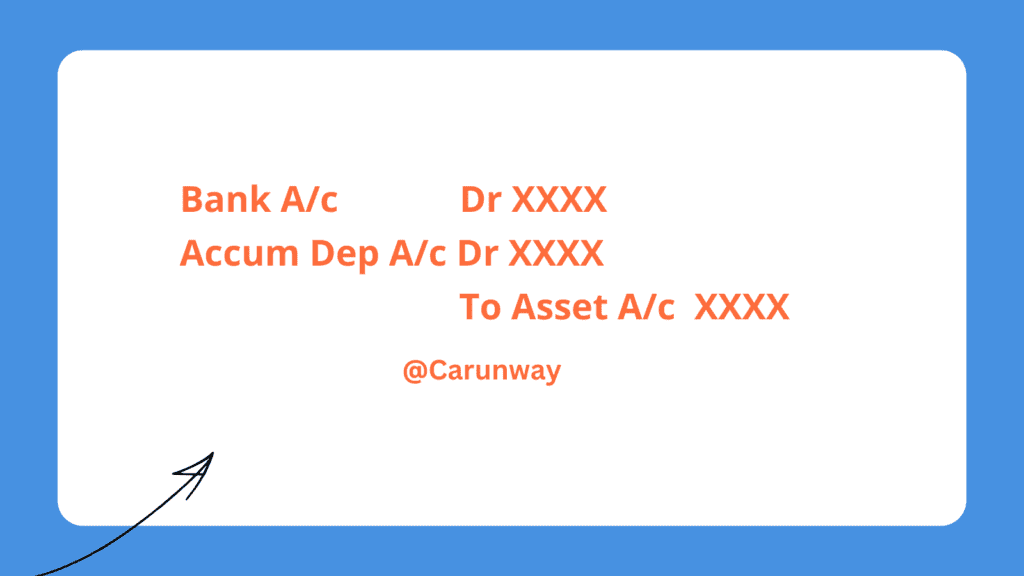

What if there is any accumulated depreciation account?

Let’s see the Asset Disposal Journal entry with Depreciation.

Accumulated Depreciation is an offsetting GL to the asset. We can consider it as standing on the liabilities side of the balance sheet.

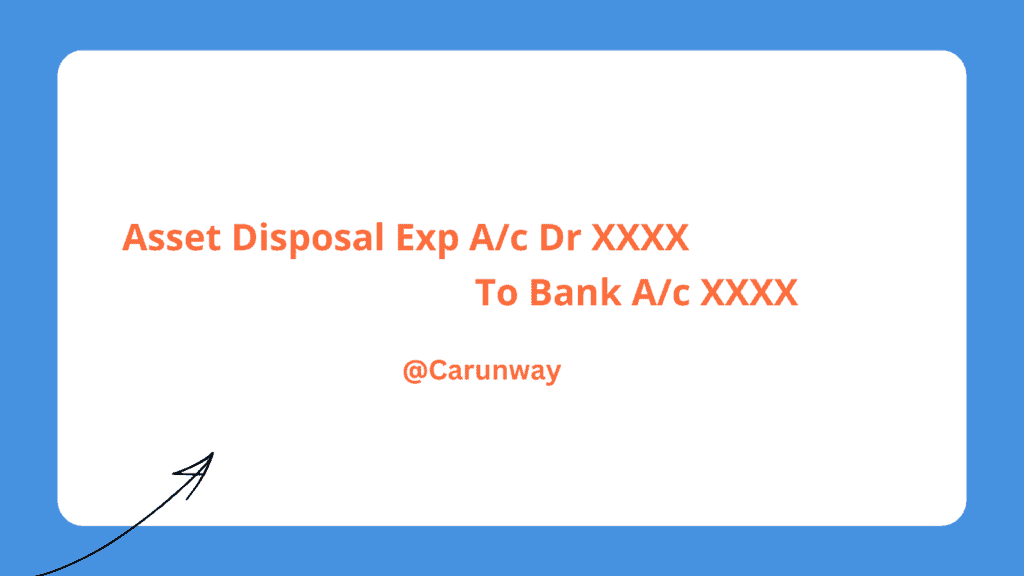

How about the journal entry if disposing of an asset had some associated expenditures?

Expenses such as Legal Fees, Labor charges (Dismantling of the Plant & Machinery), Transportation charges (Often the seller needs to transport the Scrap Materials to the buyer), Postage Charges etc.

Its not possible to dump the Computer Hardware like any other waste as their manufacture involves usage of chemicals. So, the disposal of these type of asset will have a process. It will be through E-waste recycling entities to ensure sustainability and green living.

Therefore, business needs to post/courier their electronic waste to the Recycling entities. So, it is inevitable to incur Postage charges for disposal of electronic waste.

Let’s record these expenditures as well

Frequently Asked Questions

What is the journal entry for asset disposal?

Asset Disposal entry is to reduce the asset portion from the books of accounts by crediting it with a corresponding debit to the Bank or buyer of the asset if a credit period is allowed.

What accounts are used to record the disposal of an asset?

Asset GL, Accumulated Depreciation GL, Bank GL or Buyer GL, and Profit or Loss on Asset Sale are used to record the disposal of an asset. It’s not mandatory to use all these GLs.

Well, it depends on the context.

For example, an asset sold at book value doesn’t result in any profit or loss. So, we will use only Asset GL, Bank GL and Accumulated Depreciation, assuming Bank Transactions.

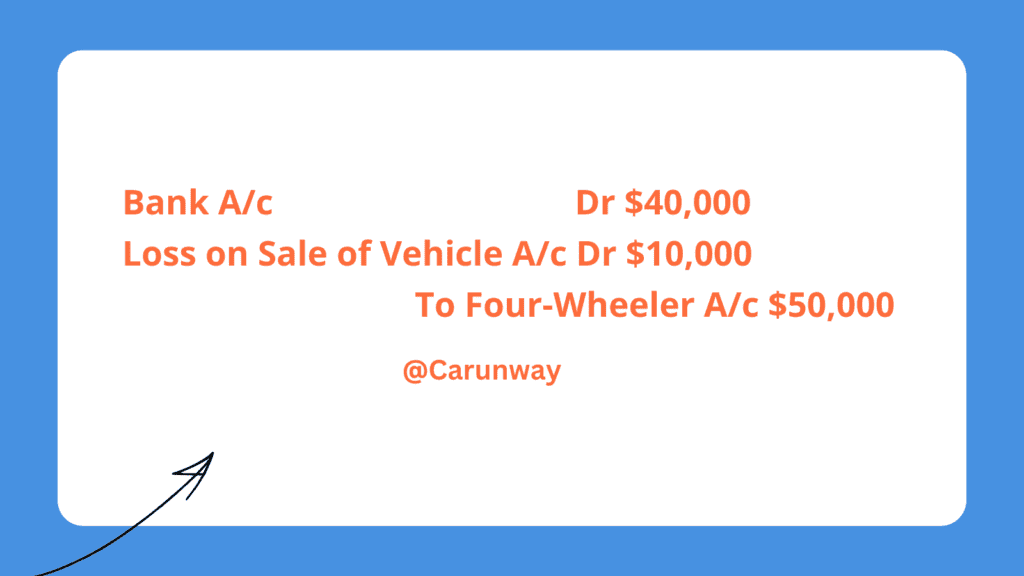

What is the journal entry for loss on sale of assets?

We will understand this with an example. Consider a Four-wheeler vehicle with a book value of $50,000 sold for $40,000.

Let’s see the entry for this transaction below

Is a disposal account debit or credit?

Disposal results in a reduction of the fixed asset balances and an increase in the cash balance at the Bank.

So, the asset being disposed of is credited as per accounting rules.

Asset disposal Journal Entry Summary

Asset Disposal Journal entry is to de-recognize the business assets. We need to understand the reasons for disposal and GL accounts which are applicable depending on the context. Answering these initial questions eases the accounting job. Maintaining appropriate documentation/email communication/invoices is always advisable to ensure the bookkeeping is fair and adheres to the applicable GAAP. The Superior purpose here is to ensure accurate and transparent financial reporting to the stakeholders. Further, it provides useful financial details for decision-making.