Posts help communicate a message from one place to another and facilitate the delivery of goods. The charges for such service are levied in the form of Stamps. So, the Sender of Post needs to purchase Stamps depending on the Pin code and weight of the Postal Cover. The usage of these Postal Stamps has come down due to Electronic Communications like Zoom, Skype, Emails, etc. However, we will learn about the Bought Postage Stamps Journal Entry to understand its accounting.

Before advancement of technology, business needs to resort to either Posts or Courier service for communication and transport of goods. So, it’s a usual practice to purchase postage stamps in advance as that’s a traditional medium for sending mail.

Estimated reading time: 5 minutes

Table of contents

Runner Insights

Do you think why do the postal services exist?

Still, some companies use this postage service to deliver the documents like Annual reports to the Shareholders, Insurance copies to policyholders, Sending ATMs and Credit Cards.

Bought Postage Stamps Journal Entry

Postage Stamp expenses will be insignificant in comparison to the business operations. So, those expenditures are not huge in amounts.

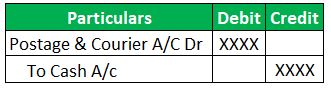

Along with Postage Stamp, Cash account (not a bank account) is the another GL account. These expenditures are petty. So, there will be the use of Cash unless the postal department has the UPI QR Codes or any other digital payments system there.

Expenditures will need to be on the debit side, and the Cash GL on the credit side as that’s going out of business.

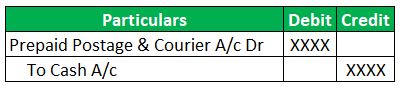

Postage stamps Journal Entry as an asset

If the Postage Stamps are for future purpose, we can create an asset GL Prepaid Postage & Courier account, to record it. Let’s see how the Entry is

How about an example here?

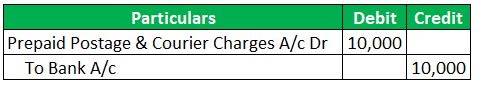

Assume a company, Toy Wonder, purchases stamp worth Rs.10,000 in the month of March of this year. However, it does not use any of it during the year. But Rs.4,000 worth of stamps is utilized in the subsequent year. What are the entries here?

The first Entry is to record the asset account. It results in a reduction in Cash and an increase in Prepaid assets worth Rs.10,000. The journal entry will be

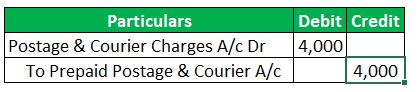

If Prepaids worth Rs.4,000 are to be expensed owing to the actual incurring of it, then the Entry will be:

The asset balance comes down to Rs. 6,000 post this Entry.

Are you interested to purchase an accounting software. Check out tally and zoho accounting software

Common Q & A for Bought Postage Stamps Journal Entry

Why do we need to use the GL description as Postage & Courier A/c instead of just Postage A/c?

Recording the transactions are very flexible with the condition that the the essence of the transactions shall not change. So, there isn’t any specific mandate for using the GL description, and the primary rule is to ensure the description is not vague.

It’s a general practice to record the postage and courier expenses together. So, that’s the reason behind considering the commonly used GL. However, there is no harm in going with just Postage A/c.

Are postage stamps an asset?

The answer will depend on the circumstances. If the postage stamps are purchased for immediate use, those fall into the expenditure category. However, if those are bulk purchases, we can recognize them as a prepaid expenditures. Refer to the above example of Toy Wonder for understanding the entries.

Is postage stamp a part of Cash in hand?

Nope. Postage Stamp is not part of Cash in hand. Postage Stamps can be an expenditure or Prepaid asset.

Is postage a credit or debit?

Postage Expenses or Prepaid Postage expenses will be on the debit side of the journal entry. However, Prepaid postage can be a credit to recognize a portion of it as a current period expenditure. See above example for practical understanding of this.

How to record the Bought Postage Stamps Journal Entry?

We will record the bought postage stamps journal entry by debiting the postage stamps GL and crediting the Cash GL account.

What type of expense is postage?

Postage is a nominal direct expenditure to the business as it will not directly impact the operational activities.

Are stamps an office expense?

Yes, those are part of office expenditure.

Conclusion:

Bought Postage Stamps journal entry records the postal expenditure incurred by the entity for various purposes like sending communications to the different stakeholders and delivery of goods (for example, delivery of medicines by medical stores). Generally, it’s an indirect expenditure to the business as it will not directly contribute to the business operations. However, it can be either direct expense depending on nature of the entities business. The Postage Entry is recorded by debiting the Postage GL and crediting the Cash.