Recording of Sold Furniture Journal Entry results in

- Increase in Cash/Bank balance

- Profit/Loss, if any

- Reduction in the asset value from Balance sheet.

We will understand the term Furniture first before proceeding to the accounting part.

What does Furniture mean?

Furniture is part of the core Non-Current asset group that contributes to the better operation of a business.

E.g., Tables, Chairs, Wardrobes, Work Stations, Book Shelves, Dining Tables, Sofas, etc.

We will understand how furniture contributes in better business operations.

Consider a software company’s. The workstations/desks assist its employees to work effectively and efficiently.

Do you still wonder how Furniture contributes to better business operations?

Just imagine employees working without any infrastructure.

Like holding a Laptop with one hand and working with the other hand (Lol.)

Hard to even imagine.

The answer is simple. It’s not possible

Don’t get me wrong.

I don’t want to criticize or make fun of any Job doers.

I was trying to steer you in understanding the importance of Furniture in any business.

Thus, it’s evident that Furniture contributes to the effective delivery of business services.

Also Read: Contingent Assets

Sold Furniture Journal Entry

Sale of such furniture results in

- Decrease in Furniture value

- Increase in Cash/Bank balnace

Furniture can be either Non-Current Asset (Fixed Asset) or a Current Asset.

Accounting treatment differs for each category.

Lets understand both of those approaches.

Approach I: Furniture as Non Current Asset

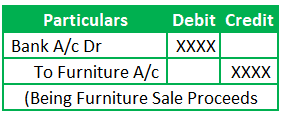

Basic Journal Entry:

Note: The above journal entry assumes that the business does not use an accumulated depreciation account. Let’s see how to record the entry with the accumulated depreciation account.

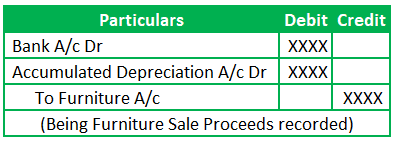

Furniture Sale Entry with Accumulated Depreciation

The above theoretical entry is spotless.

How about considering the practical scenario?

The Sale of Furniture isn’t necessarily at book value. There can be either profit or loss.

In rare cases, it can be at breakeven value as well.

The above journal entry occurs in case of happening sale at book value.

Let’s record the Furniture sale entry at Profit or Loss.

Also Read: Audit of Furniture

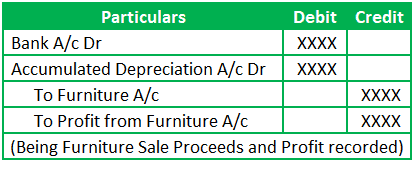

Furniture Sale Entry with Profit:

The receipts are more than the book value of the Furniture. So, there is an imbalance on the Credit side. Thus, we will record the profit on the Credit side of the entry.

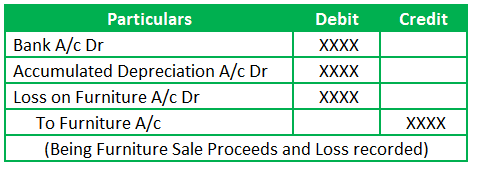

Furniture Sale Entry with Loss:

The receipts are lower than the book value. So, there is a deficit on the Debit side. Thus, we will record the loss on the Debit side of the JE.

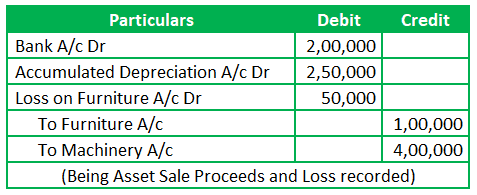

Example

Focus Failure company is into the manufacturing of Optical lenses. The Company Asset group includes Furniture. Those account for 20% of the total assets.

The company wants to improve its production capacity. So, they decided to dispose of the timeworn Furniture and Machinery. The Book Value of Furniture and Machinery are $100,000 and $400,000, respectively.

The buyer agreed to pay $200,000 for both these assets.

But the accountant needs to know how to record those entries appropriately. Thus, they appointed you as an accounting consultant for this.

Can you help Focus Failure company to record the sale of Furniture and Machinery, assuming there is an Accumulated Depreciation of $250,000 for both assets?

Note: Sale happens at lower than the book value of assets

The Journal entries for these are

Frequently Asked Questions

What is the journal entry on sale of Furniture?

The sale of Furniture is recorded by debiting the Bank GL & Depreciation GL and crediting the Furniture GL. Here, we assumed that the sale happened at book value.

Is Furniture debited or credited?

Furniture is credited for recording the disposal entry

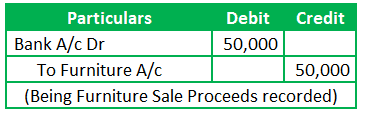

What is the journal entry for sold old Furniture for Rs 50000?

Journal entry is

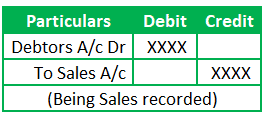

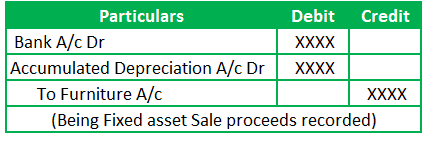

How do you record a journal entry for a sale?

Sales can be relatable to Inventory or Fixed asset Sales.

If it’s for inventory, then the entry is

If it’s for Fixed Asset, then the entry is

What is the journal entry of the purchase of Furniture?

Purchase results in Cash outflow and Furniture inflow. Refer to the Purchase of Furniture article.

Conclusion:

Sale of Furniture results in an inflow of cash and the disposal of the asset. So, we will debit the bank or cash and credit the asset. There is another GL account associated with the Fixed asset. That’s Accumulated depreciation. It’s a kind of Liability and will have the opposite effect on the furniture GL in case of disposal. So, we will debit this Liability to reduce its commitment from the business books of accounts. I hope this article brought some understanding of the Furniture sale Journal entry.