Tax Deducted at Source:

Tax deducted at Source is income tax deducted by the Employer when paying salary to their employees. The Employer is paying tax to the government on behalf of the employee. Lets understand some basics before learning the TDS on Salary Journal Entry.

Employer is under obligation to deduct tax while paying salary to employees. For this purpose, the applicable tax rates used are the normal slab rates. The details are in the income tax website.

Note that this TDS concept is in the context of Salary Income.

Further, employee shall need to declare the details of his/her other incomes on annual basis to the employer. Deduction of TDS from Salary happens every month before the salary payments based on the information furnished by employee.

TDS Example:

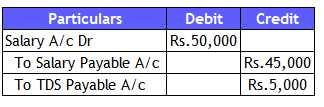

We will try to understand this TDS concept with a scenario. Mr. A works in XYZ Company for a gross monthly salary of Rs.50,000. Assume an income tax rate of 10% is applicable here. So, Mr. A is liable to pay Rs.5,000 to the government as income tax. XYZ Company directly pays Rs.5,000 to the government by way of deducting the same from his salary.

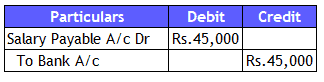

So, the Employer pays tax instead of Mr. A. The salary received by Mr. A is Rs.45,000.

Runners Insight:

Tax is deducted at the time of payment. Salary is paid on monthly basis. So, TDS is deducted while paying the amount.

Lets think of scenario of weekly or biweekly payment. Per definition, Tax is deducted at Source. So, tax needs to be deducted at the time of payment irrespective of whether that’s weekly or monthly payments.

TDS on Salary Journal Entry

Every journal entry will have at-least two GL Accounts. There shall be a minimum of one debit and credit account to balance the entry. There are three accounts here – Salary, Salary Payable and TDS Payable.

Lets understand the nature of each GL relating to Salary Journal Entry.

- Salary is a expense account

- Salary Payable is a liability

- TDS payable is the liability to pay to the government/income tax department

What’s the basis for recording the Journal entry?

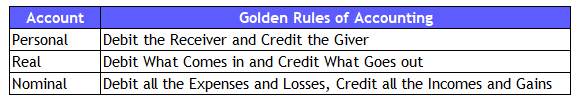

Golden rules of accounting is the basis for recording the journal entry. Those rules are for three category of accounts. Refer to the below table for accounting rules.

The next step is to identify the category under which these 3 GL account falls into. As Salary is an expenditure account, it falls into the nominal account category. The remaining two accounts are liability payable and belongs to personal account. This is because the payment of liability is to Persons (Natural Person – Employee and Representative – Government)

Now, we will post the Journal Entry to the record of Salary Expenses, Salary Liability, and TDS Liability

Salary Expense Entry with TDS component

Entry for Salary Payment

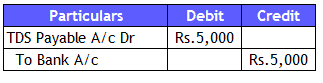

Entry for TDS Payment

(Employer Pays the amount directly to government through NSDL Website)

Also Read: Benefits of Filing Income tax return

Runners Insight:

Salary Journal Entry will also include Professional Tax, ESI (if Applicable), and Provident Fund GLs. But for ease in understanding the TDS Entry, those are ignored.

Conclusion:

TDS deduction happens before crediting salary payments to employee. The Catch here is whether TDS GL account will be on debit side or credit side of the entry.

If the journal entries recording is at the employer’s books, then the total salary is the expense, and we need to apportion the payments between employee and, the government in the form of tax. So, its obvious that TDS will be on credit side.

Said differently, employer liability isn’t increase because of paying tax on behalf of his employee. WehHope this gives a good understanding of the TDS on salary journal entry

Wanna purchase an accounting software. So, you can check out Tally and Zoho accounting software’s through these links.

Recommended Articles

The above article focused on Salary TDS Journal Entry. We have listed down all the related Journal entries articles below for a quick reference.

- Legal Fees

- TDS Receivable Journal Entry

- Commission Received Journal Entry

- Outstanding Expenses Journal Entry

Go through all these articles so that it helps in obtaining a good overview of the accounting of Journal entries.