Are you wondering how to perform the audit of expenses ?. The topic “Audit expenses” lists out audit procedures for testing the expenses. Expenses can be Operating and Non-Operating in nature. Operating Expenses are the expenses that help in the effective and efficient operations of any business. There isn’t an exhaustive list of all the expenditure which falls under the operating expenses bucket. It depends on the nature of company’s business.

We all knew what does an expense mean. Operating expenses are a sub topic under expenses. Let’s try to understand the concept of operating expenses with an example

Note: Non Operating expenses are generally out of scope for testing. However, the quantitative significance of those Non Operating expenses might result in testing by any of the two following approaches mentioned below.

Estimated reading time: 9 minutes

Table of contents

- Audit Expenses – Example:

- What’s the key take-away’s from the above example ?

- Audit of Operating expenses:

- Will both Financial and Non Financial Data are considered for Analytical procedures?

- What’s the Combined Testing Approach to Audit Expense?

- Conclusion for Auditing Expenses:

Audit Expenses – Example:

Consider two Companies – Mini Loss and Major Loss, which are into Manufacturing Automobiles and Cab Services. Both the companies incur electricity expenditure as part of their business operations.

Mini Loss company has Automatic Plant & Machinery to assemble various parts and manufacture Automobiles. So, there isn’t much involvement of humans. So, the company is heavily dependent on electricity.

Major Loss has just an office building for administration purposes. So, Office Building is primary consumer of Electricity.

What’s the key take-away’s from the above example ?

Mini Loss Company can’t carry out the business operations without electricity. So, those expenses are not operating expenses for the company.

For Major loss company, the electricity expenses support the business but not directly. Here, the necessity of electricity isn’t the core ingredient for running business.

The above example is classic for understanding the differentiating factors between an operating vs. non-operating expense.

Therefore, the operating expenses are expenses that constitute a significant portion of total costs of business. The amount involved is huge and material. Business operations can’t be carried out without these expenses. So, auditors’ scope in this expenditure for testing.

Also Read: Physical verification of Stock procedure

Audit of Operating expenses:

Testing of Operating expenses can be through performing any of the following two approaches:

- Substantive procedures

- Substantive analytical procedures

Based on the nature of risk involved, Misstatements(either prior year or current year), adverse operating expenses ratio, and industry in which entity operates, the Audit team might decide to perform both the above procedures.

Audit of Operating expenses through Substantive Procedures:

Substantive procedures are nothing but the test of details procedures. The audit team obtains and tests the details of transactions. Here details mean supporting which are from outside the entity like invoices, contracts or agreements or internal supports like internal emails, entity policies.

Runners Insight:

Sometimes inquiries with the relevant entity personnel also form part of audit documentation. Such inquiries need not be corroborative evidence but can turn out to be concluding audit evidence.

Are you wondering how inquiry support audit evidence?

Auditors might not know beforehand about the nature of expenses through testing. So, performing inquiries helps in audit of expense.

For example, an expenses entry for purchasing an actuator for batching plant is part of detail testing. The audit team inquires with the entity personnel to understand the nature and use it. This helps in gaining whether that entry comprises capital vs. revenue items.

Runners Insight:

Even auditors might go to the plant site and check with site personnel (who are independent of the client staff, to whom auditors generally deal with) to check if the entity office personnel responses are accurate.

For example,

Auditors need not rely on the inquiry responses provided by fixed asset department. Instead they will perform inquiries with the factory staff who are actually working inside the Plant & Machinery or Fixed assets. This kind of verifications gives more persuasive evidence.

Involving Industry Experts for Auditing Expenses:

Audit team are not generally aware of all the industry knowledge. Based on the item’s value, the audit team might also approach industry experts for subject knowledge questions. Then those discussions are forms part of audit documentation as evidence.

Key Test – Capital vs Revenue

The distinction between capital vs. revenue items is key aspect in this substantive testing. If the expenses result in a benefit of enduring nature, then it can be eligible for capitalization subject to the value of the expenses and entity capitalization policy.

How about an example here?

ABC entity is into the Soap Manufacturing business. Entity purchases ten calculators for the finance department. Each of them costs $100. Generally, these calculators last for more than four years. However, those have a product warranty of 3 years.

Per ABC Entity Policy, expenses can be capitalized if those provide a recurring benefit of more than one year and a value of at least $7,500.

Therefore, calculators are not capitalized even though the benefits are for more than one year as the value is negligible.

Runners Insights

The thumb rule to differentiate the capital vs. revenue expenses is –

Ask the question yourself– Will the expenses under audit distorts the profit and loss statement if it’s charged off as expenses in the current year?

This rule can be helpful, especially where there is no such entity policy. We can correlate this with the concept of deferred revenue expenditure.

Audit of Operating expenses through Substantive Analytical Procedures:

Analytical procedures are nothing but analyzing the data, either financial or non-financial.

In General, Auditors arrive at expected numbers and compares that with the current year’s data. Let’s understand this with an example.

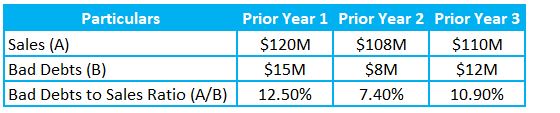

Assume that the Auditor is performing analytical procedures over the bad debts of the entity. Bad debts are correlated to the sales made.

Average Bad Debts to Sales Ratio is (12.5%+7.4%+10.9%)/3 = 10.3%

The audit team will apply the above-average current sales ratio to arrive at the expected bad debts number for the current year.

Estimated Bad debts = $134M*10.3%

= $13.8M

The difference of $1.2 M is immaterial considering the sales figures.

For any audit procedure, there shall be a basis. So, all the differences between the estimates and actual amounts are subjected to thresholds. Lets understand the logical reasoning for having a threshold from below example.

What’s Need for Threshold to Audit expense?

The numbers auditor arrives for analytical procedures are an expectation. The audit team might not consider all business implications involved in the calculation. This is because they are not expected to be aware of every factor in arriving at the calculation. The Auditor can’t derive a standard formula to arrive at an accurate estimation for testing all the account balances.

For example, an entity under audit levies a service charge for each sale made depending on the nature. The service charges vary from 4%to 8%. If the sale transactions are in millions, it’s not feasible and economical for the Auditor to categorize each transaction and apply appropriate service charges. Then, Auditor goes with a realistic percentage. So, average service charge is more appropriate here.

So, Auditor generally arrives at a threshold figure based on professional judgment and materiality. Threshold gives a buffer for all those unknown factors. The difference obtained after performing analytics is verified to see that it’s lower than the threshold.

Different ways of performing Analytical Procedures to Audit expenses:

Analytical Procedures is performed in any of the following manners as well:

- Comparing the Current year data with the previous year. For example, Rental Payments for each month shall be equal. There shall not be any extra payments made to the Landlord unless warranted by any amendment to rental agreements. So, comparing the current year data with the previous year data provides auditor with any inconsistent payment details. Then auditor discusses with entity to understand the reasons for such variances.

- Comparing the Current year data with Auditor estimated numbers (See above example)

- Compare the current year data with industry data. For example, the industry credit period for purchases is 30 days. But the entity which operates in the same industry has a credit period as ten days. This isn’t a indicator of good financial health of entity. Then Auditor shall understand the reasons, verify if the company has enough liquid assets, and check the Quick & Current ratio. In general, the decreased credit period against purchases results from the company not being able to honor its commitments within due dates or deteriorating credit position. So, the Auditor might also need to evaluate the going concern assumption considering the situation.

- Ratio Analysis. For instance, Consider Sales vs. Sales Commission. If there is an increase in sales commission in the current year while the actual sales decreased, then this calls for a discussion with the entity personnel to understand the reasons for the same.

Will both Financial and Non Financial Data are considered for Analytical procedures?

While arriving at estimates, the Auditor might employ non-financial data as well. For example, if the Auditor is building expectations of the AMC Charges, then the AMC per each Computer Software and a number of Computer Software information are the inputs.

AMC Per Each Computer Software is a financial data

Number of Computer Software is a non-financial data

Runners Insight:

Analytical procedures are applicable only when there is a reasonable basis for the Auditor to arrive at estimated amounts.

What’s the Combined Testing Approach to Audit Expense?

Considering the risk of material misstatement relating to the operating expenses, the audit team might opt for performing the testing using both methods (Test of details and Analytical procedures).

What are the considerations for adopting both the testing approaches?

- Prior year misstatements and errors in this account balance

- Performing only either of the procedures does not result in sufficient and appropriate audit evidence

- Higher risk of material misstatements

- All the Internal Controls relating to this account balance are not designed or operating effectively.

Runners Insight

Its always advisable to perform majority of testing at interim period (6 months or 9 months or 10 months). This testing of interim and final phases will reduce the work load during the year end.

Conclusion for Auditing Expenses:

Operating expenses are the expenses that drive the business operations of the entity. Such expenses are to be tested by either test of details, analytical procedures, or both. Test of details is obtaining all the related supports of the tested samples and verifying the authenticity, accuracy, valuation, classification, and cut-off. Analytical procedures test the current year data with the Auditor’s determined expected amounts and subject the difference to a threshold, which is computed based on auditor professional judgment and materiality levels.