Computer purchases is a financial transaction.

It is recorded per certain rules

Those are Golden Rules of Accounting.

Such a recording process includes:

- Understanding the transaction

- Identifying the accounts

- The monetary value involved

- Determine the Account Category

- Applicable accounting rules

Table of contents

Steps to Record the Purchased Computer Journal Entry

We need to follow the above steps. so, let’s break down all the aspects of this transaction for computer purchase.

1. Understand the Transaction:

The understanding step means getting the essence of the transaction and its nature. Here, nature means to check whether it’s a routine business expense, (or) any non-current asset or liability, or a transaction related to the operating business. For the current scenario, the transaction can be the purchase of fixed assets or inventory. The type of entry to record depends on the entity’s business.

2. Identify the Accounts:

The transaction involves the GL Accounts – Computer and Vendor Payable Account. If the payment happens immediately, then we will replace the Vendor Payable Account with a Bank Account

3. Category of Account:

Computers and banks are Assets and fall under the category of the Real Account. Computer Vendor Payable will be a liability. So, it falls under the category of the Personal Account.

Also Read: Understanding Wasting Asset (Non Current Asset)

4. Applicable Accounting Rules:

Real Account: Debit what comes in and Credit What goes out

Personal Account: Debit the Receiver and Credit the Giver

Now we understand the transaction and have all the necessary fundamentals to record the journal entry. So, we are all set to move into the primary aspect of this article.

Purchased Computer Journal Entry

We can record the transaction in two approaches. The first one is to record the entry by involving the Vendor payable GL, and the other approach is to exclude such liability accounts. We can follow any approach. But there will not be any difference in the result (journal entries).

Primary Approach

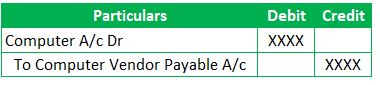

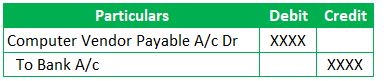

1) Recording the consideration payable to Vendor for Purchased Computer

2) Payment to the Vendor

If the transaction relates to the operating business, the computers purchased will be inventory. However, if the asset purchases are to obtain economic benefits for more than 12 months and helps in conducting business. So, we call such purchases as Fixed assets.

Fixed assets support business either directly or indirectly. The word direct here means the assets held for the production of goods. For example, there is a Plant & Machinery that manufactures the goods traded by the entity. Such Machinery will help in conducting the business. So, it directly supports the company.

There will be some fixed assets, such as buildings, computers, and furniture, for just administrative purposes. Such assets indirectly ensure that the business is run smoothly and effectively.

Runners Insight:

There is a subtle difference between fixed asset and non current asset. The term non-Current asset is a broader and it encompasses all tangible or intangible, movable or immovable, production-related assets, administrative, fictitious assets, etc. So, it’s advisable to use non-current assets instead of Fixed assets.

Secondary Approach:

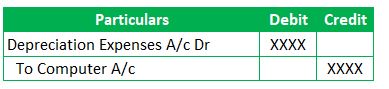

Irrespective of its usage and type of fixed asset, there will normally be wear and tear due to everyday use. Therefore, we need to charge a portion of those assets to the profit and loss statement depending on their useful assets. So, let’s learn how to record the depreciation expenses.

There are different methods of calculating the depreciation expense. One of the best methods is the straight-line method. The calculation is straightforward. We arrive at the annual depreciation by dividing the total cost of the assets by the useful life. So, there isn’t any complex formula for straight line method depreciation. That’s very simple.

Runners Insight

Determining Useful life depends on the best industry practices. So, it can be the best estimate from the experts in the respective fields.

Frequently Asked Questions

When a computer is purchased, which account will be debited?

Computer Purchases result in creating a non-current asset to the business. The description of GL can be Computer or Laptop. So, we will debit the Computer GL for recording the purchases.

Also Read: Contingent Assets

Depreciation on computer journal entry

Depreciation is a non-cash expense. We will record it by debiting the Depreciation account and crediting the computer account. However, there is a different approach of recording the depreciation to the accumulated depreciation. Let’s learn those entries with an example.

ABC Ltd purchases a computer worth $10,000, and the useful life is ten years per general industry practice. So, Annual depreciation will be $1,000.

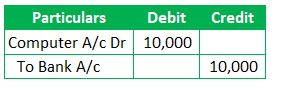

Entry to record the Purchases

Entry to record the accumulated depreciation

The above approach discloses the Fixed assets at Gross, and all the depreciation will hit the accumulated depreciation. This Accumulated depreciation can be shown under the Liability side of the balance sheet or can be deducted from the Gross fixed asset to arrive at the net Computer balance.

Purchase of Computer for office use will be recorded in

Computer or Laptop purchases for the office use can be recorded to the Computer GL account (non-current nature).

Purchased a computer for the office

Purchase of Computers for office supports the administration and does not involve the production of goods. Even though those are for administrative purpose, we will consider those as fixed asset. So, we can record such purchases through Computer GL in the journal entry.

Purchase laptop on credit journal entry

Laptop purchases made on Credit require following the first approach mentioned above. So, we need to debit the Computer and Credit the liability account to record the happening of the transaction. When the payments happen, we will debit the liability account and Credit the bank account. Refer to the Table 1 and 2 above. Therefore, we can record these purchases under Computer & Equipment head irrespective of either its Computer or Laptop.

Purchased Computer with printer journal entry

It’s pretty common to purchase a printer with Computer. We need to understand whether the printer requires a separate disclosure. The thumb rule here is to check whether the printer’s useful life and depreciation method are the same or different. If it’s the same, we can record both the assets as Computer & Equipment. The entry will be the same as the above tables in both the scenarios (irrespective of whether printer disclosure is separate or not)

Conclusion for Purchased Computer Journal Entry

Purchased Computer Journal entry is to record the Computer or laptop purchases made for the administrative purpose or as inventory. The method and way of recording aren’t different, and the difference is only grouping the GL under the appropriate head within the accounting package. The entry will be debited to the Computer and Credit to the Vendor to record the purchase transaction. The Vendor GL will be debited, and Bank needs to be credited on the payment date. Therefore, the net entry will be debit to the computer and credit to the bank account.

Latest Articles:

We have added a couple of related articles that help you in understanding how the journal entries are recorded. So, you can go through all these to gain good understanding of accounting fundamentals.