A calculator is a stationery item.

It’s part of office supplies.

We recognize it as an expense.

So, we will write off the entire amount in the same year in the Statement of Profit and Loss.

What are the other possibilities?

Accounting isn’t the same for all entities.

It varies based on industry and context.

Think of it like mathematics, where you find different ways to arrive at a solution.

How about an example?

Consider two entities – Zero Super Markets and Hero Calculator Makers.

The latter one is into the manufacture and sale of a calculator.

The former entity is in the business of the sale and purchase of household provisions and other related items.

Both these entities use Calculators in their business.

Zero Supermarkets use it for taking counts, billing, or any other calculating stuff. So, that’s a stationery item for them.

Is the same case for Hero Manufacturers?

Nope.

The Calculator is the Inventory.

In other words, that’s the profit-yielding trading activity.

Purchased Calculator Journal Entry

We now understood the importance of context before recording the Journal entry.

Let’s record the Journal entry in both scenarios.

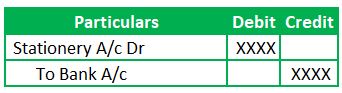

Scenario I: Considering Calculator purchase as office supplies

Note:

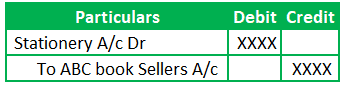

We can record the above expenditure differently as well. There is no hard and fast rule. If the payment happens immediately, we can credit the bank account and be done with accounting. However, if any credit period is allowed, we can record the below two entries assuming the ABC Book sellers is non trade creditor.

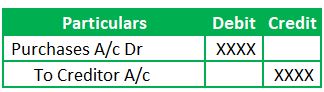

Recording the Liability:

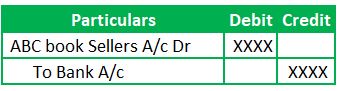

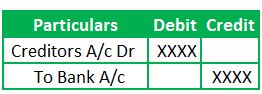

Payment Journal entry

Scenario II: Considering Calculator as Inventory

a) Recording the Purchase entry

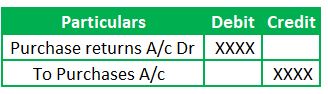

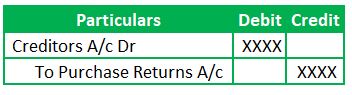

b) Recording the Purchase returns, if any

Reduce the Purchases amount and Liability as well

c) Payment Entry

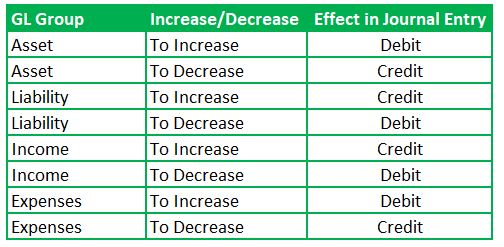

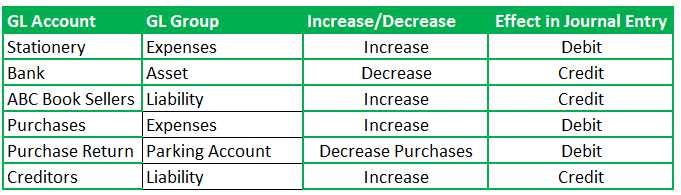

Purchased Calculator Journal Entry Analysis:

Let’s understand how to record this Entry with the help of Modern Accounting rules.

FAQs for Purchased Calculator Journal Entry:

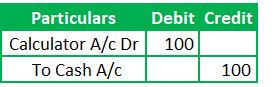

What is the journal entry of this question for the Purchased Calculator of price 100?

The Calculator falls under office supplies or stationery. We will record this similarly to any other expenditure.

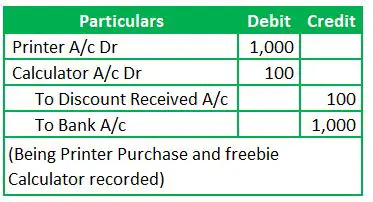

How to record the Journal entry for receiving Calculator as a freebie?

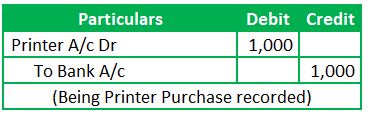

Let’s assume ABC company got to know an offer that if it purchases a printer worth $1,000, then it will receive a calculator worth $100 free.

ABC Company’s accountant is trying to figure out how to record the same. So, they want your help in passing the journal entry.

There are two approaches

1) Recording the Printer asset at the total amount

2) Recording Printer and Calculator

In the above transaction, the Calculator and Discount received will be set off in the statement of profit and loss. So, the net effect is nil.

Both the above approaches are correct. We can adopt any of them.

Can we record the Calculator as an asset?

A calculator is an item that lasts for more than a year.

The benefits last for at least 2-3 years

However, the value of a such item is quantitatively insignificant.

So, it’s a good customary practice to charge it as an expense.

Conclusion:

The purchased Calculator Journal Entry is to record the stationery expenses. We will debit the stationery expenses and credit the bank or cash accounts. We can call it as inventory depending on the context like if the business relates to manufacture and sale of calculator. So, this isn’t a different kind of journal entry. It falls into expense or inventory journal entry category.