Accounts Receivable are the amounts due to the entity from its customers. The straightforward answer to the question, ‘Is accounts receivable a Liability or asset’ is -it’s an asset.

Further, Accounts Receivable is a broad term.

So, let’s try to peel off each layer of this account balance to get a comprehensive understanding of it.

Table of contents

Types of Accounts Receivable

Accounts Receivable include trade receivables and non trade receivables. Examples of all these different types of receivables are below:

1. Trade Receivables – Sundry Debtors, Bills receivable (bill of exchange)

2. Non-trade Receivables – These are receivables that are not related to trading activity. Non-trade receivable examples are insurance claims receivable, receivable relating to the sale of scrap, income tax refunds, interest receivable on Fixed deposits, Loans to employees, and interests due on them, etc.

Recording of such receivables shall be as per GAAP.

Certainty in collectability and measurability are prerequisites for recognizing the revenue and receivables.

Why will there be any discounts allowed on the accounts receivable?

Managing Working Capital is an important activity to ensure enough funds are flowing into the business. Effective Working capital management reduces the requirement of loans (revolving borrowings or cash credits) and thereby contribute to lower interests costs.

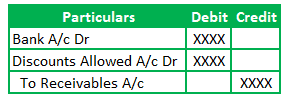

Discounts allowed on receivables help the faster inflow of funds into the business. So, discounts are provided to encourage quick payments instead of waiting till the credit period.

For example, the credit period for receivables is 30 days. The entity offers a discount of 5% if payments are made within ten days from the date of sale.

Basically, there is benefit for both the parties (Buyer and Seller) due to discounts. Those are below.

- Buyer needs to pay discounted amount

- Seller’s receivables turnaround time is less. Thus, receives liquid cash/bank quickly

How to record the discounts allowed?

Why will there be any bad debts?

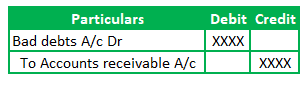

Incidents such as bankruptcy, loss due to fire, and Loss of Primary Customer will result in the debtors not being able to honor their commitments. Such debts which are not recoverable from the debtors are losses to the business, and we can call such loss as Bad debts. Thus, Bad debts are the amounts that are assessed as not recovered due to the unfavorable financial status of the debtors.

Bad debts need to be written off in the profit and loss statement.

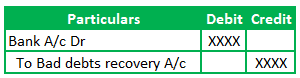

There might be some further recoveries after considering those debts as bad. We need to treat such bad debt recovery as income to the business. That’s because the business received some amount from whatever we thought as unrecoverable and written off as loss.

Recommended Article: Fictitious Asset

How to record the bad debts?

We need to reverse the already recorded accounts receivable balance. The loss due to bad debts will be on the debit side of the journal entry.

How to record the bad debts recovery journal entry?

Bad debts recovery will be income to the business. So, we will credit it with a corresponding debit to the bank.

Frequently asked Questions

Is accounts receivable debit or credit?

Accounts receivable will be on the debit side. If there are any reversals due to bad debts, we will credit them.

Have you heard of the term Net Accounts Receivable?

Thats a different concept. Learn more about the Net accounts receivable as well.

Is Accounts Receivable a Liability or Asset? (or)

Is Trade Receivables a Liability or Asset?

An asset is a resource from which there will be an outflow of benefits. For example, Fixed assets like Machinery or computer will help in production, manufacturing, or providing services and there by ensuring the business prosperous and thrive to profits.

Liability is the sum of money that the business needs to pay. There will be a cash outflow of funds due to liability.

From the above understanding of the asset and liability definition, we can classify accounts receivable or trade receivables as an Asset. However, the receivables can be a liability in specific scenarios. For example, if any advances are received from a customer as part of the contract or agreement, it will be a liability to the business. But such instances are not frequent.

We need to understand the substance before deciding upon the accounting output. So, the ultimate driving factor for such advances is to have sales, and therefore, Trade receivables are Assets in general.

Also Read: Unbilled Accounts Receivable

Are accounts receivable liabilities?

Accounts receivables are assets relating to the Sale of goods or services. There will inflow of funds into the business due to these receivable.

Conclusion:

Accounts receivable are an asset to the business, and we will record such receivables only if it is 100% sure about the collectability and measurability.

Are you tired of reading blogs or articles ?

You can try some fancy games like foosball or read books like Psychology of Money.