The purpose of the Cash Stolen journal entry is to record the monetary loss.

Loss sustained by the Company is due to theft or robbery.

Embezzlement can occur either due to internal employees or with help of external parties to the company.

A high chance of such loss are due to employees working in the Cash department.

Table of contents

- Cash Stolen Journal Entry

- Example:

- Related FAQs

- Is Cash stolen from an organization before it is recorded in the accounting records?

- Cash Stolen Journal entry and Loss of cash due to robbery are one and the same transaction?

- What is cash theft?

- What is defalcation of Cash?

- What is skimming of Cash?

- What’s the Cash Stolen Journal entry?

- How Cash can be misappropriated?

- What is misappropriation of Cash and goods?

- Can we count the Cash Stolen Journal entry and Goods lost due to fire as same?

- Key Take ways:

Cash Stolen Journal Entry

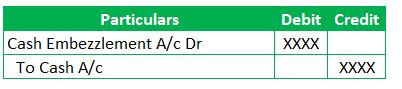

Let’s look into the Journal Entry for Cash Stolen to understand the accounts which are on the debit and credit side.

Accounting Analysis:

Debit Side

Cash Embezzlement is a GL to record the Business Loss. Per Accounting Rules, Loss falls into the nominal account category, and we need to debit the losses.

Let’s understand the logic of these rules.

Think of the Profit and Loss account and its format. We all know that the Income in the P&L account will be on the credit side.

Cash stolen results in loss to the business, and it’s completely valid to reduce the profit to the extent of the loss. So, we need to debit the Loss account.

Credit Side

Cash is a Real account; we need to credit it if it goes out of business.

The background understanding for this part of the Journal entry is

- Similar to any other Assets, Cash usually has a debit balance

- To reduce the debit balance, we need to credit it.

So, we will credit the Cash to the extent of the loss.

Example:

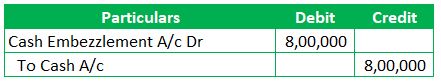

Pick Pocket Company is in the construction business and has to make certain payments in Cash as part of its operations. Cash payments are frequent and well required to ensure a smooth workflow. So, Company maintains a minimum cash balance of Rs.10,00,000.

Finance Employees robbed the Rs.8,00,000 Cash from the Company and left the State. Entity complained about the loss to the Police.

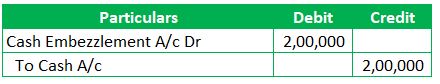

Police officers are able recover Rs.2,00,000 from one of the Culprit.

The entity could not wait till the completion of the investigation to record the accounting entries. So, they need to record all those journal entries before the end of the year.

Let’s see how to record all these journal entries

Recording the Loss of cash due to robbery:

Cash recovery entry:

Runners Insight

The illustration above is very broad and meant to help you understand with a real-life example. In general, there can be other losses, such as the loss of furniture or broken windows or doors, among other things. So, the entity must also evaluate and record those.

Related FAQs

Is Cash stolen from an organization before it is recorded in the accounting records?

Indeed, there is a good possibility that frauds of this kind will occur.

Wanna see an example of this kind?

A cashier, for example, creates a fictional vendor and records purchases with the assistance of other finance team members. Now, to satisfy the obligation, the Cashier will settle the obligation by issuing a check.

There can be a variety of possible agreements with the Vendor. The Vendor and the Cashier agree on the pricing of the products being sold, and the resulting profit is split between them. We could refer to this as kickbacks.

Cash Stolen Journal entry and Loss of cash due to robbery are one and the same transaction?

Yep. The transaction are same. Its just that the description of the transaction is different.

What is cash theft?

Cash Theft is an act of robbing money. A loss must be recorded in the books of accounts of a firm, regardless of the nature of the loss or the circumstances surrounding its occurrence.

What is defalcation of Cash?

Defalcation of Cash is an act of stealing money, and the person who performs the defalcation is misusing his entrusted capacity.

What is skimming of Cash?

Skimming is a pretty broad term that’s more relatable to white-collar fraud. For example, the Chief Financial Officer of the Company misuses his capacity and uses the business cash for personal needs.

But there is no wonder in calling it skimming of Cash if the amount involved is huge.

What’s the Cash Stolen Journal entry?

Debit the cash embezzlement account and credit the cash account to record the cash stolen journal entry

How Cash can be misappropriated?

Misappropriation of Cash can be through creating a fictitious vendor/worker or showing false payments in the books of accounts or in the form of kickbacks, as mentioned in the first FAQ.

These are the common ways of misappropriation of funds. So, there isn’t any limitation to the occurrence of misappropriation of cash. The best way to know these is to watch out for the scams happening worldwide.

What is misappropriation of Cash and goods?

Misappropriation of Cash and goods is to steal/rob/embezzlement of business assets for the personal benefit of the individual who performs it. It results in loss to the business and an advantage to the one who misappropriates it.

That’s why we have security checks in malls or shopping zones to prevent these frauds.

Can we count the Cash Stolen Journal entry and Goods lost due to fire as same?

These two transactions are of different nature. The latter one results in loss of goods and the former one results in cash loss. Just the Loss caused to business is the common point here.

Key Take ways:

- Cash Stolen is a loss to the business. Theft can be done by either internal individuals like employees or external people like Vendors or customers.

- Cash stolen is recorded by debiting the business loss and crediting the cash account.

- Misappropriation happens because of theft; then it might also have an additional loss like window break, assets stolen etc.

- Entities shall have strong internal controls and security to avoid these losses.