Personal Car introduced in the business

It results in bringing new assets into the business.

We can recognize any expense as capital if

- There is some asset inflow into business and

- It assists in advancement of business operations.

Table of contents

Are you aware of the Business Entity Concept?

We need to treat the business and its Owner as two separate persons for accounting purposes. For this reason, we have a Capital Account to reflect the Owner’s investment in the books.

The Company’s main goals are to make money and add value to customers through its operations.

Capital is an investment by the Owner which may or may not attract interest. The applicability of the interest element depends on the contracts between the business and its owner.

How about an example to understand this?

The partnership agreements drive the applicability of Interest on Capital. All the partners shall agree to the terms and conditions.

The partnership provision, for instance, can state, “Partners who bring in a Capital of more than Rs. 10,00,000 are eligible to receive an interest at 12 percent per annum“.

Like other Liabilities, business need to pay back the Capital to its Owner upon the Business Liquidation. So, business records the Capital contribution as a Liability for the Company. Therefore, we disclose the Capital account under the Liabilities side of the Balance sheet.

How to record Personal Car Introduced in the business Journal entry?

After reading the above, we have a good understanding of the Business Entity and Capital concept. Let’s examine the possibility of using a personal car value as Capital.

The addition of a car helps the business’s operational activities. For example, consider a company that engages in ride-sharing. Bringing a personal car of the Owner for carrying out the objectives results in furthering the business.

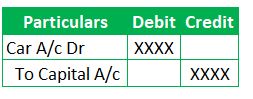

Let’s record Personal Car Introduced in the business journal entry.

The GL accounts which are part of this transaction are Car and Capital. When recording journal entries, make sure to be as specific as possible to the GL Description.

Why do we need to have a specific GL description?

To understand this, we will take an example.

For instance, Wrong Company is into the business of purchase and selling of mobile phones.

The company offers credit period to its customer as per their policies and financial stability of the consumer. Entity maintain the debtors name with first 3 letters.

Three of the company vendors are ABC Consulting Pvt Ltd, ABCD Industries and ABCDE Agency. So, it records all the transaction from three vendors.

How will this be understood by someone looking into accounts?

The company will not be able to find out the amount due from each of the customers directly from books of accounts without doing any math.

Is this related to Consulting, Industries or Agency customer?

As a result, there is no harm in clarifying the GL description.

Personal Car Introduced in the business Journal Entry is

To be Precise with Entry,

The preceding journal entry results in the recording of an asset and a liability. This is a concept of double entry. There will be an equal amount of credit for every debit.

Runners Insight:

Are you confused with different accounting concepts?

Let’s break it down.

Every entry shall result in a balancing of Financial Position. Assume the above Car is worth Rs.10,000,000. The above entry increases both assets and liabilities equally. So, the balance sheet tallies.

FAQs – Personal Car Introduced in the business Journal Entry

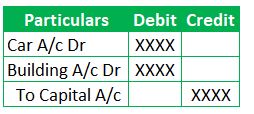

What is the journal entry for capital contribution?

Capital Contributions can be in Cash or Kind. Owners bring in Capital through Cash or other assets like cars, Vehicles, Land, etc.

Lets take a look out Capital Contribution Journal Entry assuming Cash and Building brought into the business is

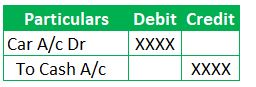

What journal entry is passed when proprietor sold his personal Car and invested the amount in the business?

The proprietor selling his Car is not a business transaction. But the investment of receipts in the business is a valid business transaction. So, the second part of the transaction requires recording in the business books. We can record the second part by debiting the cash and crediting the capital account.

Is Capital introduced a debit or credit?

Capital Contribution introduced results in crediting Capital Account in the Journal Entry.

What is the journal entry for Car?

The Journal Entry can be for Purchase or Depreciation and Sale of a Car. We will see all these three journal entries.

Car Purchase Entry:

Purchase can happen either in Cash or through a bank loan. So, let’s see two types of approaches.

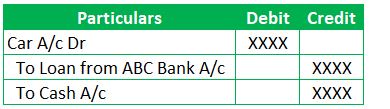

Approach 1

Approach 2

(Being Cash down payment and Loan from ABC Bank recorded)

Depreciation Journal Entry:

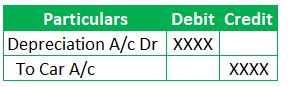

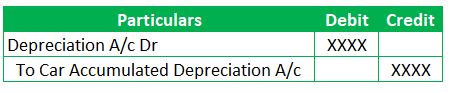

Depreciation reduces Car’s value due to normal wear and tear. It can be recorded with Accumulated depreciation or not.

Journal entry without Accumulated Depreciation

Journal entry with Accumulated Depreciation

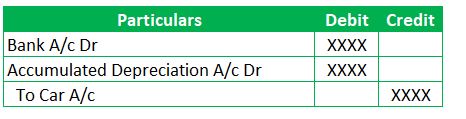

Car Sale Entry

Selling Car results in knocking off Car Asset and Accumulated Depreciation. Payments will be done immediately. Let’s see how it is recorded.

Conclusion:

Personal Car introduced in the business journal entry is to record the capital contribution. That’s because it increases assets to the business and helps in thriving operational activities. It’s recorded by debiting the Car A/c and crediting the Capital A/c.