Are you pondering about how to record the Creditors Journal Entry?

Don’t worry!

We have got you covered.

Lets peel each of the exteriors to enjoy the fruit.

We will start with some basics here.

Creditors fall under Current Liability

Those are Suppliers of Goods or Service

They facilitate business operations by supplying goods or providing services.

Further, the creditors extend credit facilities by allowing a grace period from the date of purchase of goods or the date of providing services to clear the dues.

However, there are scenarios where ancillary (business supporting) activities also result in a Current Liability balance.

Table of contents

- Creditors Journal Entry

- Frequently Asked Questions

- What is a creditor’s journal entry?

- How is a payment to a creditor journal entry recorded?

- What are accounts payable journal entries?

- How is an expense recorded in accounting entries?

- How is a paid creditor on account journal entry recorded?

- What is the purpose of a creditor journal?

- Can machinery be accepted as payment for a debt owed to a creditor?

- Conclusion

For example, Internet bills and Office Security are prerequisites for better functioning of the business. But those are not the primary cash flow-generating activities.

Said differently, Liability against the indirect expenses also falls into the Current portion. But we will call them as Non-Trade Creditors.

Accounting terminology has concepts of Trade creditors and Non-Trade creditors. Liabilities relating to Operating activities are Trade creditors and others as non-trade creditors.

But these days, there’s increasing common practice of calling trade creditors as creditors in general. Non Trade Creditors as Other Current Liabilities.

Creditors Journal Entry

When a company needs to pay a creditor, it is important to record the transaction accurately in the accounting records.

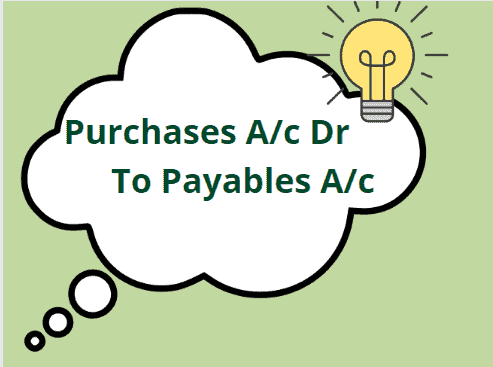

To record a creditor’s journal entry, the company must first identify the two GLs.

The GLs applicable here are the Payables account and the Purchases account.

The next step is to identify the nature of these GLs and, after that, understand applicable accounting rules.

Let’s record the Liability Journal entry.

Note:

We need to record the full amount of the outstanding balance in the payables account when entering the journal entry. This will ensure the company has an accurate record of the payment made and the remaining balance owed.

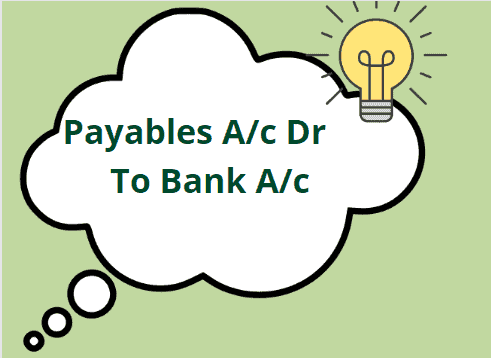

How about recording the Payment of Liability Entry?

Remember to maintain the proper documentation, such as invoices and receipts or proof of payment, to support the transaction. This will ensure accuracy and transparency in financial records.

Frequently Asked Questions

What is a creditor’s journal entry?

A creditors journal entry is a type of accounting transaction used to either record the creation of Liability against the purchase of goods/receipt of services by an entity or payment of debts owed to a company’s creditors.

How is a payment to a creditor journal entry recorded?

Debit to the cash or bank account, and credit to the Creditor account.

What are accounts payable journal entries?

Accounts payable journal entries refer to recording the Liability through credit or clearing the dues through a debit of the Liability.

How is an expense recorded in accounting entries?

The entry here is to debit the expense and credit the accounts payable.

How is a paid creditor on account journal entry recorded?

This entry is to debit the creditor’s account and credit the bank account.

What is the purpose of a creditor journal?

Creditor journals are used to change creditor balances – To Create a new vendor, increase the balance on purchasing goods or receiving services, and decrease payments.

Can machinery be accepted as payment for a debt owed to a creditor?

Yes, they can accept payments in Kind. But, the agreed terms and conditions between the buyer and the seller drives it.

Conclusion

By following these simple steps and recording the creditor’s journal entry accurately, the company can ensure that its accounting records are accurate and current. This will help the entities to make good planning and financial decisions and maintain healthy relationships with their creditors.