Are you trying to get the answer for the the question, “What is the difference between Cash Credit and Overdraft” ?

Tap on your back. You’re on the best platform to find the perfect answer. Lets see understand each of the terms before understanding the differences.

What is Cash Credit?

Cash Credit (“CC”) facility is a Credit Facility which is short term in nature and is to meet the working capital requirements of the business.

Similar to any other Loan or credit facility, the requirement of having security is a mandate for Cash Credit. Here, the assets hypothecated are Stock and book debts. Therefore, Lenders grant Cash Credit after considering the book value of inventory and book debts or either of them.

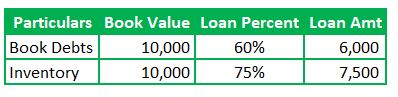

Credit facility is not provided on the total value of stock and book debts. Instead of full value, credit facility is granted as a certain percentage on the book value.

Banks or Financial Institutions (Now Called as “Lender”) acts on a conservative basis and keeps a cushion before granting the CC. As such, Lenders allow credit facility after reducing a percentage of margin from the total book value of security.

How about an example here?

Lets assume the margin percentages for Book Debts and Inventory is 40% and 25%. These percentages are not standard. It usually depends on Lender and credit worthiness of the borrower. So, these might keep changing.

Computation of Cash Credit:

Runners Insight

Borrowers are required to submit Stock and Book Debts Statements periodically as agreed upon with the Lender. Additionally, the sanction terms may insist the borrowers for Audited balance sheet (ABS) or Provisional balance sheet(PBS). If there is a delay in submission of these documents then it might result in some bank charges. So, be mindful of all the terms and conditions for Cash Credits.

What is Overdraft Facility?

We can infer from the name that Overdraft means drawing over and above the balance available. Said differently, this facility allows for utilizing the credit facility which is in excess of the funds available. For example, if an entity has a balance of Rs.100,000 and the Entity issued a Cheque of Rs.101,000 to repay its Suppliers. The additional amount for which Cheque issued is Rs.1,000. However, Banker honors the Cheque even if the balance in the account is insufficient due to the overdraw facility sanctioned.

Types of Overdraft:

Bank overdraft (O.D) can be of two types}—>

- Secured

- Unsecured

Secured O.D is disbursed based on the value of the Shares, Mutual Funds or Surrender value of LIC, Asset pledged or fixed deposit receipts. The Unsecured O.D depends on the Salary of the Individual or business transaction. These are also called clean overdrafts.

Runners Insight

Individuals might have some petty requirements. Opting for personal loans will not be the best solution. Loans require processing fees, documentation charges, and time-taking approaches as proper appraisal need to be done. Bank Overdraft will be the best option in such scenarios

Lenders will consider several factors for approving limits such as Credit Score, repayment capacity, credit history, incomes, the purpose of the loans etc.

The Major advantage in choosing any of these credit facilities is the payment of interest only to the extent of the limit utilized. So, the borrower need not pay interest on the whole sanction amount but only to the extent of over drawl or the CC limit used.

Do you know about Loan Calculators?

Banks also provide calculators for the Cash Credit and Overdraft. We have listed a link to HDFC Bank Calculator. Browse and check out this calculator

Difference between Cash Credit and Bank Overdraft

- Cash Credit is generally for operating cash requirements. However, the bank overdraft need not necessarily be for business operations.

- Cash Credits are sanctioned only on Security of assets. However, Bank overdraft can be unsecured.

- Banks started providing the Overdraft upfront at the time of opening bank accounts with them. Lenders are granting a pre-defined overdraw limit for their customers. But, this is not the case of Cash Credits.

Similarities between Cash Credit and Overdraft:

- CC and O.D facilities require Strong Creditworthiness of the borrower. Hence, financial health is directly proportional to these credit facilities.

- Unlike traditional Loans, the payment of Interest is on the portion of credit/over drawl which is in use.

- Prevents from Cheque being bounce or decline of Debit Card transactions.

Conclusion:

Cash Credit and Overdrafts seems to be a different credit facilities. But they have couple of differences. Cash Credits are primarily for meeting the working capital needs of business. However, the overdraft is not only for the business use but also for non business purposes. Overdrafts can be opted by individuals as well. Borrowers choose these facilities based on their respective requirements. Hope this article brings some insights to you.