NSF Check means non-sufficient funds check

It is a type of check return by a bank

Why does such return happens?

Due to insufficient money in the issuer’s bank account.

It’s a check bounce scenario, and this may result in penal charges.

We need to account for this transaction by recording the journal entry.

In accounting, it’s essential to know how to properly record and account for these transactions so that your business remains up-to-date with the latest financial reporting standards. This article discusses NSF checks and how you should journal them in your business’s books.

What is an NSF Check?

An NSF check is a check that fails to clear because the person writing the check does not have enough money in their checking account at the time of writing. Some other reasons can be due to overdraft protection or stop check payments. When this happens, the bank usually returns the check with a note explaining why the transaction was unsuccessful.

Why Should You Record NSF Checks?

Recording your NSF checks is essential for two reasons –

- It allows you to understand the money which is due from customers.

- Accountants need to check if the debt seems to be doubtful of recovery.

- Not recording these payments results not being able to track what the business owe from customers who issue them accurately.

How do I Journalize an NSF Check?

As a general rule, companies must record the payment of the check, but the company must reverse the receipt when the check is returned. In addition, the company must increase the customer’s account balance.

Creating a journal entry for a bounced check involves the same steps as any other journal entry. Depending on your software, you may need to make a special journal entry to account for the bank fees associated with the NSF payment.

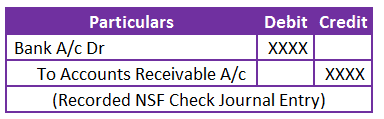

NSF Check Journal Entry

When journalizing an NSF check, you should debit Cash/Bank and credit Accounts Receivable for the bounced check amount. This Journal entry ensures that all business debtors are accurately recorded in the books.

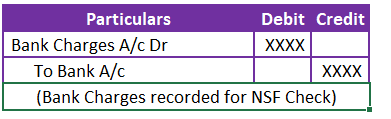

Additionally, any fees associated with the processing or returning the bounced check (such as an insufficient funds fee) must be recorded. In that case, you should also debit Bank Charges and credit Cash/Bank for those amounts.

This will ensure that all charges associated with a returned check are accounted for properly.

Additional Procedures:

We should also keep track of any NSF checks by creating a log or spreadsheet detailing

- When each bounced check occurred,

- Who wrote it, and

- How much was it for?

The above checklist will help ensure accuracy when journalizing future transactions involving checks from those same customers or businesses. Follow up with customers with Bad debts to collect payment on outstanding balances or seek further clarification regarding their situation before proceeding with any additional business transactions involving them in the future.

NSF Check Journal Entry Summary:

In conclusion, Recording NSF check correctly in your books is important for accurate financial reporting and data analysis purposes.

If you do not have enough funds to cover a check, the bank will return it as a bounced check. This return of checks can result in some financial penalties and Charges.

Keeping track of returned checks helps you stay organized and prepared when dealing with customers who have written bad reviews in the past – ultimately allowing you to manage better your accounts receivable as we advance.