Net Accounts Receivable is the leftover balance after deducting the bad or doubtful debts.

Are you wondering why there would be bad debts?

Operating a business on a Cash basis isn’t feasible.

So, there is a need for credit.

It’s possible and expected that each debtor pays reliably. However, some losses or balances cannot be honored by those customers.

So, we can expect some portion of the Accounts Receivable balance as unpaid.

Let’s course back to the primary topic.

Net AR is a critical metric for the sales collection team as it portrays the cash receivables.

Table of contents

- How is Net Accounts Receivable expressed?

- How about an example to understand this concept?

- How do you record the Net Accounts Receivable?

- What’s the usage of Net Accounts Receivable?

- How to improve Net Accounts Receivable?

- Where do we present the Net Accounts Receivable in Balance Sheet?

- Q&A Section

- Conclusion

How is Net Accounts Receivable expressed?

Net Accounts Receivable is expressed in ratio as below

Net AR ratio= (Net Accounts Receivable)/ (Gross Accounts Receivable)

It’s advisable to maintain a higher ratio.

That’s an indicator of positive cash flow.

So, it’s a good measure of financial stability and performance.

Thereby, it helps operational management in decision-making.

How about an example to understand this concept?

Flower Blossom is in the wholesale business of Flower bouquets. Major Customers are corporate companies and a few individuals.

Company needs to furnish this Gross and Net AR amounts to its Lenders on 15th of next month.

Current Month Sales Amount = $150,000 with a doubtful debt of $1500 from one of its corporate customer due to being bankrupt.

What’s the Net AR Ratio?

Net AR Ratio = ($150,000-$1,500)/$150,000 = 99%

On the day of reporting to its Lenders, Company realized that there is another loss of $1,500 due to non repayment of debt by a customer. This is not considered while arriving at Net AR ratio.

So, the revised Net AR ratio is ($150,000-$3,000)/$150,000 = 98.66%

Considering the two scenarios, the first one realizes more cash flow to the entity. So, its advisable to maintain higher ratio.

How do you record the Net Accounts Receivable?

Net AR is not a transaction to record in the books.

So, there will not be any journal entries here.

Instead, it’s a ratio or amount.

It’s a measure of the performance of the marketing or sale collection team and operational excellence.

Note: If we are sure of bad or doubtful debts, we will record a provision for the same. This provision offsets the accounts receivable.

What’s the usage of Net Accounts Receivable?

- Net AR is the best metric to gauge the cash inflows compared to gross accounts receivables. So, it previews the operating cash flows of the entity.

- Business runs with either cash or credit facilities from lenders. If we have a clear picture of operational cash flows, business can figure out the financing portion of the capital amount.

- Inaccurate calculation of Net accounts receivables might result in unnecessary borrowings and higher interest expenses.

The benefits don’t stop there.

Investors and Lenders look up to the company as self-sustaining and considered trustworthy. There builds a reputation.

How to improve Net Accounts Receivable?

Managing the Net AR is challenging if the business comprises a wide class of customers like Industry, Commercial and Residential.

The following steps will pave the way to improve the receivables position.

- Having a Strict Customer Policy and business practices while extending credit to debtors. Careful evaluation of the customer’s credit risk and regular monitoring of financial stand-ups by assessing customers’ operational results.

- Regular Follow up for any delays in customers’ payments. These follow-ups can be done by establishing a separate team/agents.

- Friendly reminders will inform debtors of upcoming payments. This helps customers to be prepared for their cash outflow.

- Incentives for early payers will spark speed payments.

- Opt for Superior bookkeeping software with built-in facilities to help you with customer analysis and pick the odd ones out for you.

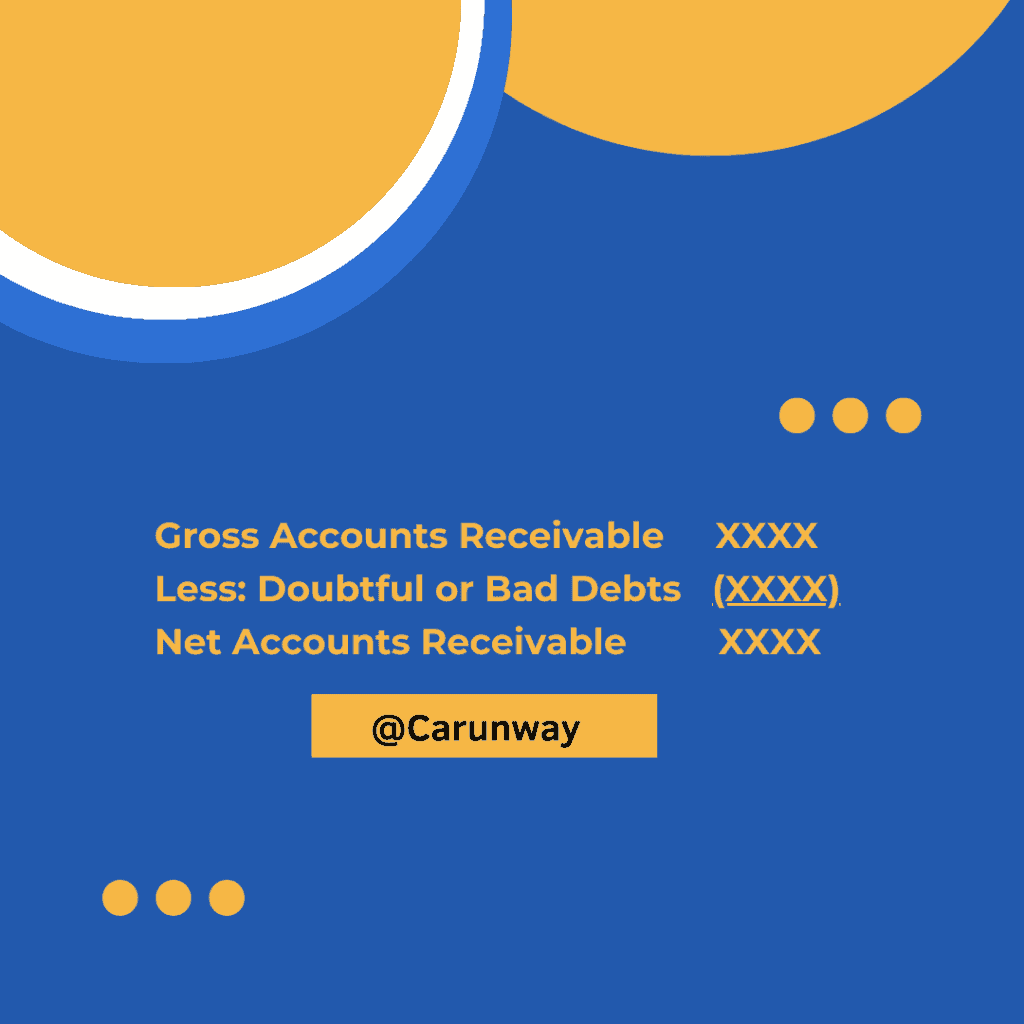

Where do we present the Net Accounts Receivable in Balance Sheet?

The turnaround time for Accounts Receivable falls within the working capital conversion cycle.

So, it’s part of the Current asset category.

The business presents it as

Q&A Section

Is net accounts receivable an asset?

Net AR is the net amount arrived after deducting any doubtful debtor balances from the gross accounts receivable. The Nature doesn’t change.

Just that this Net AR balance result in depicting the true cash position of receivables.

So, it’s an asset.

Is net Account receivable debit or credit?

Net Account receivable Account will have a debit balance as its an asset.

Let’s get back to some basics.

We all learnt the Golden Rules of accounting. Per these rules, we must debit what comes in and credit what goes out for the Asset Accounts. So, these receivables being the collectable amounts from debtors, fall under the debit side of a journal entry.

However, we will not record the net Account receivable as such in the journal entries. We record the Gross Accounts Receivables and Provision for doubtful debts and bad debts in the books of accounts. Recording these aspects will result in the final output as a record of net accounts receivable.

What is the difference between net AR and gross AR?

Gross Accounts Receivable represents the total debtor balance before considering bad or doubtful debts. On the other hand, Net Accounts receivable balance arrives after deducting those non-recoverable balances, resulting in the final amount expected to be recovered.

What are net accounts receivable examples?

We all love contextual examples to understand the application of the topic. So, let’s see an example.

Silly Solutions is in the business of manufacturing children’s toys. The entity has two customers – Laughing Techs and Cry workers. The details of sales in the current year to its customers are below.

Laughing Techs Sales – $300,000

Cry Workers Sales – $400,000

Silly Solutions offers a 1% discount to early payers.

Considering the historical experience, Laughing Techs always pay in advance and bags the discount.

The finance team is always conservative in estimates. So, it expects that there can be 2% of doubtful debts from Cry Workers being a new customer.

Silly Solutions CEO wants to know the net accounts receivables at this point of time.

Net AR Calculations

– Laughing Tech – $300,000*99% = $297,000

– Cry Workers – $400,000*98% = $392,000

Therefore, the total net AR amount is $689,000 ($297K +$392K), or the ratio is 98.42% ($689K/$700K).

Conclusion

Net Accounts Receivable is the decision-making input for the management. Entities need to focus on improving the Net AR balances or ratio.

Business needs to constantly train the sales collection team on best practices to be followed, maximizing the cash inflows and sending timely reminders.

All these measures will help the business to showcase itself as a better cash-generating unit before its investors and lenders.