Bad debts are losses to the business.

What’s the reason for losses?

Because debtors did not pay their dues.

So, these are unrecovered receivable.

Therefore, entity needs to post a JE by

- Crediting the accounts receivable,

- Debiting them to a loss account.

Such loss due to debtors is a bad debt.

Can there be recovery of bad debts?

Yes, it can happen.

In such cases, entity prepares a entry.

But recorded to the extent of recovery.

Lets see such bad debts recovery JE.

Table of contents

Are you wondering why there will be any bad debt recovery?

Here is an answer for you. Let’s consider an example of a “Failure” company having a receivable balance of $10,000 from a “Successful” Company in its books of accounts. Due to some fire accident at the Successful Company(the debtor), there is loss of all the stocks at Go-down and buildings, and so the going concern of Successful Company is a question mark now. Per this accident, Failure Company considers all the amounts due from the Successful company as bad debts.

However, the Successful company has an insurance policy for the loss and received almost 75% of its losses. So, it paid back the $7,500 of its due amount to the Failure company.

Read the Goods Lost by fire article to understand the accounting in case of loss of asset.

Runners Insight

The example is added to assist the readers with an understanding of why there is a requirement to record bad debt entry and then why bad debt recovery happens from such debtor balance.

Now, let’s understand how to record the entries relating to the bad debt Loss and Recovery of bad debt in the books of accounts.

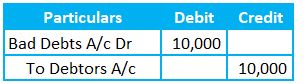

1) Bad debts Journal Entry

Bad Debts are loss to the business and falls under Nominal accounts. All the nominal accounts hit the statement of profit or loss. The accounting rule applicable for Nominal accounts is debiting all the expenses or losses and Crediting all the incomes or gains. So, we will debit the bad debts GL.

Bad debts result in reducing the accounts receivable or sundry debtor’s balance. So, we need to cancel the accounts receivable GL having debit balance, and therefore, we need to credit the receivable to nullify it.

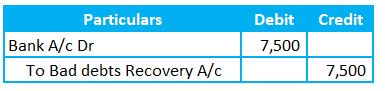

2) Bad Debts Recovered Journal entry

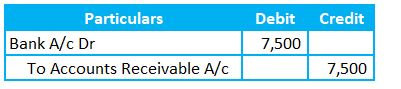

The books of accounts do not comprise of any journal entries relating to Successful company transactions. Receipt of amount will be through Cheque or Cash.

Also Read: True Up Journal Entry

General Approach

A bank or Cash is a real account. Per the Golden rule of accounting applicable to the Real Account, we need to debit what comes in and credit what goes out. So, it’s clear that we need to debit the Bank account for the money received.

Due to the accident in this example, the receivable balance is considered bad debt, and the full amount is a loss. So, the extra amount received from such debtors is a bonus and is nothing but income. The Credit will be the bad debts recovery GL (income account).

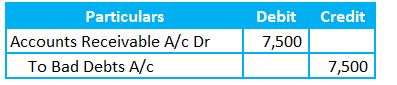

Alternative Approach

However, there is another accounting treatment to record the bad debt recovery. We can reverse the debtor and bad debts through a Journal entry to the extent of the collectible amount, and it increases debtor balance and reduces bad debt expense. Let’s see the Journal entry for those as well.

Also Read: Unbilled Accounts Receivable

1) Reversal of Debtors and Bad debts balance

2) Recording Bad Debts Recovered Journal entry

The above entries also result in almost the same output as the first approach mentioned above. There is no correct or incorrect approach. So, we can follow any of the two approaches.

Runners Notice

We want you to excel in accounting skills. So, I have added a free resource here. Hope this helps you in moving up the ladder of accounting.

Frequently Asked Questions

Is bad debts recovered debit or Credit?

Bad debts recovered are income to the entity and belongs to the Nominal account. Per Nominal account Golden rules of accounting(see above), bad debts recovered will be credited in the journal entry

Is bad debts recovered a revenue?

Yes, Bad debts recovered is a revenue.

Also Read: Cash Coverage Ratio

What happens when bad debt is recovered?

We can record all debts that are uncollectible as bad debts. However, if there is any recovery from such loss due to any reason, then it’s an income. Therefore, we need to record such cash inflow as income to the entity.

How do you treat bad debts recovered in the Profit and Loss Account?

We will treat bad debts recovered as income in the Profit and Loss account considering its nature.

Bad debts recovered Journal entry in the trial balance

In General, all Assets and Expenses will have a debit balance, and all Liabilities and incomes will have a credit balance. Therefore, Bad debts recovered GL being income will be on the credit side of the Trial balance.

Summary for Bad Debts Recovered Journal entry

Bad debts recovered entry is to record the income receivable from already recorded bad debt. So, it’s a recovery from a loss asset. So, we will debit the bank account (asset account) and Credit to the bad debts recovery account (income account) in the journal entry.