Sundry Debtor is a current asset.

Let’s understand it in the literal sense

Sundry means of various types

Debtors mean a receivable GL balance

Sundry debtors are customers who owe money to the business against purchasing goods or receiving services from it.

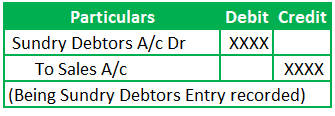

How to record Sundry Debtors Journal Entry?

Sundry Debtors entry is recorded when there is a happening of credit sales. The entry will be

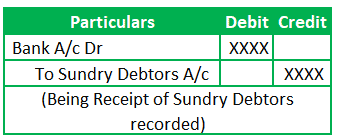

Entry to Clear Debtor’s balance:

Clearing the Debtor balances from books happen on receipt of consideration from the customer.

Let’s learn the journal entry for this transaction.

Runners Insight:

Trade receivables and sundry debtors mean the same.

Frequently Asked Questions:

Is the Debtor a liability or asset?

We can associate Sundry Debtor balance with the inflow of funds. So, it falls under asset. However, debtors can be part of liability in rare instances. For example, advances received from customers fall under liability.

Also Read: Unbilled Accounts Receivable

What is Debtor in balance sheet?

The Debtor is a current asset that comes into existence as part of the operational activity of the business.

Is Debtor a fixed asset?

The short answer is “No.”

Let’s drill down on this as below.

A fixed asset is a non-current asset that helps achieve the business’s principal objective. Lands, buildings, Plant and machinery, Computers, Furniture, fixtures, etc., fall under Fixed assets.

A debtor balance is a realizable cash asset. We can associate debtors with the sale of goods or services, whereas fixed assets are the one that helps in the production of the goods or supports the rendering of services.

How is Sundry Debtors Journal Entry recorded?

We record the Debtors entry by debit to the customer account and credit to the Sales or Services GL account

Also Read: Sold Furniture Journal Entry

Who is Debtor in accounting?

The Debtor is a customer with a debit balance in accounting. We can use Sundry debtors and debtors terms interchangeably.

What is Debtor with example?

The Debtor is a receivable balance attributable to the sale of goods or services. For example, the Loss Company sold goods worth $10,000 to the Profit Company. Here, the Profit company is a debtor with a balance due of $10,000 to the Loss Company.

Is a debtor a customer?

Yes, the Debtor is a customer.

Is debtor account receivable?

Accounts receivable is a comprehensive term and has broad meaning. Debtor balance is one such GL under accounts receivable.

Conclusion:

Debtors are the balances due to the business. It’s a liquid assets. We recorded it as a part of sale of inventory or service rendering. So, we will debit the Debtor with a corresponding credit to the income generation GL (Sales or Service).