The Cheque received journal entry is to account for the bank receipts. Such receipts primarily will be from the debtors. However, there will be receipts from the other transactions as well. Such examples are added below for reference

Receipts relating to

2. Security deposit as part of business contract or agreement

3. Sales of Asset

4. Scrap Sales or Other income which is ancillary to primary business operations

There will be an inflow of funds into business for depositing the Cheque. So, the bank balance will increase. As such, we need to consider Bank GL for all the Cheque related transactions (either issue or receipts).

Every journal entry will have an equal amount of debit and credits. So, there shall be at-least 2 GL accounts to record a transaction.

Cheque received journal entry

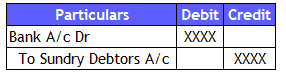

Let’s understand the Cheque received journal entry by assuming it’s from debtors. So, the two accounts here are Bank GL and Debtors GL.

Golden rules of accounting form the basis for recording entries. Per such rules, we need to categorize the identified GLs into Personal, Real and Nominal accounts. Refer to the Journal entry article to get a comprehensive understanding of these rules.

Real accounts comprise asset balances, and there are two accounts in this transaction. The Real account rule is to debit what comes in and credit what goes out.

From the above, we can confirm that Cheque is coming in and the debtors’ balances are reducing. Therefore, the journal entry is

Also Read: Cheque deposit in bank and Cheque dishonour entry

What’s an entry for insurance claims?

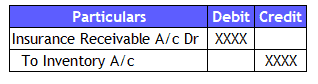

For example, consider Fire Failure Company lost its goods due to a fire accident. So, all the goods were lost. However, the entity has insurance coverage for the total amount. Let’s see how the entry is

Receivable Journal Entry

Entry to record the receivable amount is

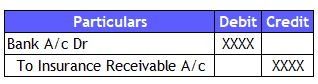

Cheque received journal entry

Entry to record the cheque received

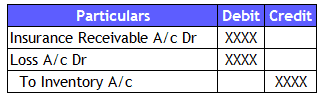

If the insurance claim does not cover the full inventory cost and there is a loss, then the journal entries are

To Insurance Receivable A/c

If the insurance claim does not cover the total inventory cost and there is a loss, then the journal entries are

Journal Entry 1:

We need to add the Loss account to the extent amount which is not paid by insurance company

The total inventory cost is split between insurance claim receivable and the remaining amount as loss. Journal Entry 2 will be the same as in the above scenario.

Interested to purchase an accounting software. Check out tally and zoho accounting software

Frequently Asked Questions:

Is receiving a cheque credit or debit?

Receiving Cheque is a debit in the Journal entry as there is an inflow of funds.

Is check considered Cash in journal entry?

Cash transactions are not that frequent. So, all Checks are deposited in the bank account, which is why we consider Bank GL for recording these Check transactions.

What is a cheque in accounting?

A cheque is a financial transaction to pay or receive amounts through a safe medium like banks. So, it’s an alternative mode to Cash.

Cheque received journal entry Summary:

Cheque-received journal entry records the bank transaction resulting in the receipt of money from customers, insurance claims, or other ways as a part of business operations. We will debit the bank account and credit the customer account as this transaction increases the bank balance and reduces the debtor receivable balance. The receivable balance is converted into a more liquid form (Bank balance).

Recommended Articles