Cheque deposit results inflow of funds.

We will understand JE in Q&A form.

What does Cheque deposit mean?

Its a receipt from the debtors.

Where is Cheque deposited?

Deposit happens in Banks

How to record the Journal Entry?

Identify the GL accounts impacting the transaction.

So, we need to understand the details of the debtors from whom there is a Cheque receipt.

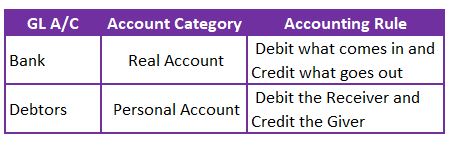

Cheque deposited in bank journal entry involves the Bank Account and the Debtors GL account.

We will now apply the golden rules of accounting for these two GLs to understand which account will be on the debit and credit sides.

From the above table, we will debit the bank account as there is an inflow of funds and credit the debtors as it’s a Giver. As there is a receipt of money from the debtor, we need to reduce the receivable balance to the extent of receipt. Receivable GL will have a debit balance, and to decrease the debit balance, we need to do the opposite of debit. So, we will be crediting the debtors GL in the journal entry.

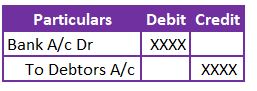

Cheque deposited in a bank journal entry:

Runners Insight:

Note that there will be a gap between when the cheque is deposited in the bank and when it’s cleared. So, there might be a difference between the bank account as per the accounting software (or books of accounts) and the balance as per the Bank (Internet banking or Passbook). We will call those differences reconciling items. A bank reconciliation statement is prepared to ensure both the book balance and bank passbook balance agree.

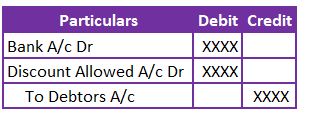

Cheque deposited in the bank Journal entry if there is any discount

Entities generally allow a discount to their debtors if there are quick payments. There will be a discount if the debtors pay off their due amount before the credit period ends. For example, Always Neglect company offers a credit period of 45 days to its debtors. However, there are 3% and 2% discounts if payments happen with a credit period of 15 days and 30 days, respectively.

Runners Insight:

Do you know why the entity offers such a discount?

Cash Inflows will reduce the financing costs. So, the entity offers a discount. However, the discount offered shall not exceed the interest costs saved. The discounts will not exceed 2%-5% of the total receivable in general.

Now that we understand the reasons for allowing discounts, we will learn how to record such discount journal entries.

The new GL account here is the discount allowed. It’s a Nominal account. Per the Golden accounting rules, we need to debit all the expenses and losses and credit all the incomes and gains. So, the discount allowed is forgoing the receivable amount. Therefore, it’s nothing but a loss to the business. As such, we need to debit the discount allowed to GL.

We need to note that the debtor’s balance will be on credit side of journal entry for the full amount. Discounts will not impact it. This is because the entity forgoes the amount, and the balance will be a receipt in the form of a cheque.

Conclusion:

The cheque deposited in the bank journal entry is to debit the bank account and credit the giver. The giver can be debtors or any other entity from whom amounts are due. If any discounts are allowed, the GL will be debited to the extent of the discount, and the balance will hit the bank account. These days we have Cheque deposit machines as well to facilitate easy banking for customers.