Insurance Claim Received Journal Entry

Insurance claim is made due to

- happening of an event or

- the death of the policyholder

Here, happening of event meaning depends on policy.

For example, own damage or damage due to road accident for a car are the events that results in claiming insurance for loss.

An insurance claim will be of a capital nature.

That’s because policy holders opt insurance for assets of higher value like Fixed assets (Machinery, Building etc.,).

Estimated reading time: 5 minutes

Table of contents

- Insurance Claim Received Journal Entry Example

- Different Accounting Approach

- Runner’s insight

- Insurance Claim Received Journal Entry – FAQ:

- Is the insurance claim received an income?

- Is insurance claim an indirect income?

- What is an insurance claim receivable?

- Is insurance received debit or credit?

- Is insurance claim received an asset?

- Which type of account is insurance claim account?

- Is insurance claim a capital receipt?

- What are the types of Insurance claims?

- Conclusion:

Insurance Claim Received Journal Entry Example

XYZ company lost its furniture due to a fire accident in its office building.

Company received the insurance claim in this respect for its furniture immediately.

Want to understand this with some numbers?

The numbers are below

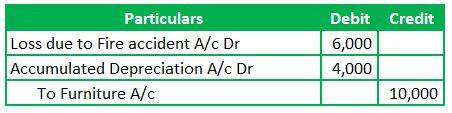

- Cost of furniture lost is $10,000

- Accumulated depreciation is $4,000

It’s clear that the loss equals to $6,000

Also Read: Sold Furniture Journal Entry

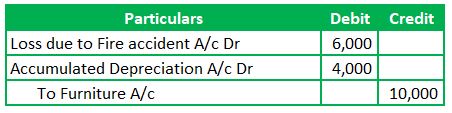

The journal entry in this scenario assuming there is no insurance coverage, is

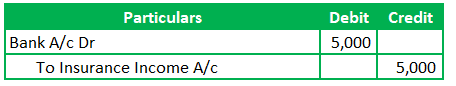

What if there is insurance cover and the insurance company allowed $5,000?

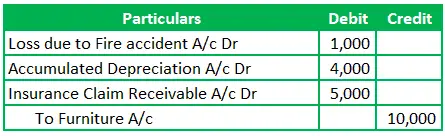

Entry on the receipt of insurance proceeds is

Are you wondering why there is a requirement to pass two entries?

Its usual business practice to record a receivable or liability for any transaction. There can be a time gap between approval of the claim and receipt of the amount. So, we follow accrual concept for recording these kind of transaction.

The concept isn’t over yet.

Different Accounting Approach

Will there be any involvement of the Income account and recognition in the profit & loss account?

Confused?

Don’t worry.

Let’s break it down

Sometimes, the insurance claim takes time to revert back regarding the admission of the claim. So, the total book value of the asset is written down as a loss with no delay.

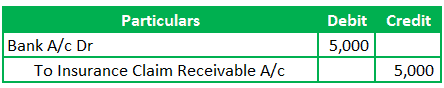

The entries will be

After a month, insurance company allows $5,000

Now, the entry is

Previously, a loss of $6,000 hit the Profit and Loss account.

Now, we need to reduce the loss as there’s a insurance receipt.

So, we choose to nullify the loss by increasing income portion.

It’s just accounting convenience.

Therefore, the net loss is $1,000.

Also Read: Life Insurance Premium Journal Entry

Runner’s insight

We can’t recognize the future Gains in advance owing to conservative accounting conventions or the doctrine of prudence. However, revenue recognition is a different concept. The business can recognize the same if there is certainty and measurability regarding the revenue. Here, Insurance Claim is not a regular income. So, an entity needs to be very sure regarding the realization before recognizing it as income.

Insurance Claim Received Journal Entry – FAQ:

Is the insurance claim received an income?

The insurance Claim received is a capital receipt and will falls under the Income group assuming the above different approach (affecting the Statement of Profit and loss) in accounting is followed

Is insurance claim an indirect income?

Yes, it falls under other income or indirect income.

What is an insurance claim receivable?

Insurance Claim receivable is an asset. The entity can recognize the receivable if the insurance company authorizes the claims. So, there shall be certainty regarding the receipt before recording a receivable asset.

Is insurance received debit or credit?

The insurance Claim received is an income if the second accounting treatment (affecting the Statement of Profit and loss) is followed. Per Nominal Account golden accounting rules, we must credit all incomes and gains. So, we will credit it.

Is insurance claim received an asset?

Insurance claim receivable falls under the asset category. Refer to the above analysis for better understanding.

Which type of account is insurance claim account?

It depends on the scenario. Accounting can be done in two ways: one is to pass an entry hitting the bank account and insurance income, and the second is to create an insurance receivable asset, as mentioned above.

Is insurance claim a capital receipt?

Yes, it’s a capital receipt.

What are the types of Insurance claims?

There isn’t one kind of insurance claim.

The insurance business expanded its wings in a variety of functions, such as home insurance (theft and burglary), wedding insurance, travel insurance, etc.,

Conclusion:

Insurance Claim Received Journal Entry is to record the insurance receivable asset and then the receipt of the amount. There isn’t any new approach to follow. Just following the golden rules of accounting, we need to create an insurance asset and then we will nullify it on receipt of funds. Hope this article provides good insights on insurance claim entry.