Journal entry for Interest on Drawings is to records the interest income.

What’s the need to record?

Drawings might attract interest.

Are you wondering why there is interest charge on drawings?

Come, Lets explore this.

Drawings are the amount that partners withdraw for personal use from the firm.

Business must find an other source of money to substitute the amount of the withdrawals.

Borrowing finances from other sources will not be cost-free.

Therefore, the business obtains funds from external sources to cover the amount of the draw.

That’s the logic for charging Interest on the drawings.

Table of contents

Wanna check some examples here?

Here we go…

- Cash Drawings,

- Usage of business Assets by owner,

- Rental Payment of Owners Residence, or

- Payment of Personal Life Insurance (no commitment from business).

Journal entry for Interest on Drawings:

Interest on Drawings Journal entry is recorded in different manner. Thanks to the flexibility in the accounting.

Drawings Interest can be recorded to either Capital account or Drawings Accounts. Lets take a look at both of those approaches.

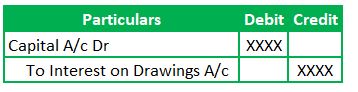

1) Journal entry involving Capital Account

Recording of Interest receivable on drawings from partners:

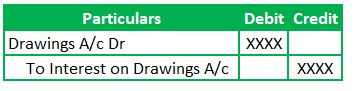

2) Journal entry involving Drawings Account

We need to record the transaction with drawing account. Later on, the drawing account settles with capital account on periodical basis. Let’s look at these entries.

Recording Interest with drawings account:

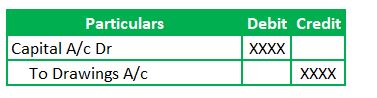

Settlement of drawings account with Capital account:

3) Blended Accounting treatment

The approaches are not over yet.

We got more.

Generally, payment for the Interest on drawings will not be in cash immediately. But in some rare scenarios, partners agree to repay the drawings and interest amount before the year end.

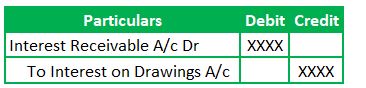

Alternative treatment will be posting the journal entry with the Interest receivable. The entry will be

Recording of Interest Receivable on Drawings:

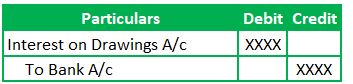

The subsequent entry to record the receipt of the interest from partners.

Note: The above blended approach does not happen frequently.

Runners Insight:

The rate of interest and repayment terms of both the Drawings & Interest will depend on the agreements among the partners. Its worth reading the Partnership acts for a better understanding of all the applicable rules and regulations.

FAQs relating to Journal Entry for Interest on Drawings:

How do you record Interest on drawings?

Interest on drawings is income to the Partnership firm. So, we will credit the incomes and gains as per the golden rules of accounting.

Said differently, an income account can be increased by crediting it per modern accounting rules. The corresponding debit will be the Capital account to decrease to the extent of Interest payable by the partner or Bank account if the payment occurs immediately.

Is Interest on drawings debited or credited?

Interest on drawings will be on the credit side in Partnership’s books.

Is interest on capital debited?

Interest on capital is also a relating concept. Such interest is a expenditure to the business and will be debit in the journal entry. Refer to Capital Interest JE.

Will Withdrawal of Cash for Office Use falls under Drawings?

Nope. Withdrawal of cash for office use is for business operations. So, the transaction will not fall under personal drawings category.

Drawings comes only if the funds or assets used for personal purpose.

Why is Interest on drawings income?

The Interest charge on drawings compensates the Interest payable on External borrowings. The extent of the capital withdrawn from the business needs to be sourced from Lenders like Banks, Financial Institutions, etc. Such Borrowings attract Interest. So, there will be a interest charge on the drawings and is income receivable from the partner to the entity.

Summary:

Interest on drawings is an income to the business and will be on the credit side of the journal entry. The Corresponding debit will be to the Capital account.

A capital account is a liability to the business. Interest on drawings is a receivable from the partner. So, we will set off the capital liability with the Interest receivable asset. Therefore, it is appropriate to debit the capital account in the journal entry.

We hope this article provided a better understanding of Interest on drawings entry.