Life insurance covers the policyholder’s life in case of a mishap.

So, premium is an expenditure for the individual taking the policy.

The frequency of payments can be monthly or quarterly, half-yearly, or annual.

It depends on the agreed terms between the parties.

Premiums are paid as a mandate from the debit cards, credit cards or net banking.

However, there can also be cheque payments, and business entities or corporates will prefer cheques.

Lets see exactly how to record Life Insurance Premium paid by cheque journal entry.

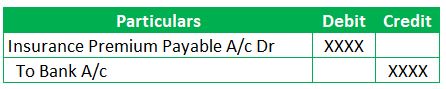

The Insurance Premium and Bank are the GL account part of this transaction. The journal entry will be

Table of contents

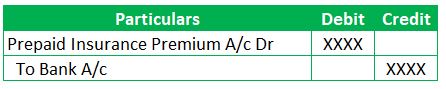

What’s the journal entry for premium paid in advance?

The Prepaid Insurance amount is considered an asset, and it’s because the excess payment does not relate to the current period expenditure. When recording any financial transaction, we must adhere to the Matching Concept.

Per Matching Concept, “Deduct only the Expenses which relate to the current period from the Current year Income.”

Therefore, the prepaid is not a part of the Statement of Profit and Loss. However, we will present it as an asset under the Balance Sheet. Let us look at how to record this transaction.

What is the Entry if the entire amount is not prepaid?

The above Entry applies where the entire payment does not relate to the current period.

Want to read a practical example of insurance policy. Go through this example.

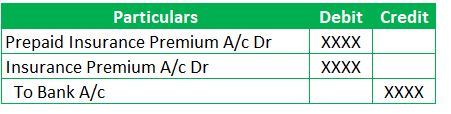

What if some part of it relates to the current period?

Then, one more GL account will record the current year’s expenditure. The Journal entry will be as below.

Logic Pointer

Irrespective of whether the expenditure relates to the current year or subsequent years, the entity must pay the full payment. So, the total of current expenditure and prepaid will equal the cash going out of business.

FAQs:

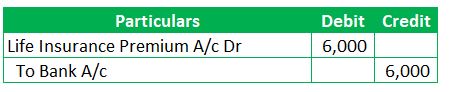

Paid for life insurance premium by cheque Rs.6000 journal entry

The above transaction is the same as the parent topic. The distinction is the explicit mention of the premium amount.

GL descriptions shall be as descriptive as possible. The description of Insurance Premium does not provide a complete picture of the transaction.

Note: Life Insurance Claim

What about the relevant GL description?

The formula is straightforward. Identify the nature of the transaction and apply it. Here, the purpose is not for medical or vehicle insurance; the transaction is for Life insurance.

The ideal Journal Entry, as per the above understanding, is

What is the journal entry if you paid your life insurance premium from the office’s cash?

Payment of Life insurance premium from office cash is an obvious personal expenditure. These transactions occur in the case of a partnership or sole proprietor business.

The Owner or Partner spends office cash for personal purposes. Whenever there is a transaction by Partners of the business, the GL account applicable is Capital or Drawings.

Transaction results in an increase of liability from Partner to business as per the business entity concept. So, we can reduce the Capital account or increase the drawings to the insurance premium.

Logic Pointer

Are you stuck in picking the right approach?

The two approaches are using either a Capital account or a Drawings account. Surprisingly, they both yield the same result, and it is because the Drawing account sets off periodically with the Capital account.

The Journal Entry, in the case of drawings, is

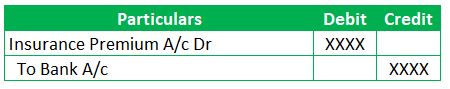

How do you record an insurance payment?

Insurance can be for Health, Marine, Vehicle, Home, Fire, Theft, etc. So, the critical part before recording this transaction is to identify the nature.

The naming of the GL account will have the most significant impact on understanding the transaction’s nature. The GL description should be Home Insurance Premium Account if the expense is for home insurance.

We will, however, learn accounting for this transaction in a general sense. The insurance payment journal entry will be

(Or)

Entities will generally record the accrual entry by debiting the expense and crediting the liability. So, the liability account will be debited for payment entry.

Summary:

Life Insurance Premium paid by Cheque Journal Entry is to record the premium paid through the bank. The transaction results in increasing expenditure and a reduction in the bank balance. The Journal entry is debiting the insurance premium and crediting the bank account.

If the transaction relates to a scenario where the partner spends the office money to pay a personal life insurance premium, then we will consider it drawings. The Journal entry will be debiting the drawing account and crediting the bank account.