Recording of Rent of Proprietors Residence Journal Entry happens in case of Partnership business. There will be no requirement for the business to pay its Owner’s rent expenses. It’s because residential rent is a personal expenses. Furthermore, the business and Owner are treated as two different persons per the business entity concept. So, we can count such expenditure as a drawing for accounting purposes.

Table of contents

- Why to record the drawing’s Journal entry?

- Rent of Proprietors Residence Journal Entry

- Can we record the net transaction instead of passing two journal entries?

- FAQs – Rent of Proprietors Residence Journal Entry

- Do the drawings involve only cash transactions?

- Are you thinking about why this must be part of the drawings?

- Which account is debited when proprietor house rent is paid?

- How to rectify the error – Rent of Proprietor Residence amounting Rs.6,000 is debited to Rent Account.

- What’s the Rent of Proprietors residence journal entry amounting to Rs.40,000?

- What’s the Journal entry for the transaction where the Proprietor pays his rent expenses from his bank account?

- How do you record rent in a journal entry?

- What account type is rent expense?

- Conclusion:

Why to record the drawing’s Journal entry?

Drawings result in the withdrawal of Capital from the business. For example, the Owner withdraws cash from the business to pay his new home down payment. It results in reducing the funds available to meet the daily business operational needs. So, businesses must borrow money from lenders to bridge the gap.

A loan from outside does attract financing charges. So, borrowers will expect interest on the Loan amount. Business incurs the interest expense just because there are drawings.

In other words, if the Owner does not withdraw cash from the business, this borrowing situation will not occur. As a result, there would not have been a requirement to pay additional interest.

Rent of Proprietors Residence Journal Entry

The transaction involves three GL’s – drawings, rent, and cash. The initial transaction is to record the rental expenditure and then allocate it to drawings account.

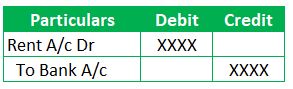

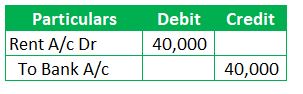

Recording the Rental expense Transaction

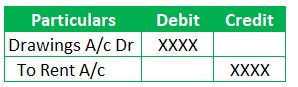

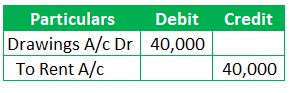

Allocating the personal rent expense to Drawings

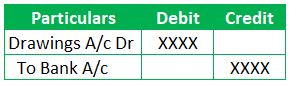

The net transaction is

Can we record the net transaction instead of passing two journal entries?

There isn’t any rule. It’s always advisable to record as per the first approach. If we see the net entry alone, it seems that the Owner has withdrawn some cash from the business unless there is a clear description of the Narration.

Furthermore, most of the time, accountants who handle bookkeeping won’t be familiar with the big picture. So, we will record the first two entries instead of just last entry.

FAQs – Rent of Proprietors Residence Journal Entry

Do the drawings involve only cash transactions?

Nope. Drawings can also be an in-kind transaction.

For Instance, Faithful Company buys and sells refurbished computers as a business. The Owner withdrew a laptop and gifted it to his daughter. Here, we can count the value of such goods as drawings.

Are you thinking about why this must be part of the drawings?

Think the other way round.

If the Owner does not withdraw the laptop, selling it would have generated revenue. However, we need to recognize the laptop cost as drawings. We shall not include the profit portion in this. This is because we’re attempting to balance the books. Therefore, we need to consider only book value.

Drawings (in Kind) result in decreasing the value of the purchase. So, we will credit the purchase’s GL account with a corresponding debit to drawings in a journal entry.

Related Article: Interest on Capital

Which account is debited when proprietor house rent is paid?

We will debit Rent Account on payment of proprietor house rent. Later, we shall transfer it to the drawings account.

How to rectify the error – Rent of Proprietor Residence amounting Rs.6,000 is debited to Rent Account.

From the above, we can infer that the drawings entry is not recorded. So, we will debit the drawings and credit the rent account for Rs.6,000

What’s the Rent of Proprietors residence journal entry amounting to Rs.40,000?

Runners Insight:

In General, the drawings account settlement happens periodically with Capital. So, the Final effect is reduction of drawing account balance from the capital account.

What’s the Journal entry for the transaction where the Proprietor pays his rent expenses from his bank account?

The Journal entry will not be part of books of accounts. It is not necessary to record the entry if there is no involvement of business cash.

The owner uses his bank account to pay his rent (a personal expense). No money or business bank accounts are involved; it is strictly personal. Therefore, we won’t record it in the company books of accounts.

How do you record rent in a journal entry?

We can record the Rent Journal entry by debiting the rent account and crediting the rent payable account. When payment occurs, we will debit the rent payable account and credit the cash account.

What account type is rent expense?

Rent Expense is an indirect expense and will be part of the nominal account.

Conclusion:

Rent of Proprietors residence journal entry results in recording personal expenses of Proprietors. We shall not record the non-business transaction in the books. If personal expenses are paid through business cash, then it results in recording drawings.

The initial entry in books will be recording the debiting the rent and crediting the bank.

The final entry will be a debit to the drawings and credit to the rent account.