Cash withdrawal is a contra entry.

Here, this JE involves Cash & Bank GL.

Cash can be withdrawn for

- Office use or

- Personal use

Personal drawings is not for business.

How about an example?

Owner pays his rent with office cash.

It doesn’t facilitate business in any way.

Lets see the thumb rule

“Check whether drawings help business”

Digital payments led to less withdrawals.

Can we say that there are no Cash transactions ?

Nope.

We can say that cash transactions are negligible.

There are still instances that require cash usage.

For example, Staff welfare requires cash payment.

So, let’s learn how to record such transactions.

Withdrew Cash for Office Use Journal entry

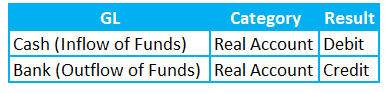

Cash withdrawn from bank journal entry involves 2 GL accounts.

Those are Cash and Bank. So, there will be

– Increase in Cash balance as it comes into the business and

– Decrease in Bank balance as it goes out

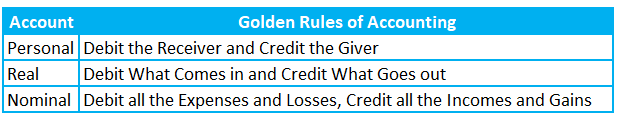

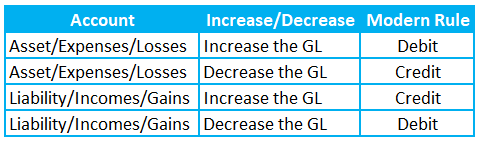

We can record the entries as per Golden rules or Modern accounting rules. Let’s learn the two types of rules.

Golden Rules of Accounting

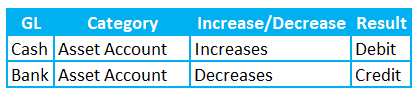

Modern Rules of Accounting

The accounting team needs to analyze the basis of these rules and determine which account needs to be debit or credit.

We will understand how to analyse the Withdrew Cash for Office Use Journal entry before recording it as per Modern rules and Golden rules.

Also Read: True Up Journal Entry

Analysis as per Golden Rules of Accounting

Analysis as per Modern Rules of Accounting

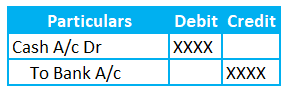

We can now record the journal entry.

FAQs for Withdrew Cash for Office Use Journal entry

What is the journal entry for cash withdrawal?

The Journal entry for cash withdrawal is debiting the cash and crediting the bank account.

What is the entry for drawings for office use?

Drawings for office use do not hit the capital account. So, it will affect cash and bank accounts. The entry will be debiting the cash and crediting the bank.

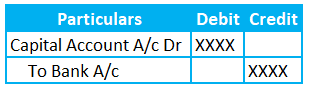

How do you record withdrawals for personal use?

Withdrawals for personal use are drawings and happens generally in partnership firms. Capital accounts get reduced if partners withdraw cash from the business. We can consider this type of transaction as repayment of capital.

The journal entry will be

Is a withdrawal a transaction?

Yes, withdrawal is a transaction. So, withdrew cash for office use journal entry is recorded in the books of accounts as its a financial transaction. Transaction that does not affect the business finance does not need to be considered for accounting.

Also Read: Cash Coverage Ratio

How is Cash withdrawn from bank journal entry recorded?

Cash withdrawal from Bank Journal entry can be for office use or personal use. If the intention is not clear, we can assume it as for business purpose. So, the journal entry in this case will be

debit the cash and credit the bank.

Also Read: Interest on Capital JE

When the owner withdraws cash from the business for personal use?

If the owner withdraws cash for personal use, it’s nothing but drawings. Refer to the drawings journal entry article.

Are withdrawals debit or credit?

Withdrawal of cash results in a decrease in bank balance and an increase in cash balance. So, we need to credit the bank for withdrawals.

Conclusion

Withdrew cash for office use journal entry records the drawings for business use. Every entry needs to be recorded in the books of accounts irrespective the amount involved. For recording the journal entries, we need to follow the golden rules or modern rules of accounting. So, this entry results in debiting the cash and crediting the bank as per the rules.

Runners Insight:

Do you know the synonym transactions for “Withdrew Cash for Office Use Journal entry”?

- Cash withdrawn from bank journal entry

- Amount withdrawn from bank journal entry

- Cash withdrawal from Bank Journal entry

- Cash withdrawal from Bank

Naming of the above terms seems different but the intention and meaning are same. Also, the meaning business use or office use or official purpose is same.