Recording the Purchase Typewriter Journal Entry, we will understand some basic understanding of typewriter. A typewriter is a mechanical device that allows you to type characters and create documents. It was before the invention of computers. The Typewriter’s major flaw is that it doesn’t have a backspace or delete button. As a result, the person who will type and prepare the documents must be extremely accurate with their typing skills. We might need to use Magic Eraser or Whitener if that isn’t the case. The Typewriter will be part of the assets group. The classification of it as a Current or Non-Current Asset depends on the business or entity that purchases it.

Table of contents

- How about an example here?

- When can we consider it a Fixed Asset?

- Purchase Typewriter Journal Entry:

- Practical Question & Answers

- What is a typewriter in accounting?

- Which of the following account will be credited when a typewriter?

- Is the Typewriter a debit or credit?

- What type of asset is a typewriter?

- What is the journal entry for a purchased typewriter for Rs.7,500?

- How to record Purchase Typewriter Journal Entry for cash for 8000 for office use?

- There is a Sale of Typewriter that has been used in the office. What should the GL account be credited in this sale journal entry?

- Purchase Typewriter Journal Entry Summary:

Want to see the old manual typewriter?

Check out this manual typewriter and new age typewriter to get a sense of how it looks.

How about an example here?

For Instance, assume False Typewriting is a company that manufactures and sells typewriters.

Typewriters are sold to make a profit, compared to the stock of goods, which is a primary product that aids in achieving business objectives. Furthermore, it takes to convert such stock into cash to be less than 12 months. So, it falls into the Inventory (Current Asset) category for the False Typewriting Company.

When can we consider it a Fixed Asset?

Dishonest company is in the business of preparing and designing pamphlets and flyers. The Company business is increasing year over year. So, the company intends to purchase two more typewriters.

In the above example, the typewriter assists in creating pamphlets and flyers. The economic benefits of such a resource are not limited to a single year, and as a result, the value it provides lasts for more than a year. To be precise, it lasts for the life of the Typewriter.

Are you wondering how precisely the life of the Typewriter is?

That’s not an easy answer, and it depends on the usage. However, we can count on a minimum of 5 years and no upper limit to give you an idea.

Purchase Typewriter Journal Entry:

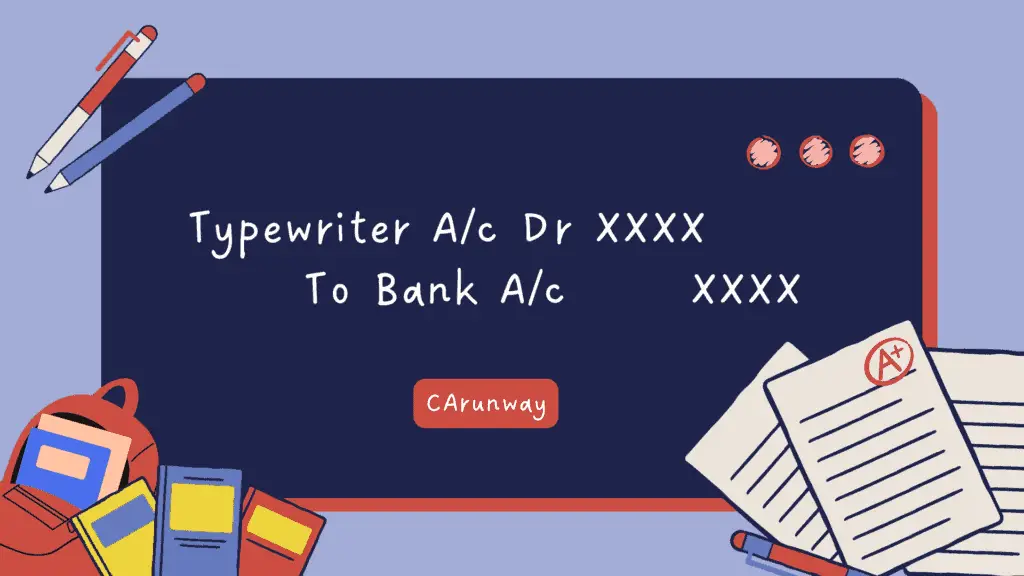

Let’s see how to record the journal entry for typewriter purchase. The GL accounts here are Typewriter and Bank Account.

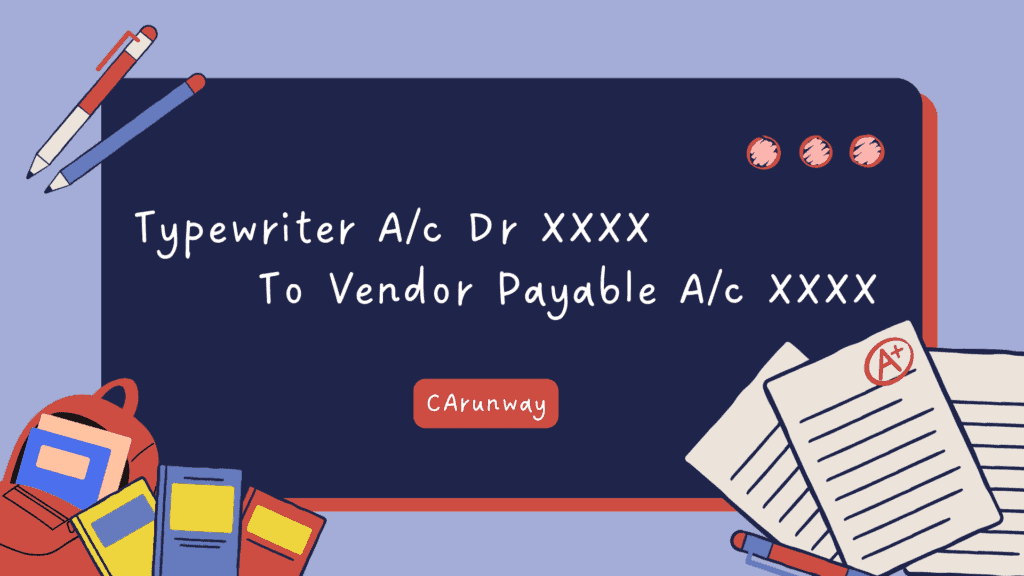

What if the vendor offers credit to repay the amount?

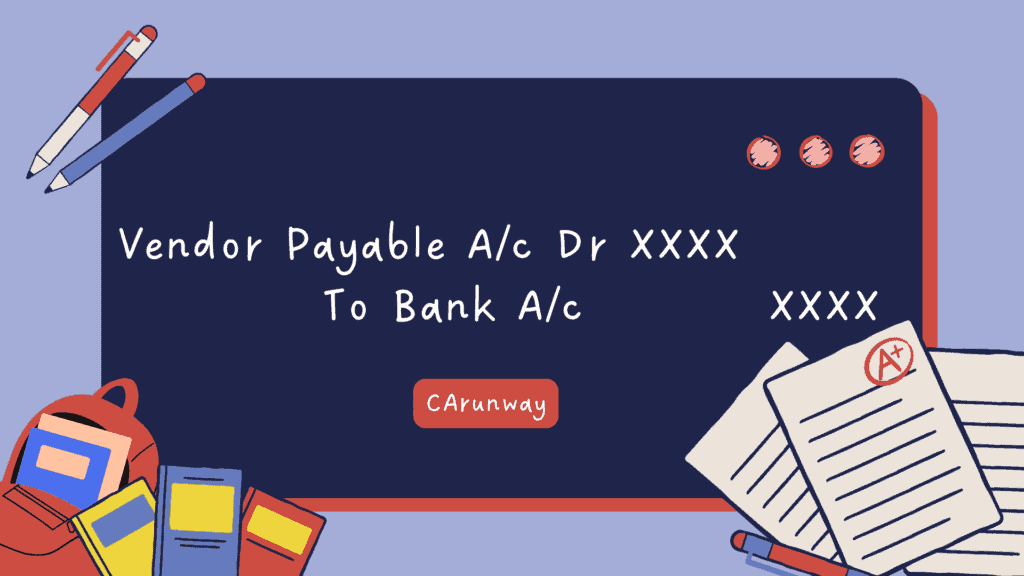

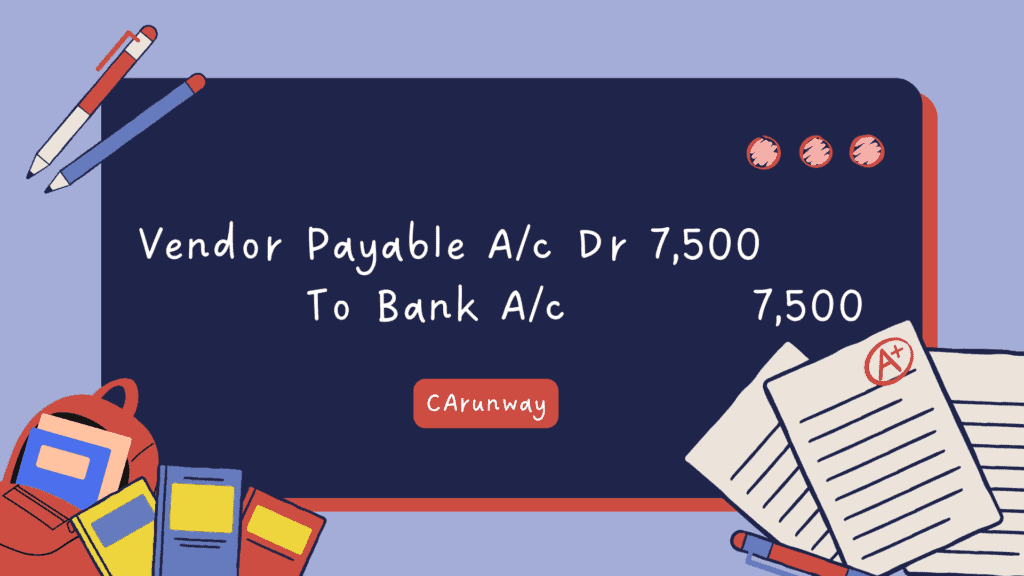

The Journal entry to record the Payment

Practical Question & Answers

What is a typewriter in accounting?

A typewriter falls under the category of an asset in accounting. Business entities pay money and bring the equivalent monetary value as an asset.

The asset is a resource that contributes to creating value for the business. For example, Mr Zach owns a ten-story building and earns rent from each of its flats. Here, the building is an asset in this case because that’s a resource that yields a return in the form of rental income.

Said differently, it’s not an obligation (Liability) to the business. If you are unsure about understanding a concept, simply learn its antonym.

Which of the following account will be credited when a typewriter?

The purchase of Typewriter results in a new asset to the business. However, it’s a standard business practice to categorize the accounts under different GL heads depending on their nature.

So, the Typewriter can be categorized as an Office Equipment head.

Is the Typewriter a debit or credit?

The Typewriter is coming into the business, and its value is increasing. So, we will debit what comes in per the Real Account Golden accounting rules, and the Typewriter will be on the debit side of the journal entry.

What type of asset is a typewriter?

The short answer is that it is a Non-Current asset.

The long answer is that it depends on the nature of the business. If the entity is in the business of trading or manufacturing typewriters, it is a current asset. Otherwise, Non-Current assets will be the appropriate category.

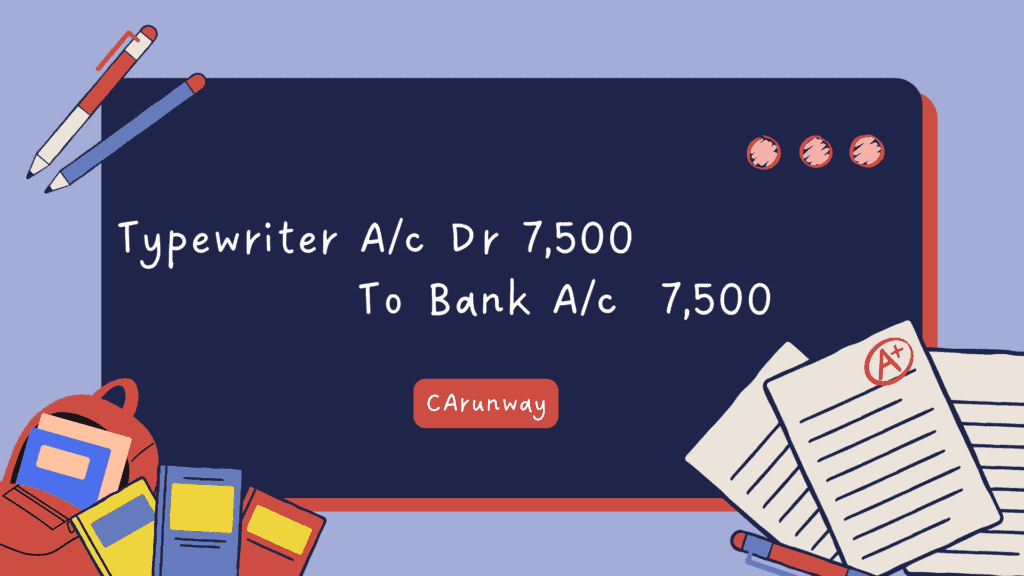

What is the journal entry for a purchased typewriter for Rs.7,500?

Journal Entry can be recorded in two approaches:

1) Cash Approach (Immediate Payment)

2) Credit Approach (Deferment in Payment)

Entry to record the settlement payment

How to record Purchase Typewriter Journal Entry for cash for 8000 for office use?

The Journal Entry will debit the Typewriter and credit the cash for Rs.8,000.

There is a Sale of Typewriter that has been used in the office. What should the GL account be credited in this sale journal entry?

The sale of a typewriter results in a cash inflow. So, on the debit side, there will be cash, and on the credit side, there will be a typewriter.

Selling such fixed assets can result in a profit or a loss. Let’s look at an example to grasp this better.

Mr Loss owns two typewriters, each of which is worth Rs. 10,000. The company is not doing well. As a result, he chose to sell by entering into a contract with Mr Profit.

Depending on its condition, Mr Profit agrees to purchase the Typewriter for between Rs.12,000 and Rs.8,000. Let’s look at the journal entries for recording the proceeds from the sale of the typewriters.

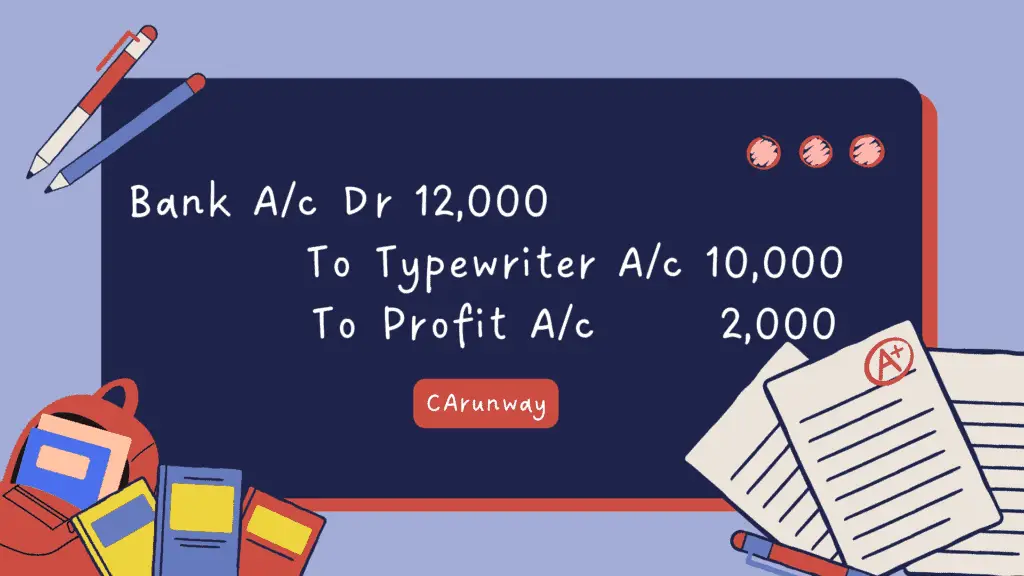

Typewriter Sale value is Rs.12,000 and Profit is Rs. 2,000

Sale of Second Typewriter

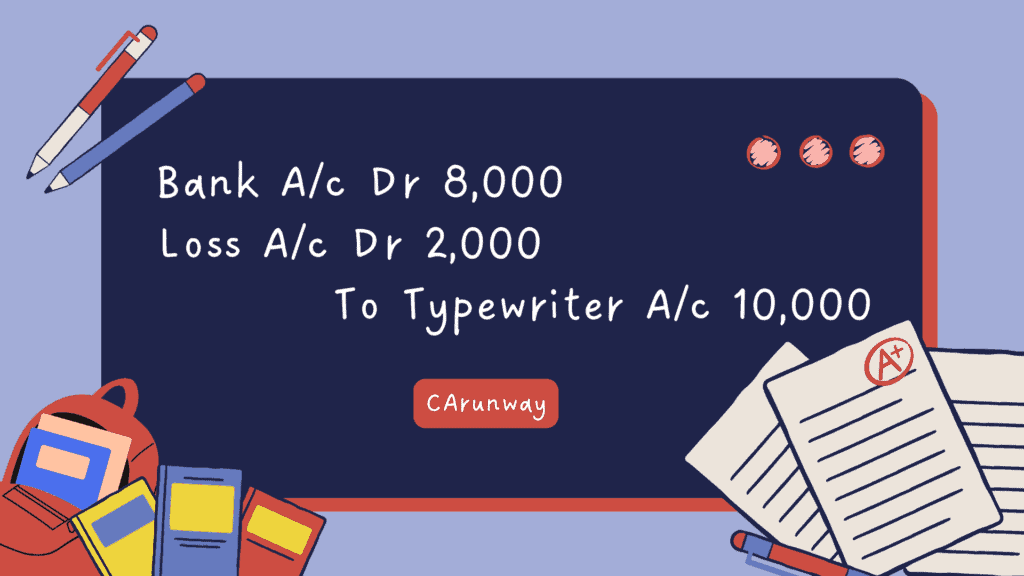

Typewriter Sale value is Rs.8,000 and Loss is Rs. 2,000

Purchase Typewriter Journal Entry Summary:

The use of manual typewriters has decreased in recent years, and computers are taking their place. Typewriter purchases are recorded by debiting the Typewriter and crediting the cash. It can be either a current or non-current asset depending on the nature of the business.