Every Business Model seeks to earn profit by selling services or goods to customers. The first steps in this process are planning and preparation. Budgeting is a component of such preparation. Budgets estimate the costs of acquiring raw materials, purchasing machinery, paying wages, maintaining equipment, and a variety of other expenses. Then, comes estimation of profits and sales volume. The PV Ratio is a metric that aids in determining a product’s profitability. Let’s break it down with the PV Ratio formula and some examples.

PV Ratio means Profit Volume ratio. The ratio helps expressing the relationship of Contribution to Sales. This ratio is also called as Contribution to Sales ratio.

The Profit Volume ratio isn’t just useful when you’re just starting off. But also facilitates the continuing business too.

Table of contents

What’s the formula for PV ratio?

Profit Volume ratio is expressed in terms of Contribution and Sales. It is also called as Contribution ratio.

Profit Volume Ratio = (Contribution/Sales)*100

Are you wondering what does Contribution mean?

Contribution is the amount of sales revenue available to cover up for the fixed costs and profit.

The only thing that matters in a business is how much money the company made in sales. Contribution is one such metric that helps in determining the sales revenue which remains after reducing the variable costs.

Let’s understand the calculation of contribution.

Contribution = Sales Revenue – Variable Costs

Therefore, the contribution is the amount that contributes for the remaining costs which includes Fixed costs and also profit.

Recommended Article: Fictitious Assets (also called as Fake Assets)

PV Ratio Additional Formulas

We can replace the contribution element with Sales revenue and Variable costs in the Contribution ratio formula. Profit Volume ratio is expressed as

PV Ratio = (Sales – Variable Cost)*100/Sales

How about an example to understand the PV Ratio?

ABC Company is a manufacturer looking to grow its business. The cost of expanding a business is enormous. So, it’s important to know how much money you’ll be making. As a result, the company is interested in learning more about how their sales ratio has changed over time.

Since that’s the case, the company wants to see if the current year’s ratio is consistent with last year’s ratio. The information you need to compute the ratio is provided in the following section.

- Sales = $10,000

- Variable Costs = $6,000

- Fixed Costs = $2,500

1) Contribution = Sales – Variable Costs

= $10,000 – $6,000

= $4,000

2) PV Ratio = (Contribution/Sales)*100

= $4,000*100/$10,000

= 40%

The above findings led us to the conclusion that the PV ratio is comparable to that of previous years.

Do we have any different ways to find the Profit Volume Ratios?

PV ratio can also be computed based on the change in contribution or profits and change in sales.

Profit Volume Ratio = (Change in Contribution/Change in Sales) *100

= (Change in Profits/Change in Sales) *100

Example

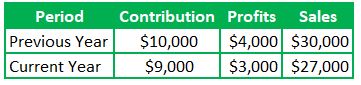

Happy Company is into the business of manufacturing of soft toys. As the financial year end is close, company wants to understand the Contribution ratio. However, does not have the complete information.

So, requested your help to find out the PV ratio with the below limited information.

Contribution to Sales Ratio (based on Contribution amount)

= ($10,000 – $9,000)/($30,000 – $27,000)

= 33.33%

Note: Profit volume Ratio value will be same irrespective of whether the contribution or profits are considered in the formulas

What are the advantages of PV Ratio?

- Profits Volume ratio helps in decision making. Higher PV ratio for the business is more favourable as it indicates high profits. So, PV ratio helps in decision making as well.

- Also assists in calculating the Contribution, Profits, Break-Even point and margin of safety.

Also Read: True Up Journal Entry

Runners Insight#1

What does Break Even Point means?

Break Even point is the number of sales to be made so that the entity does not incur neither profits or losses. So, this is a neutral position.

Break Even point is not just in quantity. We can express that in terms of value as well. The formula for the break even point is below.

BEP in Value = (Fixed Costs/PV ratio)*100

BEP in Sales Units =(Fixed Costs/Contribution per unit)

Runners Insight#2

What does Margin of Safety means?

Margin of Safety is the difference between the total sales and break even sales.

Margin of Safety is the point where the business moves into a favourable position as there will be inflow of revenue contributing to the profits.

Similar to Break Even point, we can express the Margin of safety as well in both value and sale units. Lets see the formulas for it.

Margin of Safety in Sales Units = Total Sales – BEP Sales

Margin of Safety in Value = (Total Sales – BEP Sales)* Contribution per unit. (or) Profit/PV ratio

Also Read: Cash Coverage Ratio

Practical Examples

We understood all the three concepts – Contribution Ratio, BEP and Margin of Safety. Theoretical knowledge does not suffice for a complete learning experience. So, we will do a knowledge check of these concepts with a example.

Worry Ltd Company wants to find out the Profit Volume ratio, Margin of Safety and Break Even point for the Current year. Details of Costs are below.

- Sales = 100,000 Units and Selling price is $30 per unit

- Variable Costs is $15 per unit

- Fixed Costs is $1,000,000

Contribution = Sales – Variable Costs = $15 per unit

Profit Volume ratio = (15/30)*100 = 50%

Break Even Point = Fixed Costs/PV ratio = $1,000,000/50% = 2,000,000

Margin of Safety = Total Sales – Break Even Sales = $1,000,000

Conclusion

PV ratio is expressed in terms of contribution to sales. This helps in calculating Contribution and also various ratio like Break even point, Margin of safety. Entities with a multi product business and limited capital then PV ratio is good metric to determine which is the more profitable business to invest.