Fictitious assets are expenses presented as asset.

Preliminary expenses is example of this asset.

Presentation is for disclosure purpose.

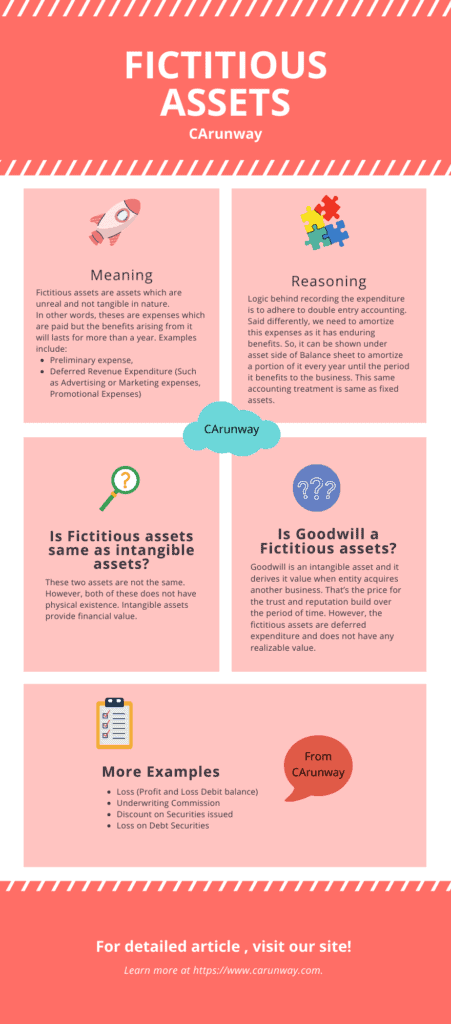

What’s the Fictitious definition?

Fictitious means unreal or not true

Fictitious assets are

- Not real in nature

- Represents miscellaneous expenditure recorded in books

- Not tangible in nature

- Doesn’t have any realizable value

So, we can infer those as fake assets from name itself.

Want to skip the article and read Infographic or Summarized version of this article?

Access the summary from the table of contents below

Lets understand the following terms first.

- Asset

- Miscellaneous Expenditure

- Quick Recap of Golden Rules of Accounting

The above terms are kind of basics.

So, good knowledge about these basics helps in easy understanding of fictitious assets.

Table of contents

- Asset:

- Miscellaneous Expense:

- Quick Recap of Golden Rules of Accounting:

- Understanding the logic behind recording expenses as fictitious assets:

- It’s time for an fictitious asset example in this context:

- Example

- Advantages:

- Disadvantages:

- Frequently Asked Questions:

- What are Fictitious assets?

- Does Fictitious assets realize cash when sold?

- What’s Fictitious Meaning?

- Is Fictitious assets same as intangible assets?

- Is Preliminary expense a capital expenditure?

- Is Goodwill a Fictitious assets?

- Can we classify fictitious asset under Current Assets (or) Non-current Assets?

- Is Preliminary expenses an asset?

- Can we determine the amortizing period for such expenses ?

- Does Fixed Assets and Fictitious assets are one and the same?

- What are the Examples of Non Fictitious Assets?

- Understanding the Miscellaneous expenses which are grouped under Fictitious asset:

- Fictitious Assets Infographic Summary:

- Key Points:

- Conclusion:

Asset:

Asset is a property or resource that provides future benefit. It can be either in tangible or intangible form. These assets drives the operational activities of the entity and helps in advancing the business operations. So, assets help in thriving the success of any business.

Miscellaneous Expense:

The word Miscellaneous means items of varied or different sources. As such, this expenses comprises of different categories. The details of all such category is below:

- Preliminary expense,

- Deferred Revenue Expenditure (Such as Advertising or Marketing expenses, Promotional Expenses),

- Loss (Profit and Loss Debit balance)

- Underwriting Commission

- Discount on Securities issued

- Loss on Debt Securities

Note: Please refer below for detail understanding of each of these terms

Quick Recap of Golden Rules of Accounting:

Do you remember the Second and third Golden Rules of Accounting?

Second rule (Real Accounts) is “Debit what comes in and credit what goes out“

Third rule (Nominal Accounts) is “Debit all the expense and losses, and credit all incomes and gains”

Also Read: Understanding Wasting Asset (Fixed Asset)

Understanding the logic behind recording expenses as fictitious assets:

Now, we understood the above three terms and will see what’s the logic behind the treatment of fictitious assets.

If incurring a Miscellaneous Expenditure provides benefit that lasts for more than one accounting period then its not appropriate to amortize it in the same year. These expenses provide future benefits over a period of time like Assets.

Further the quantitative value of these expenses is very huge. If those high value expenses are written off completely in the same year against the earnings, then it distorts the net income in the financial statements.

It’s time for an fictitious asset example in this context:

ABC Company spent huge amount on promotions during the year . This helps consumers to know about the company. Because of these continuous advertising spends, it results in good reputation & relation with consumers. So, there are higher chances of purchasing the products of ABC Company. There’s no guarantee that sales will increase immediately but it will happen over course of time.

This huge expense provides enduring benefits and the company shall amortize for more than one period.

Recording in the books of accounts:

While recording journal entries in the books of accounts, debit all assets with corresponding credit to bank (for cash transactions) or credit to a liability (for non-cash transactions). So, all the GL accounts having debit balance is comes under assets side of balance sheet. This presentation of GL with debit balance under Assets and GL with Credit balance under liabilities is to ensure the double entry book keeping. It’s based on the principle that every debit shall have a corresponding credit.

What if, the entities does not follow this principle ? Balance sheet does not tally. Assets will not be equal to Liabilities. So, this expense having debit balance are good to present under asset side but not along with liabilities side.

Note: The basis for all these is golden rules of accounting. Debiting the expenses and crediting the liability or cash depending on whether its a cash or credit transaction.

Also read: Test of details

Example

Lets see an example to get a holistic picture of this concept.

Large Construction Company is into the business of Pharmaceuticals. It’s one of the most successful and a leader in its industry, with a profit of $10 Billion. The company has incurred a massive loss of $16 Billion in one of its primary generating Plant due to an Earthquake.

This business loss is not a normal one. But is an abnormal loss which is part of ordinary course of business. Can we consider this abnormal loss as a Fictitious asset?

Let’s see why this loss is a Fictitious asset from below analysis.

The loss is very high and equals 1.6 times of annual profits. We need to recognize the losses in the Statement of Profit and Loss as a debit against the incomes per Nominal Account golden accounting rules. However, this loss can’t be recognized in the same year because of its abnormal nature. Further, the loss incurred will distort the company’s income if recognized in one year. Additionally, it’s not a transaction that impacts one business’s financial year, and this will impact over a couple of years on the business and takes time for the business revival.

Also Read: Contingent Assets

Factors to Consider:

Management deemed this loss as unforeseen and decided to recognize the loss over the next five years based on the above reasons mentioned. We need determine the period of amortization of such loss is as per the following considerations:

- Company will be able to complete the plant construction within the next six months.

- Company will be able to revive the business within a year

- Profits will start normalizing from the 2nd year of revival

- Insurance Claims received for this loss are $11 Billion.

So, the Management decided to recognize the remaining $5 Billion loss equally over the next five years to ensure uniform spread.

Runners Insight:

The factors that require consideration vary with the facts of the scenario, industry in which the entity operates, internal factors like a revival of business, financial stability, and external factors like insurance claims receivable. The above considerations in the above example are provided to give a holistic understanding of the Management thought process. Thus, the entity needs to study all these factors before recognizing these losses as fictitious assets or miscellaneous expenditures and determining the amortization period for such losses.

How to Record Journal entry for Fictitious Assets?

Let’s understand how to record the Journal entry for the Fictitious assets in this scenario.

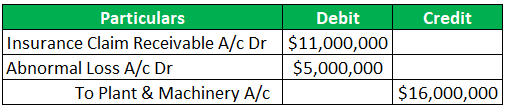

Recording the Abnormal Loss as Fictitious assets in the year when a loss occurs. So, the GL accounts which are part of this transaction are:

1. Plant & Machinery Loss of $16 Billion

2. Insurance Claim of $11 Billion

3. Abnormal Loss of $5 Billion

Recording Business Loss

Per Modern rules of accounting, Asset Increase and decrease results in debiting and crediting the Journal entry.

(Being the business loss relating to the Earthquake recorded)

The Loss GL, which needs to be amortized over the period, will be named based on its nature. There isn’t any formula to derive the GL account description, and it’s a good practice to ensure the GL name reflects its nature. In this scenario, we can describe it as abnormal loss and group under fictitious assets.

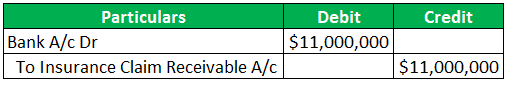

Entry to record the Insurance proceeds

Runners Insight:

Note that any insurance claims require a nominal fee to be paid along with an application claim for processing. If there are any such charges then we need to consider it as an expense and the amount of disbursement will reduce to that extent.

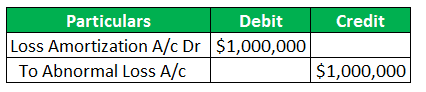

Abnormal Loss Amortization

The abnormal loss is shown as Non-Current Assets under the grouping of Fictitious assets. Every year the abnormal loss is written off as decided by the Management over five years. The entry will be

(Being Abnormal Loss amortized)

Lets consider a different example. Assume that the company found confiscation of the property worth $1 Million. The loss here is negligible in comparison to the net profits of the company. So, it’s advisable to write off the entire loss in the same financial year instead of recognizing it under fictitious assets.

Advantages:

Accounting of Fictitious assets results in spreading the expenditure or loss throughout the period until its impact falls. Thereby the annual net income isn’t distorted.

Ensures following of the Matching concept of recording the expenses against the relating income

Disadvantages:

Determining the total costs that need to be considered a Fictitious asset isn’t easy, and it involves understanding the nature of the transaction and industry proficiency.

Fictitious assets increase the balance sheet value due to deferred expenses or abnormal losses, which are not representative of the entity’s asset value. There will be unnecessary increase in asset balances which are not real.

Frequently Asked Questions:

What are Fictitious assets?

Assets which are fictitious and does not represent any real value are called as Fictitious Assets. For example, its a common practice to present the capital loss as fictitious asset and amortize that loss over a period of time. The one example of fictitious asset is preliminary expenses.

Does Fictitious assets realize cash when sold?

Fictitious assets are nothing but expenditure which are recorded as assets. They do not represent any value. So, the answer is no.

What’s Fictitious Meaning?

Fictitious meaning isn’t require in-depth analysis. We can take fictitious definition in literal sense. So, fictitious means unreal or fabricated (asset in this context).

Is Fictitious assets same as intangible assets?

These two assets are not the same. However, both of these does not have physical existence. Intangible assets provide financial value. For example, intangible asset such as copyright provide rights to the owner for intellectual property such as ownership over the books or music works etc. Whereas Fictitious assets is an imaginary asset. Therefore, fictitious assets is different than intangible assets.

Is Preliminary expense a capital expenditure?

Preliminary Expense is in nature of Capital item. If we recognize the total preliminary expense in the statement of profit and loss then it distorts the total income for the year. Further, the benefits arising from such expense last for more than one year. As such, the preliminary expense is recognized as asset.

Is Goodwill a Fictitious assets?

Goodwill is an intangible asset and it derives it value when entity acquires another business. That’s the price for the trust and reputation build over the period of time.

How about an example?

Small Company is into the Footwear business for more than a decade. Consumers really like the Small Company products and is another name for the quality products.

Big Company is a Multi-National Conglomerate and wants to acquire the “Small company”.

Book value of Small Company Net assets (Assets after reducing the liabilities) is $10K. However, the Market price is $15K. The difference between the Market value and Book Value equals to $5K. Payment of excess price over and above the book value results in recording Goodwill in the books.

After buying the Small Company, Big Company sells all its products under the brand name of Small Company because for its quality. So, big company earns more profits. That’s how Big Company makes money from buying the goodwill (business of Small Company).

However, the fictitious assets are deferred expenditure and does not have any realizable value.

Can we classify fictitious asset under Current Assets (or) Non-current Assets?

Presentation of Fictitious assets is at the end under the assets side (after Current and Non-Current Assets Section). However, we can present it under Current or Non-current asset to adhere with any legislature requirements based on the amortization period of those assets.

Note: While calculating any financial ratios, there is no need to consider fictitious assets .

Is Preliminary expenses an asset?

Preliminary Expenses is not an asset. But for accounting convenience, we need to recognize it as fictitious asset under non-current category due to its debit balance.

Can we determine the amortizing period for such expenses ?

This is very subjective and depends on actual benefit. The context of business plays a crucial role in determination of the period . So, there is no predefined formula for that.

Does Fixed Assets and Fictitious assets are one and the same?

The answer is no. The nature of both the assets are different. Fictitious asset is a deferred expenditure but not at all real asset. Its just a different accounting treatment.

What are the Examples of Non Fictitious Assets?

Sometimes, its best to learn in the reverse order. Non Fictitious Assets are the assets which has either physical existence like Plant & Machinery, Land, Buildings, etc., (or) which does not have the physical existence like Goodwill, Copyright, Patent, etc.

Similar to Non Fictitious asset, these Fictitious assets will also have a charge to the income statement as amortization.

Understanding the Miscellaneous expenses which are grouped under Fictitious asset:

1. Preliminary Expenses

The word Preliminary means initial. So, all the initial expense which are incurred before formation of any entity are called as preliminary expenses. Normally these expenses include legal fees, Auditor fees, printing and stationery expenses.

Before the entity came into legal existence, entity incurs all these preliminary expenses. These are one time and will not be recurring in nature. Entity need not pay legal charges for its formation every year. Amortizing all these expenses in the first year of operations is not appropriate. It distorts the income statement of the company. Further, these expenses results in very existence of a company. So, it should spread over a period of time. Hence, these are accounted as Fictitious assets.

Note: Promoters or initial members who wants to establish business are the representatives of Entity. These personnel incurs expenditure on behalf of the entity. Once entity comes into existence, entity assumes all such expenditures as relating to its business.

2. Deferred Revenue Expenditure (Such as Advertising or Marketing expenses, Promotional Expenses)

These are expenses which are not in capital nature. Benefits from the expenses incurred will extend beyond one accounting period. Such expenses are called as deferred revenue expenditure.

As per Matching concept, amortization of expenses shall be against the related revenue until the period to which the benefits arise.

What does Capital nature here mean?

It’s a common practice that any expenses incurred in relation to bringing fixed asset to useable condition are also capitalized. These kinds of expenses are not qualifying as deferred revenue expense thereby not a fictitious asset

How about an example of deferred revenue expenses?

For example, assume that Amazon is planning to have “Great Sale days” in the Jan, 2022 (Next year). Great sale days are the days when Amazon offers the products at discounted prices. Customers intend to buy the products more on those days.

So, amazon incurred huge advertising expenses by filming ad shoot with a celebrity in the month of Jan, 2021 to have a big reach to its customers. Expenses incurred amounts to $10M.

Even though the expenses are incurred in 2021 but these relates to 2022. They should be recorded in 2022 to match against the corresponding revenues. So, this deferring of expenses ensures that the financial information does not comprises any misstatements.

If in the above example, these expenses benefit for more than one accounting period, we recognize those expenses as fictitious assets over a period.

3. Loss (Profit and Loss Debit balance)

Excess of expenditure over the income from operation results in loss. Loss or expenditure are shown as debit balance in the Balance sheet. Therefore, Loss is nothing but the profit and loss debit balance.

4. Underwriting Commission

Underwriters are the investment bankers who help the entities in raising securities. The perfect example where underwriters assist is IPO. They will help issuing entities by determining “securities price”. Also buys the surplus securities (which are not subscribed) from entity and sell those securities in market.

Note: Each and every company that goes for IPO might not be successful. In other words, All the securities might not be subscribed fully by the public/investors. Underwriter provides guarantee to sell specific number of securities to public and in case of failure, they should buy those securities

So, Underwriting commission is the commission for such investment banker for handling the IPO. Those expenses provide benefits for more than a year. That’s because with the funds sourced through IPO will not help just for a year. Company uses those funds to expand its business for a period.

Note: The reason for going to IPO is to mobilize funds at no cost. There will not be any interest that needs to be paid to the investors. Further, dividend is not mandatory to pay. Additionally, those IPO funds are huge and the end use is primarily to expand the business operations which will be having benefits that extends for more than a year.

5. Discount on Share issued

Shares are issued at discount to attract more investors. Its like a profit for the Share holders. Even-though Share holders pay price less than its face value, entity owes the full-face value to the holders.

Raising Capital by offering discount is to utilize for the company business over a period of time. That does not relates to one period. Hence, amortization of those expenses over the period of application of the capital will be more appropriate.

6. Loss on Debt Securities

Issue of Securities at lower prices than its face value to mobilize more debt similar discount on shares

Fictitious Assets Infographic Summary:

Key Points:

We understood in and out of the concept of Fictitious assets along with examples and FAQ. It’s time to put together all the key points.

- Fixed assets (Example – Land and Buildings) and Intangible assets (Example – Goodwill) are real assets and different from Fictitious assets

- Fictitious asset is an Expenditure that benefits the business for more than a year and does not realize any cash as those does not represent any value

- Fictitious asset isn’t always an expenditure that is deferred but can be loss as well. The presentation of such loss as an asset is pure presentation purpose in the balance sheet.

- Examples of Fictitious assets are Deferred Revenue Expenses, Preliminary Expenses, and Discount on Shares issued

Conclusion:

Fictitious assets are the fake assets and presented under non current asset section in the balance sheet. These are nothing but expenditure or loss incurred. Generally, the benefits from these expenses accrue for more than one accounting period. So, these are recognized in the balance sheet as asset instead of full amortizing in the year in which such expense or loss is incurred. These fictitious assets are different from the intangible assets like goodwill.

Fictitious asset examples:

Examples of these fictitious assets are Preliminary Expense, Deferred revenue expenditure, Profit and Loss Debit balance, Underwriting commission, Discount on shares issued and Loss on Debt securities

Lets understand two of the fictitious assets

Preliminary Expenses meaning and example:

Preliminary expenses meaning expenditure incurred during the business kick off period. Entities incur business expenses before legal existence. So, such expense are not fully charged off in the profit & Loss account. Accounting Treatment for the same is different.

Entities capitalize preliminary expenses as fictitious asset and amortize it over the estimated life.

Preliminary expenses examples include legal fees towards incorporation expenses, registration charges, Auditor fees, professional charges, logo charges, advertisement or promotional expense, any other incidental expense etc.

There is no limit for examples of preliminary expenses. To sum up, preliminary expenses are an example of fictitious asset.

Underwriting Commission:

Underwriting commission is a kind of insurance before issuance of shares or other securities. Underwriters are entities who will ensure to have minimum subscription for the issuances. The financial risk is reduced by paying a fee to the underwriters.

Final words: Therefore, understanding the nature of expense or loss and benefits arising from it is a prerequisite to decide if those require recognition as fictitious assets or fully write off in the same year.

Recommended Articles:

Accounting is a vast subject and requires continuous study to have good understanding of the concepts. So, we have added related topics below for reference.