Unearned fees in accounting are a common but often overlooked financial transaction.

When do Unearned Fees Occur?

These Fees occur when customers pay for goods or services in advance, such as with a magazine subscription. Said differently, any transaction involves inflow and outflow of benefit. In case of Unearned fees, it results only in benefit inflow but there is no benefit outflow. Therefore, its a kind of advance. Thus, such advance falls into the category of Liability.

Examples:

- Loan sanction fees,

- Advance Payments,

- Down payments on items which we will purchase at a later date.

Let’s define it.

It’s part of revenue receipt to a company or business before completion of the service necessary to earn the fee.

Why do we record Unearned Fees?

We need to record it as unearned revenue because it does not represent income earned. This means that we should not report it as income on the Statement of Income and Loss at the time of receipt.

Instead, we need to record it as a liability on the balance sheet until the completion of service and the fee becomes “earned.”

Runners Insight:

Even though we defer the recognition of revenue, we need to record all the financial transactions as it happens per accounting conventions

Importance of Unearned Revenue Accounting:

It is important to properly account for these revenue advances because incorrect reporting of these fees will result in not accurately reflecting a company’s true financial picture.

For instance, if reporting of revenue advances as revenue on an income statement, then this will lead to overstating net income and creating an inaccurate representation of profits made by the company during that period.

Also Read: Outstanding Income Journal entry

Further, keeping track of and accounting these type of revenue involves lot of effort and time as well.

Runners Insight:

In addition to correctly reporting all those transactions on financial statements, businesses should also keep track of all such prepayment transactions. Some common prepaid assets include prepaid rent and prepaid insurance.

Accounting department need to track the assets, so businesses receive full value from them when due. Doing so will help businesses manage their cash flow more effectively and maximize their value from all sources of revenue

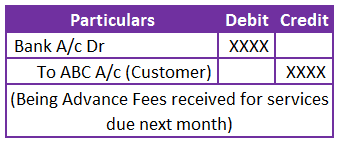

Unearned Fees Journal Entry

It’s a fees that’s already part of Sales invoice, but there is pending completion of services. So, it falls under Liability. We will record the Journal entries as below.

Frequently Asked Questions

What type of account is unearned fees?

These fees occur when a customer pays for goods or services in advance, such as when they prepay for a service that won’t be provided until later. So, it falls under Liability because there is advance payment from a customer before receiving the service or delivery of goods (assuming it’s a sales transaction)

Are unearned fees debit or credit?

It will be on the credit side because it’s a Liability account.

How do you record unearned fees?

We will record the unearned revenue by debit to the bank account and credit to the Liability. If the receipt from a customer, we will credit the accounts receivable account instead of Liability.

Do unearned fees go on the income statement?

It will be part of the income statement only after the completion of service or delivery of goods. So, un-till completion of service or delivery of goods, we call it Liability.

Are unearned fees a current asset?

It falls under current Liability for the provider of service or goods and Current asset for the recipient of service or goods.

Conclusion:

Unearned fees are important for all businesses to report their finances accurately and ensure proper asset management. Understanding how unearned revenue transactions is essential for maintaining accurate records and ensuring profitability through efficient asset management practices.

Businesses can maximize their value from their revenues while ensuring accurate reporting of their financial position at all times through:

- Keeping track of any unearned revenue received

- Ensure properly accounting of those transactions

- Tracking any prepaid assets received so that they can be used efficiently when due

While unearned and unrecorded fees can seem minor in the big picture, they should not be omitted. We need to account for those promptly to ensure the accuracy of financial records.