Sold goods for Cash Journal Entry

It’s all about accounting treatment for cash sales.

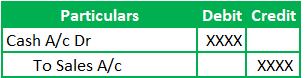

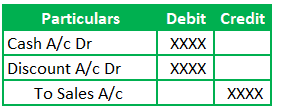

Cash Sales Journal entry:

I know you all are waiting to see the entry.

With no delay, let’s see the accounting treatment

(Being Cash sales recorded)

Estimated reading time: 6 minutes

Table of contents

What’s the amount at which cash sales are recorded?

Trading involves the Purchase and Sale of goods.

Business exist to make profit.

It’s not free of cost.

There is always a profit element.

So, business owners record the Sale of goods at cost plus profit element.

Also Read: True Up Journal Entry

Examples of Sold Goods for Cash Journal Entry:

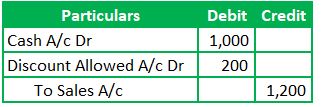

1. Raju receives Rs.1000 as settlement against Rs.1200 due to Mohan in respect of cash sales.

In the books of Raju,

Note: We can name the concession/rebate account as a cash discount or discount allowed.

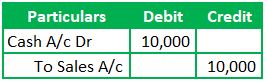

2. Sold goods for Cash Rs.10,000

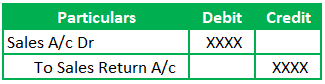

What’s the Sale Returns journal entry?

All customers are not alike.

So, there can be an excellent chance of sale returns.

Of course, returns depend on entity policy.

Lets assume that customer can return within a period of 14 days.

There will be a general clause like –

Goods shall be in original conditions (like no removal of price tags, unaltered and in the resalable state)

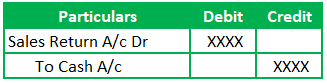

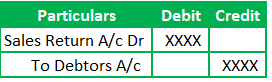

Lets see the sales return entry. It can be either of the following.

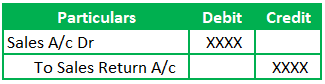

1) Journalize with Sales account

2) Recording with Cash GL account

Note: Generally, returns are not allowed in case of cash sales. That does not mean it’s not at all allowed.

How about a practical example?

We make purchases of provisions from Super Markets.

I remember that the supermarkets allow free delivery of rice. It was a big deal before the COVID times. Particularly when the big basket, Grofers, is slowly starting its operations.

They used to offer sales returns for higher value items like Rice bags for any reason.

Also Read: Cash Coverage Ratio

Do you want to learn the returns journal entry in case of credit sales?

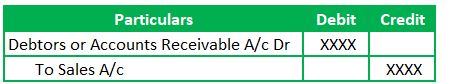

Credit sales:

Sales return:

What if the Sales include a discount element?

Why will there be any discount element in the sales?

Suppliers encourage quicker payments from Customers/Debtors by offering discounts.

Discounts motivate fast cash realizations.

Frequently Asked Questions

When goods are sold for cash which account is debited?

Cash will be on the debit side of journal entry as there is an inflow of funds due to the Sale.

What are goods sold on account journal entry?

Goods sold on account mean sales made on a credit basis. So, there will be a debit to accounts receivable and credit to the sales to record the journal entry.

When goods are sold on cash?

We can’t decide the answer. It depends on the business. For example, wholesale business relies on credit purchases and sales. However, retail businesses will have cash transactions.

For example, if you want to buy some gold ornaments, can you buy them on a credit basis? That isn’t possible. Alternatively, you can buy an Apple iPhone on credit or EMI.

Is sold goods a debit or credit?

Sold goods for cash or credit results in the outward movement of stock. So, goods will be on the credit side of a journal entry.

What is the journal entry for the cash sale?

Journal entry for cash sales will have

- Cash on debit side and

- Sales on Credit side

Here, the sales account represents the goods or inventory of the business.

Cash and Sales are real accounts. So, the real account’s golden rule of accounting is to debit what comes in and credit what goes out.

Cash is coming into the business, and goods are going out. Therefore, cash and goods will be on the debit and credit side of the journal entry respectively.

Conclusions

Sold goods for cash journal entry is to record the cash sales. Debit and credit happen as per the golden or modern rules of accounting. Accordingly, we need to debit the cash and credit the sales. That’s not an end of accounting treatment. There is a scope for a discount. If there is any discount allowed by the seller, then the amount of cash receivable will decrease to the extent of the discount.

To sum up, the cash sales entry with a discount will result in an additional debit of the discount GL account along with the cash and sales GL account. Its just that the cash realized will decrease and the decreased portion is nothing but the discount.