Carriage is an shipping expense.

Such Carriage can be

- Inward Expenses or

- Outward expenses.

What does Carriage here mean?

Expenses incurred for the

- Transportation and

- Handling costs

Why to incur these expenses?

To bring in the goods from suppliers or delivering goods to its customers.

All these are Carriage expenses.

Depending on the nature, we call it as either Carriage Inwards or Carriage Outwards.

Let’s understand the background and nature of Carriage expenses before moving on to the topic, ‘Paid for Carriage Journal entry’.

Table of contents

- Paid for Carriage Journal entry

- Frequently Asked Questions:

- What is the journal entry for Carriage outwards?

- What if the Carriage relates to the asset?

- Is Carriage in a debit or credit?

- How are carriage accounts treated?

- Where is Carriage inwards recorded?

- Where is Carriage outwards recorded?

- Is Carriage on sales an expense or income?

- Is Carriage outwards a direct expense?

- Conclusion

Carriage expenses are like direct expenses as those are necessary either for the purchase or sale of goods. Those expenses will be part of the trading account instead of the profit and loss account. So, it applies to the Manufacturing or trading industry.

The Concept of trading account, profit and loss account isn’t relevant today. So, we can group them under operating expenses in the Statement of Profit and Loss. Carriage and Freight charges are used interchangeably.

Paid for Carriage Journal entry

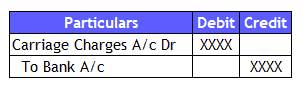

The two GL accounts involved in this transaction are Carriage Charges and Bank account. Carriage Charges are an expenditure account, and Bank account is an asset.

Runners Insight

We can describe such Carriage accounts as Carriage inwards or Carriage outwards, depending on the nature. It helps in bringing more clarity on understanding the nature of transaction.

Per Modern accounting rules, we will debit the expenses and asset accounts to increase them. So, the entry will be as below:

Runners Insight:

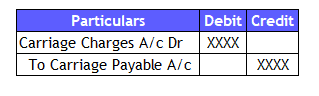

The credit account in this scenario is a bank account. However, that does not always need to be a cash payment. Instead of immediate payment, there can be a deferment per the credit period allowed. For example, if the entity needs 20 transport trips for delivery of goods. It’s not feasible to pay for every trip or day. So, then we need to recognize Carriage Payable GL instead of a bank account.

Carriage Payable Journal entry

Liability Journal entry

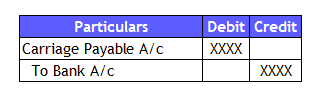

Bank Journal Entry

Carriage Payable A/c

To Bank A/c

The net entry nullifies the Carriage payable GL and result is debit to the Carriage Charges account and credit the Bank account.

Frequently Asked Questions:

What is the journal entry for Carriage outwards?

Carriage outwards is also an expense to the business. But the purpose is different than Carriage Inwards. Those shipping charges relate to the sale of goods as there will be movement of inventory outside the business. The entry will be debiting the Carriage outwards and crediting the bank account.

What if the Carriage relates to the asset?

We need to Capitalize all the expenses necessary for bringing the asset to the working condition. So, we need to record such carriage charges by debiting the asset and crediting the bank.

Is Carriage in a debit or credit?

Carriage is an expense. So, we need debit all the nominal accounts to increase it.

How are carriage accounts treated?

Carriage accounts are direct expenses relating to the business operations and will record it on the debit side of the journal entry.

Where is Carriage inwards recorded?

Carriage inwards relates to the Shipping charges for Purchase of goods. So, the expenses are incurred for bringing the goods from the supplier. If there is a deferment of payment then we will debit the Carriage inwards account and credit the transport liability.

Where is Carriage outwards recorded?

Carriage outward is for transporting the goods to its customers. So, the entry is the same as Carriage inward, just that the GL name is different.

Is Carriage on sales an expense or income?

Carriage on Sales is an expense. If the seller charges such carriage expenses on the invoice to the buyer, we need to first record it as an expense and then we can reverse the same once once the buyer pays it back to the seller.

Is Carriage outwards a direct expense?

Yes, it’s a direct expense because these are primarily related to customer sales.

Conclusion

Paid for Carriage journal entry is to record both the Carriage inwards and Carriage outwards. It’s an expense incurred in trading goods, and that does not apply to the service industry. We can record such expenses by debiting the Carriage Charges and Crediting the Liability or Bank account.