Salary Paid journal entry is to record the expense and payment.

That’s a most frequent expense for any business.

So let’s learn how to record it in any accounting software.

Recording journal entries seem to be rocket science until its learned in the right way. Every transaction includes debit and credit of GL accounts.

The critical rule is that the sum of balances of all GL accounts on the debit side shall equal the credit side. However, it is not a mandate that the GL accounts on the Debit and Credit Side of the Journal Entry shall be equal.

Now that we know the fundamentals of recording the journal entry, we can jump into how to record the Salary paid journal entry.

Table of contents

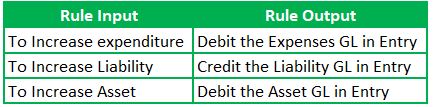

The GL Accounts involved here are Salary Expenditure and Salary Payable Liability. First, we need to understand when shall a GL account will be on the debit side or credit side of the journal entry. So, let’s learn the rules of accounting.

Per Modern Accounting Rules,

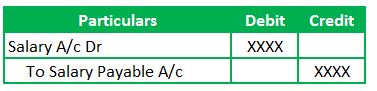

Salary Paid Journal Entry:

We need to debit the Salary GL to increase the expenditure with a corresponding credit to the Salary Payable GL per the above rules.

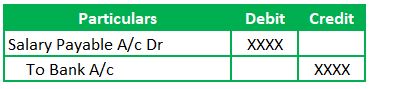

Journal Entry when payment happens:

Journal Entries relating to the Salary:

Let’s look into various journal entries relating to the Salary

Recommended Article: Fictitious Assets (also called as Unreal Assets)

Salary journal entry example:

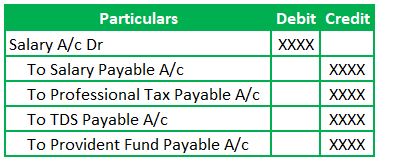

The journal entry is to record salaries due to the entity’s employees. So, the entity debits the expenditure with corresponding credits to the payable. Here Payables include the Salary Liability, other Liability due on behalf of the employees, and taxes, including the professional Tax & TDS payable. First, let’s see how the entry is recorded in the books of accounts.

(Being Salary Expense entry recorded along with the Statutory Liabilities)

Also read: Salary TDS JE

Runners Insight:

Provident Fund

Provident Fund is the amount of contribution from both Employee and Employer to a fund established by the government to support the employees after their retirement. So, the employee contribution is also deducted from Salary and deposited to the Statutory authorities.

Nowadays, employers are quoting the Salary on a CTC basis (Cost to the Company basis). So, the Salary amount debited in the above journal entry includes the employer contribution. So, we need not debit this employer PF contribution as expense separately.

What’s the percentage of Provident Fund?

Provident Fund amounts to 12% of the Basic salary and Dearness Allowance, if any. Refer to PF website for further details on the calculation.

Tax Deducted at Source:

TDS provisions are introduced to ensure the quick and smooth manner of depositing the income tax applicable for the individuals based on their applicable tax rates. So, Employers have the Liability to deduct the Tax applicable to each employee every month and deposit it to the income tax authorities within the stipulated dates.

What’s the rate of TDS?

There is no fixed TDS rates. Employers ask their employees to declare all their income and tax saving information like insurances, mutual funds, 5 Year Fixed deposits etc. This helps employers to understand the total net income for each employee and applicable slab tax rates. Refer to income tax website for tax rates.

Also Read: True Up Journal Entry

Professional Tax

Professional Tax is a tax levied by the governments in the respective states on all persons earning income. The tax amount depends on the Salary of the employee. It has different slabs. For example, a professional Tax of Rs.150 is applicable for salaries in Rs.10,000-Rs. 20,000.

The Primary Liability is of the Employee. Similar to TDS, where Tax is deducted at the source, the professional Tax is also deducted from the Salary by the Employer and deposited to the respective tax authorities. Understand more about the professional tax here.

Salary Received Journal Entry:

Salary is a receipt to the employee. Generally, the employee isn’t required to maintain the books of accounts and record all their financial transactions. Also, there is no legal requirement that says that employees shall not preserve books. The cost of maintaining books is more than the benefits arising out of it. However, we can see how the entry is recorded.

(Being Salary Income received from the company)

Also Read: Cash Coverage Ratio

Salary paid in an advance journal entry:

Employers provide the salary advance to their employees to meet their personal requirements. The amount of advance deducted from the Salary depends on the Employer’s terms and conditions.

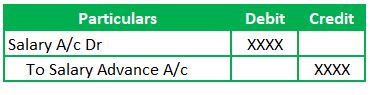

The transaction involves the Salary Advance (Asset) and Bank (Asset). So, these two GLs are real accounts. Therefore, per the above modern rules of accounting, we will record the entry as below:

(Being advance paid to the employee)

The Salary advance will be adjusted against the salary expense when recovered. Suppose the Employer recovers the advance from the next month’s salary. Then, the entry will be

(Being Salary advance adjusted with Salary)

Conclusion:

Salary paid journal entry is to record the payment by the Employer to its employee. So, it will be a debit to the Salary or Salary Payable (if there is already an accrual of liability) and corresponding credit to the Bank account. Like any other journal entry, the steps to record a transaction depend on the GL accounts involved and applicable accounting rules. I hope this article provides a good foundation for recording the different types of salary journal entries.