Purchased Stationery JE is an expense.

Recording stationery expense is simple.

How’s the JE output?

- Debit to the Stationery GL

- Credit to the Cash/Bank GL

There is an alternative treatment.

Credit GL can be a different one.

Credit can be either to

- Vendor Payable or

- Accounts Payable

Estimated Time to Read:

4 minutes

Accounting is to record all the financial transactions to reflect the accurate profit or loss of the business.

Said differently, Capital Investors primarily look for the outcome of the business, i.e., whether they can make some profits from the business.

If that profits are more than the traditional investments, they will be more inclined to add capital to the business.

So, recording the transactions shall need to be precise and speak up for the background of the transaction.

Let’s break down each of the above aspects.

What does recording a transaction in a precise manner mean?

The Journal entry posted in the books of accounts shall be Specific for the GL accounts. If we consider the Stationery Purchase as an example, then the GLs to be involved for entry shall be Stationery GL and Bank or Payable GL.

Instead of Recording Accounts Payable, adding more reference to the GL Account helps in improving the context of entry.

For suppose, Purchase of Stationery is from ABC Stationery Traders. Then, it is more appropriate to record the entry with credit to ABC Stationery Vendor GL.

What does adding a background of transaction means?

We are following the concept of adding Narration and recording each journal entry in the books of accounts.

Let’s consider the same example of recording the Journal entry for Stationery Purchased now. If the Purchase of Stationery is for the administration department or Payroll department, it requires a specific mention in the Narration.

If the Purchase of Stationery is for a new project of the entity, then it should be capitalized. So, the entry being a debit to asset and credit to liability without proper context will result in unnecessary confusion.

Note: Nowadays, the term Narration has different names. For example, SAP requires adding the details in the text field. So, the Narration purpose is the same irrespective of its different names in various accounting software.

Purchased Stationery Journal Entry:

Stationery Purchase journal Entry is similar to recording any other expenses incurred by a entity as part of its Ordinary Course of business. So, it is a debit to expenditure with a corresponding credit directly to Bank Account or to Liability GL. Lets see these entries in detail.

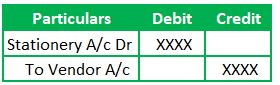

1) Purchased Stationery Journal Entry

Note: Generally, the GL Account description used for recording the Stationery transactions is Printing & Stationery GL. This is not a rule. But its more appropriate to follow the generic GL names.

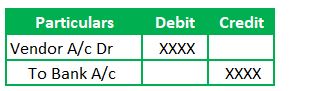

2) Payment Entry

Examples of Stationery Purchase transactions:

Examples for the Stationery Expenses include the Printing, Postage and Courier Charges, Stationery for Office administration like books, files and folders, pens etc.

Summary for Purchased Stationery Journal Entry:

Stationery Purchase is an expenditure Ledger and relates to Nominal Account. So, the Journal entry is recorded by a debit to the Stationery GL with a corresponding credit to Liability GL or Bank GL. There will not be any Tax element in these transactions. However, Sales tax (GST) is already part of the product’s price and need not require a separate mention in the journal entry as the purchasing entity will be the end consumer. Hope this entry brought some clarity on recording journal entry for stationery purchases.

Recommended Posts:

Commission related Journal entry

Audit Fees Accrual Journal entry

Bank Transaction Fees Journal Entry

Cheque Dishonour JE