Identifying the GLs is the first and foremost step in recording any transaction. The GLs in the Purchase goods for Cash transactions are Goods GL and Cash GL. Its general practice to record all transactions relating to the inventory or stock of goods through any of the following GLs but not with the Goods GL account.

- Purchases GL

- Sales GL

- Purchase Returns GL

- Sales Returns GL

Table of contents

- Purchase Goods for Cash Journal Entry

- What’s the Purchases journal entry if there is a credit period?

- What’s the Payment entry for Purchase Goods for Cash after the credit period?

- Why do Suppliers offer discounts along with Credit Periods?

- What’s the Journal entry for the discount received on the Purchase of goods?

- What’s the Journal entry if there are any returns?

- Common Questions and Answers:

- Conclusion:

Depending on the nature of the transaction, we will be using the above GLs for recording the transaction.

Cash and Goods are assets (Current asset by nature) to any business and falls under the real account grouping of Golden rules. So, the applicable accounting rules for these GLs are

- Debit what comes in and

- Credit What goes out

Refer to the Golden rules for a comprehensive understanding of the applicable accounting rules.

Purchase Goods for Cash Journal Entry

Runners Insight

Businesses’ Operations have changed drastically in respect of handling the funds. There are lesser cash transactions and more digital transactions due to the advancement of E-money. So, it’s become a common practice to use “Cash and Bank account” Instead of just describing the GL account as “Bank.”

Also Read: Cash Coverage Ratio

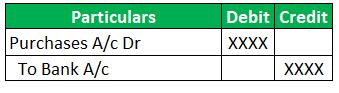

What’s the Purchases journal entry if there is a credit period?

Business needs working capital to ensure a smooth flow of its operational activities. So, obtaining credit from lenders like banks and financial institutions is necessary. Further, Supplier of goods often allows credit period to their customers. The credit period depends on factors such as industry practice, the relationship between Suppliers & customers, the credibility of the buyers, etc. The common credit periods range from 30-45 days.

It’s become inevitable to allow credit due to high competition. So, we will learn the accounting of purchases on credit.

Runners Insight

Having the GL accounts description as specific as possible will be awesome. For example, if the entity has two hundred vendors with whom the business transactions are performed, grouping all the transactions under one account, “Vendor payable” is not a great idea.

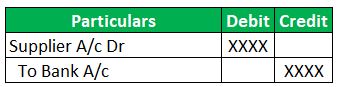

What’s the Payment entry for Purchase Goods for Cash after the credit period?

Per the above entry, it’s clear that the Supplier GL account nullifies, and the net entry is between Purchases and Bank account.

Why do Suppliers offer discounts along with Credit Periods?

Who doesn’t like money coming into their pockets as soon as possible? So, Suppliers offer a discount to the one who pays early.

Let’s compare this scenario to a real-life example

For instance, consider E-Commerce and Online business platforms. They will encourage immediate payment along with purchases.

Have you ever seen discounts offered for cash on delivery?

The answer will be no.

Firstly, the reason for asking quick receipts is to meet their working capital needs. Secondly, it results in lower finance costs.

Also Read: True Up Journal Entry

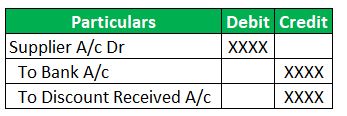

What’s the Journal entry for the discount received on the Purchase of goods?

The first entry to record the liability will be the same as above (Debiting the Purchase and Crediting the Supplier)

Discount received GL will be additionally recorded at the time of payment.

Discount here is a gain to the buyer as the seller agrees to less payment. So, the total liability sets off with short payments. In other words, the credit side amount is split between the bank and the discount.

What’s the Journal entry if there are any returns?

Purchase returns are applicable for credit transactions. Generally, the seller will not entertain the returns in case of Cash transactions. So, the journal entry will be

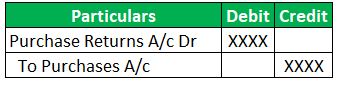

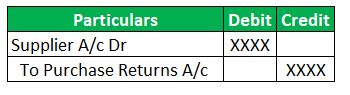

1) Entry to record the returns

2) Entry to reduce the liability

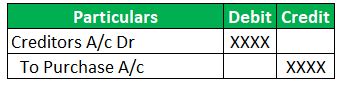

Few entities will avoid the usage of purchase returns and directly debits the Supplier and credits the Purchase to the extent of returns.

Common Questions and Answers:

Purchase return journal entry

Purchase returns are also called returns outwards. So, there will be a decrease in the purchases. The Journal entry will be

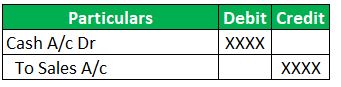

What’s the Sold goods for cash journal entry?

The sale of goods increases cash balance and decreases goods. The entry will be

Purchase Goods for Cash Journal entry

We can record the purchase Goods for Cash Journal entry by debiting the purchases and crediting the cash.

Conclusion:

Goods can be purchased either through Cash and Credit. Cash Purchases result in debiting the purchases and crediting the liability. If there are discounts from suppliers, buyers will pay lesser amounts as it’s a gain.