Salary due to Clerk Journal entry

That’s expenditure for the business

Entry is to record the

- Salary

- Wages

What does Salary due mean?

An expense incurred but not paid.

Business runs on a credit basis.

So, no requirements for immediate cash payments

There will be a credit period.

So, payments will happen within credit period.

Let’s see how to record the entry

Estimated reading time: 4 minutes

Table of contents

- Salary due to Clerk Journal entry

- Journal Entry Analysis

- Frequently Asked Questions:

- Salary Payment Entry

- Conclusion

Salary due to Clerk Journal entry

Journal Entry Analysis

The foremost step is to check for the subject of the transaction and then apply accounting rules.

How do we identify the GL accounts in the transaction?

Let’s go through some foundational stuff here.

Each Financial transaction is recorded with at-least two GL accounts. The GL Accounts are identified with having a good understanding of nature of the transaction.

Every transaction involves both inflow and outflow of value.

How about an example?

Mr. A goes and purchases a pen worth $10 from the shopkeeper. Now, we will analyze this.

What’s the value coming in for Mr. A?

A Pen worth $10

What’s the value going out?

Cash worth $10

Thus, we can say that the inflow and outflow values are equal.

Let’s apply the above principles in the current transaction to record the Salary due to the clerk’s journal entry.

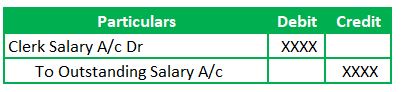

The value coming in is the Clerk Services (Clerk Salary Account), and the value going out is Liability (Salary Outstanding Account). We identified the two GL accounts and now let’s understand how to record the journal entry.

What is the nature of GL accounts in this transaction?

Clerk Salary is an Expenditure GL.

Salary Outstanding Account is a Liability GL.

How is the Salary due to the Clerk’s Journal Entry recorded?

Let’s learn entry under two approaches.

Modern Rules of Accounting:

Debit the expenditure and Credit the Liability to increase them

Golden Rules of Accounting:

Debit all the expenditures and Losses per Nominal Account Rule

Credit the Giver per Personal Account.

What to get a comprehensive understanding of the rules of accounting?

Refer to the Journal Entry article.

Frequently Asked Questions:

What is the journal entry for Salary due?

Debit the Salary and Credit the Outstanding Salary Account.

The nomenclature of the GL account depends on the nature of the transaction. For example, if the entry is to record the factory workers’ Salaries, we can describe the account as Factory wages GL.

Is Salary due debit or credit?

The Salary due is a liability. So, we will record it under the Credit side of journal entry.

What is a salary Journal?

Journal is a record of financial transactions. For example, Sales Journal will have all the Cash and Credit sales. Similarly, the Salary journal houses all wages, remuneration and salary expenditures.

Before the start of Accounting software, mode of accounting is in manual form. Recording of journal entries used to happen through written mode.

The written mode requires for maintaining different books like Cash book, bank book, purchase book, sales book etc.

GL accounts for which there are very frequent transactions are maintained in a book. However, those are not required due to use of accounting applications (Electronic mode).

How do you treat Salary in accounting?

We need to debit the Salary GL as its an expenditure for the business.

How do you do a salary provision entry?

Salary Provision Journal entry is recorded by debit to the Salary and credit to the Salary Provision Journal entry. That’s the same as Salary due entry.

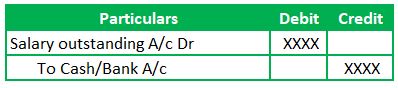

Salary Payment Entry

Recording the Salary Payments is the next entry. We will record the same by reducing the liability and crediting the cash/bank.

Liability is recognized instead of not paying cash immediately. If payment is being made, then no need to have the liability. So, we nullify the already recorded liability credit with a debit in the payment entry.

So, entry is

Conclusion

Salary due to clerk Journal entry is to record the wages/remuneration/salary expenses. We need to debit the Salary expense and credit the Salary Liability.

The subsequent journal entries here are payments of Salary due. We will debit the Salary outstanding entry and credit the Bank account to record the payment Journal entry.

Salary due is also commonly referred to as Salary Provision.