Are you wondering how to record the Goods lost by fire journal entry?

Goods Lost by Fire is similar to any other Loss to the business, and the only difference here is the Loss is in the form of the goods. Therefore, the goods which are purchased are lost due to fire.

Estimated reading time: 7 minutes

Table of contents

- Understanding the Goods Lost by Fire Journal Entry:

- What are the Golden Rules of Accounting?

- Goods Lost by Fire Journal Entry:

- What if there is loss recovery from the insurance company?

- Practical Example:

- Scenario:

- Journal Entries:

- 1) Journal Entry for purchase of goods:

- 2) JE for Purchase returns:

- 3) Goods lost by fire Journal Entry

- 4) JE for recording receipt of the residual value

- 5.1) Journal entry if there is full insurance cover

- 5.2) Entry on receipt of insurance proceeds

- 6) Journal entry if there is partial insurance cover

- 7) Entry on receipt of insurance proceeds

- Conclusion for Goods Lost by fire Journal Entry:

- Recommended Articles:

Understanding the Goods Lost by Fire Journal Entry:

The Goods Lost by Fire and Purchases are the two GLs in the journal entry.

Let’s understand the nature of these two GLs to learn the accounting treatment and pass the journal entry.

Goods Lost by Fire – Nominal Account

Purchases – Real Account

Runners Insight:

Some authors have a different opinion and treat purchases accounts as part of nominal account. The Accounting treatment is the same under both approaches. As these purchases represent Inventory, and it is more appropriate to treat them as a real account.

What are the Golden Rules of Accounting?

Real Account – Debit what comes into the business and credit what goes out from business

Nominal Account – All Expenses and Losses forms part of the debit side of the journal entry, and All Gains and Incomes will be on the credit side of the journal entry

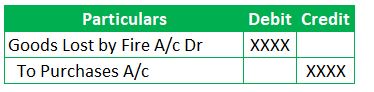

Goods Lost by Fire Journal Entry:

What if there is loss recovery from the insurance company?

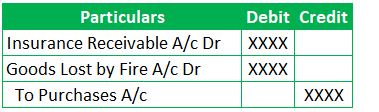

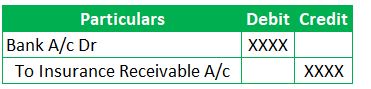

Insurance companies compensate the loss by paying in cash/bank against the insurance coverage policy terms & conditions. So, the journal entry is

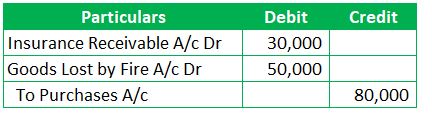

The above entry is applicable if there is partial loss coverage from insurance. So, we need to reduce the Goods Lost by Fire Account to the extent of the Loss covered by the insurance company.

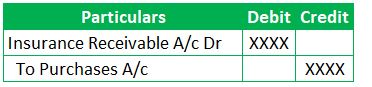

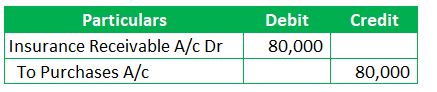

If the Insurance cover is for the total value, then there will be no loss. So, there will not be any Goods Lost by Fire A/ in the journal entry.

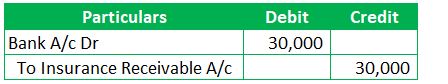

The Journal entry for recording the receivable is:

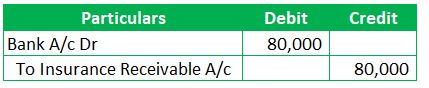

The Journal entry on receipt of insurance proceeds is:

Practical Example:

Scenario:

Let’s see an example with detailed journal entries at each stage, right from purchases to till recording the Loss by fire.

XYZ Company is into the business of manufacture of wooden tables. The primary raw material for this entity is wood. The details of all the financial transactions are below.

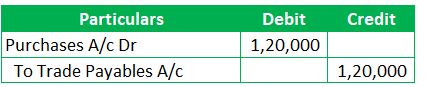

Total Wood Credit Purchases – Rs.1,20,000

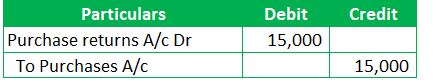

From the above purchases, there are purchase returns due to quality issues with the wood – Rs.15,000

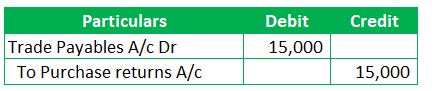

There are two Go-downs – A and B for the purpose of storage of goods. First Go-down A is bigger with a capacity than the second one B. The details of goods in the two go-down’s are

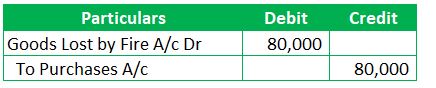

- Go down A – Goods in the store worth Rs.80,000 and

- Go-down B- Goods worth Rs.25,000 are in store

Due to short circuit, there is a fire accident at Go-down A, and all the goods are lost in fire.

Journal Entries:

From the above the scenario, lets deep dive into accounting part and record all theses transactions in the books of XYZ Company

1) Journal Entry for purchase of goods:

2) JE for Purchase returns:

Vendors allow returns only when purchases are on credit basis.

Purchase returns reduces the purchases and also liability. So, there will be another journal entry to reduce the trade payables liability to the extent of the purchase returns.

There is no accounting impact on Purchase return GL. So, the net effect is on Trade Payables and Purchases GL.

3) Goods lost by fire Journal Entry

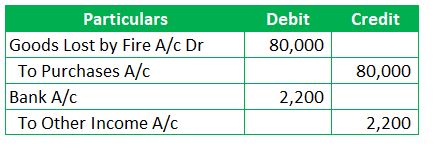

4) JE for recording receipt of the residual value

The above third journal entry applies if there is no residual value from the goods lost. Let’s assume that the scrap value of the wood received is Rs.2,200. Then the third entry will be

The residual value received will not affect purchases as the goods are entirely lost. So, entity needs to record the scrap value as the other income.

5.1) Journal entry if there is full insurance cover

5.2) Entry on receipt of insurance proceeds

6) Journal entry if there is partial insurance cover

Lets assume the insurance cover as Rs.30,000

7) Entry on receipt of insurance proceeds

Conclusion for Goods Lost by fire Journal Entry:

Goods Lost by Fire is a nominal account and is a loss to the business. The Loss here relates to the goods purchased, represented by the purchases account. The two GL accounts are Goods Lost by Fire and Purchases Accounts. Per Golden rules of accounting, Loss and expenses being nominal accounts, will be under the debit side of journal entry .

When goods are brought into the business, purchases being real account will be under debit side of journal entry. Here, the Loss relates to already goods. So, entity needs to reduce the purchases. Therefore, we need to credit the purchases account and debit the Loss in the journal entry.