Rent Paid Journal entry results in

- Debiting Rental expense

- Crediting Rent Liability Account.

Rent is a payment for property use.

What does Properties mean?

House, Buildings, Machinery, Car etc.

Is there any limitation on purpose?

Nope.

It can fall into any of the following purpose

industrial, commercial, or residential purpose.

Therefore, there are no limitation for purpose.

Nowadays, this Leasing business is expanding quite rapidly.

The rental business moved online like

Table of contents

How to record Journal entries ?

Let’s learn how to record journal entries first by following the below steps.

- Identify the Company at which the Journal entries are to be recorded

- Identify the GL Accounts in the transaction

- Understand the nature of GL Accounts

- Apply the Rules of accounting

- Record Journal Entry.

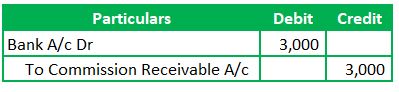

Also Read: Commission Receivable accounting

Example to understand the steps:

We will understand all these steps with an example to ease the learning process.

Flop Company rents wooden furniture with lease payments due each month. Hit Company took the sofa on Rent for 12 months at Rs.3000 per month and a security deposit of Rs.50,000, which is refundable at the end of the rental tenure.

Recommended Article: Fictitious Assets (also called as Fake Assets)

Steps to record Rent Paid Journal Entry:

Consider the above steps as questions and these below ones as the answers.

Step 1. We are recording the journal entries in the books of Hit Company.

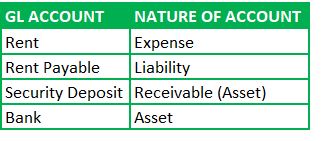

Step 2. The GL accounts which are part of this transaction are Rent A/c, Rent Payable A/c, Security deposit, and Bank A/c.

Step 3 – Nature of GL accounts:

We need to classify the above accounts as any of these – Asset, Liability, Income, Expense, Losses, and Gains

4. Applicable Accounting Rules:

Rent Payable – Liability

Security Deposit – Receivable (Asset)

Bank – Asset

4. Applicable Accounting Rules:

Accounting has 3 rules

- Personal Account Rules

- Real Account Rules

- Nominal Account Rules

The accounts involved in this example are Asset, Liability, and Expenses. So, the applicable accounting rules are Real Account for Liability & Asset, and Nominal Account for Expense.

Real Account Rule: Debit what comes in and Credit what goes out

Nominal Account Rule: Debit the Expenses and Losses, and Credit the Incomes and Gains

5. Recording the Journal Entry:

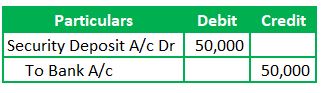

1) Security Deposit JE:

Hit Company needs to pay the Liability and Security deposit per the above rules. Hit company pays the Security deposit now and will get that as a refund at the end of rental tenure. So, the Security deposit is receivable, and Cash from Bank will be paid.

Per Rules,

Security Deposit is debit because it’s the amount that comes back

The bank is credit because it’s the amount that goes out.

(Being Security Deposit made as per rental agreement)

2) Rental Expense JE:

The Rental liability is not a refundable amount. Therefore, Rent Payable is Credit because that goes out, and Rent is debit because it’s an expense.

(Being Rent accrued for the April month)

3) Rent Paid Journal entry:

The rent paid journal entry will be a debit to the Rental Liability which is already recorded above and credit to the Bank GL. So, it results in nullifying the rental liability and resulting entry is debit to the rent and credit to the Bank GL.

Frequently Asked Questions:

How do you record Rent paid in accounting?

Rent paid will be debited with corresponding Credit to the Bank Account, if paid immediately, or Credit to the Rent Liability, to record the accrual entry.

Is Rent paid a debit or Credit?

Rent is an expenditure account and, in nature of Nominal Account. Per Golden rules of accounting of Nominal Account, Debit all the Expenses & Losses and Credit all the Gains & Incomes. So, we will debit the rent expense.

What is Rent paid in accounting?

Rent paid is an expenditure to the business. Therefore, rent paid will be part of the Statement of Profit and Loss.

What is Advance Rent Paid Journal Entry?

Advance rent is an asset to the paying entity. Thus, the advance rent GL will be on the debit side with corresponding credit to the bank GL.

How do you record Rent in a journal entry?

Rental expenses are recorded as a debit in the journal entry. This is because rent expense is a nominal account. Per Nominal Account rule, all expenses and losses need to be debited. Thus, rent expense will be on the debit side of entry.

Is rent liability in accounting?

The rental transaction involves Rent GL and Rent Payable GL. Any business needs to pay the rent for using any commercial space or property. So, rent is an expense and rent payable will be liability.

What kind of expense is a rent payment?

The answer depends on the nature of the business. If the rental premise is critical for business operations, it falls under operational or direct expenses. For example, building a Rent Car showroom is a direct expense. If the rent expense is ancillary to the functioning of the business, then it’s an indirect expense. Therefore, we need to understand the business nature to figure out the type of expense.

Conclusion for Rent Paid Journal Entry:

Rent Payments are expenses to the business. We will record the journal entry by debiting the rent expense and crediting the rent payable (Liability). Generally, the rental agreements will have a tag of security deposit. Such a security deposit is a refundable amount at the rental agreement tenure. The above example entries provide an overview of the concept. Thus, it isn’t a very different from normal expense journal entry.

Related Articles: