Cash Deposit in Bank JE

Its a seldom used journal entry.

Physical cash usage decreasing.

That’s due to use of digital money.

Thus, cash deposits are not frequent.

Thanks to digital era!

There are lot of tech advancements.

Cash Deposit machines are one such improvement.

The majority of the deposits are happening through cash depositing machines.

These deposits are infrequent among the business entities.

However, let’s learn journal entry to understand the accounting part.

Cash Deposit into Bank Journal entry:

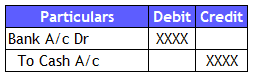

We will first learn how the journal entry looks. Said differently, we will see which accounts are debit and credit to record this transaction.

Runners Insight:

A business will have Loads of banking transactions happening every day. So, the companies are not limiting their bank accounts to one. Therefore, when recording the bank transaction in books, we need to clarify the details of the Bank to which it relates. So, Bank GL Description shall be apparent. For example, Adding the GL description as ABC Bank instead of just mentioning it as Bank will be more appropriate. Thus, such a clear description helps identify a particular transaction in the bank account.

How is the Cash Deposit into Bank Journal entry recorded?

The transaction comprises Cash and Bank GL. These both are assets. Per Modern Rules of Accounting, we need to debit the asset to increase it and credit to decrease it. So, here Bank balance increases and physical cash decreases.

We also have the Golden accounting rules, which form the basis for recording any journal entry. The result will be the same irrespective of the rules of accounting followed.

Recommended Article: Fictitious Assets (also called as Fake Assets)

The GL accounts are categorized into three as per Golden rules, and these are Personal, Real, and Nominal Accounts.

Refer to the below table for

- Understanding the nature of these accounts and

- Summary of rules applicable to all these accounts.

All assets fall into the real account. So, we need to debit what comes in and credit what goes out. Cash going out will be credit, and the Bank balance coming will be debit.

Frequently Asked Questions:

Is cash deposited in bank Debit or Credit?

Cash deposited in Bank will be credited as it’s going out of business. To decrease a GL account with a debit balance, we need to credit those in the Journal entry.

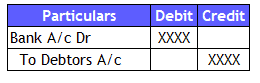

Deposited into bank journal entry

Deposited into bank journal entry accounts for the cash deposits into the bank account. So, we will debit the bank account and credit the cash account. However, if a cheque is deposited into the bank account, we need to identify the other GL Account involved in this transaction. Most of cases, the other GL will be receivables or sundry debtors. All the receipts in the form of the cheque will be deposited into the bank for clearance. The entry for such deposit of cheques will be

What is contra journal entry?

A Contra journal entry is a transaction between bank accounts or cash and Bank. The net effect will not change the balance at higher level GL.

Said differently, Contra entry is similar to keeping money from one pocket to another.

For example, there is a transfer from one bank account to the other. This results in balanced movement within the cash and cash equivalents financial statement line item. There is no increase or decrease in bank balance at the financial statement line-item level.

Also Read: True Up Journal Entry

Is Bank to bank transfer a contra entry?

Yes, Bank to bank transfer is a contra entry. Both the bank accounts are grouped under the financial statement line item “Cash and Bank. ” So, there is no change in the Cash and Bank GL balance.

How can deposit cash entry in tally?

A cash deposit is a contra entry. So, this can be recorded by choosing – ‘Accounting vouchers’ and then Contra (F4). Later, we can select the Ledgers and pass the entry.

Also Read: Cash Coverage Ratio

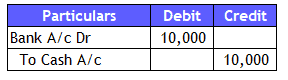

Deposited cash into bank journal entry

The entry results in a debit to the bank account and a credit to the cash. We will learn the money deposited in bank journal entry with an example. Suresh deposited excess cash in hand of Rs.10,000 in the Bank so that he could earn interest on such deposit. The interest received for the year is Rs.400. The entry for deposit and interest will be as follows.

Deposit entry

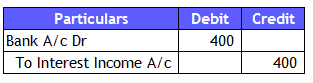

Interest receipt at the end of the year

Bank interest is payable in the account itself. So, an increase in bank balance will result in a debit to the bank account. The receipt is an income and falls into the category of nominal account. Per Nominal accounting rules, we will debit all expenses and losses and credit all incomes and gains. So, we will credit the interest income.

Conclusion

A cash deposit into a bank journal entry is a contra entry, and it’s a contra account because this transaction does not affect the business operations. After all, the net effect is zero. We can record the transaction by debiting the bank account and crediting the cash account.