The dividend is a way of sharing profits with investors.

Do you know the reason to Pay Dividends?

Those are significant motivating factors for driving business investments.

So, Companies tend to declare dividends to its shareholder.

We must follow several steps to correctly record a cash dividend in an entity’s accounting system.

Let’s first see the Journal entry and then will move into further understanding.

Table of contents

- Cash Dividend Journal entry

- How about an example?

- FAQs on Cash Dividend Journal entry

- What’s the Date of the Record?

- Is it required to record Journal entries on the date of Record?

- What’s the nature of the dividends payable account?

- What is the source of funds for cash dividends?

- What happens to the Cash Dividends account after the dividend is paid?

- What is the journal entry for paying out cash dividends?

- Do investors need to make a journal entry for receiving cash dividends?

- Is cash dividends an asset?

- Is a dividend an income or expense?

- Conclusions:

Cash Dividend Journal entry

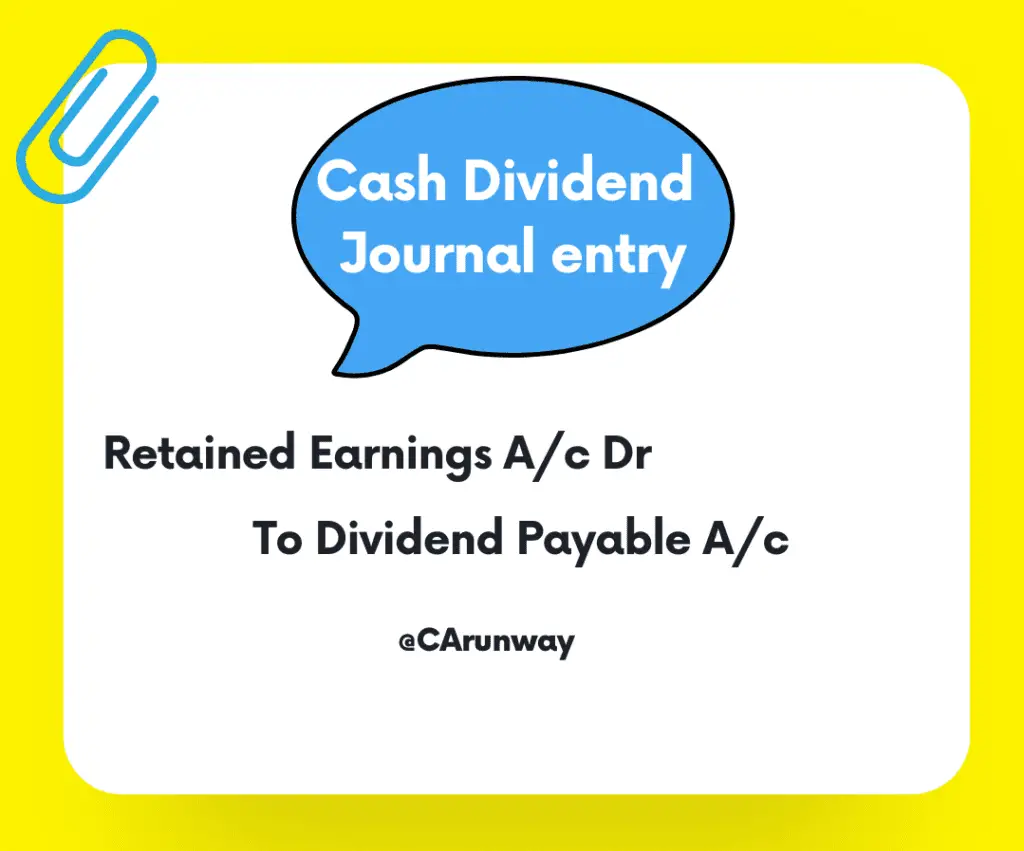

To Record Liability

The first step in recording the cash dividend is to debit the retained earnings (Stock Holders Equity) account while crediting the dividends payable account.

Reasoning:

Retained Earnings (RE) have a credit balance

Those are nothing but the accumulated profits of the business.

Profits are the source from which Dividend payments happen.

So, we need to debit the Retained Earnings GL and credit the Liability GL.

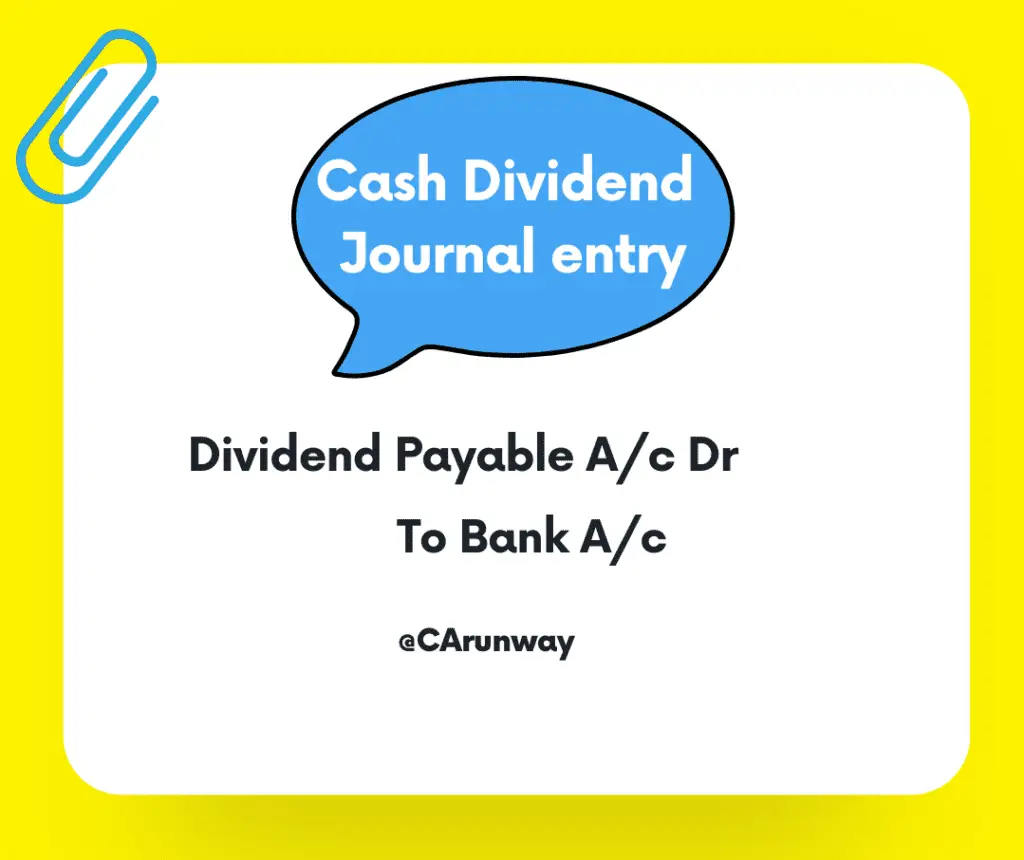

To Record Payment:

Next, we will record the Payment journal entry.

Reasoning:

Dividend Payment results in

- Decrease in Liability and

- The outflow of cash/bank.

So, we will debit the Liability to offset the already recorded credit.

The corresponding credit here will be in the bank account.

Recording cash dividends in a entity’s accounting system requires an accurate and detailed understanding of the process. By following these steps and properly recording the related transactions, a entity can better manage its finances and ensure its shareholders receive their entitled dividends.

Related Article: Companies that Pay higher dividends.

How about an example?

ABC Company has 10K shares with a face value of $100 and a Market Price of $150. Directors of ABC Company declared a dividend of 10% to its shareholders.

ABC Company Accounting department is trying to determine how to account for this transaction. So, they contacted you to record this transaction as you have subject matter expertise.

The primary consideration point here is how to apply the 10% dividend.

Is it applied to the Face value or Market price?

The dividend declared is always on the Face value.

Investor contributes only the Face value of shares to the business. So, its appropriate to pay dividends on face value.

Dividend amount will be = 10,000 Shares * $100*10% = $100,000

FAQs on Cash Dividend Journal entry

What’s the Date of the Record?

The date of Record is a stipulated date by which the entity is required to freeze the shareholders entitled to dividends declared.

Is it required to record Journal entries on the date of Record?

The answer is no. Accounting is applicable on a declared date and paid date.

Also Read: Distribution Journal Entry

What’s the nature of the dividends payable account?

The dividends payable account falls under the current liability group on the balance sheet.

What is the source of funds for cash dividends?

Net profits are source to pay out the Cash dividends.

What happens to the Cash Dividends account after the dividend is paid?

The Cash Dividends payable account nullifies after payment of dividend. So, there will not be any balance in that account. Refer to the above journal entries section for further understanding.

What is the journal entry for paying out cash dividends?

When a entity pays out cash dividends, the journal entry involves a decrease (debit) in the Dividends Payable account and a decrease (credit) in the Cash account, which reflects the reduction in the company’s cash balance.

Do investors need to make a journal entry for receiving cash dividends?

Investors do not need to make a journal entry to receive cash dividends. The dividend payment will be reflected in their account balance.

Generally, books of accounts are maintained by an entity with significant operations. So, its not mandatory to record the entries and maintain books. Therefore, Books of accounts help entities to track their business transactions effectively.

Is cash dividends an asset?

Cash dividends are payments to the investors. So, those will be part of the Liability (Payable) in the books of the investee. However, it falls under the asset group as receivable for investors.

Is a dividend an income or expense?

The dividend is a kind of expense and income for the investee and the investor, respectively. So, the classification depends on the context.

Conclusions:

The cash dividend is a share of profits from the business invested by shareholders. That’s a Liability to the business.

Accounting is easy after considering all inputs, such as understanding the nature of the transaction, arriving at the amounts involved and applying the appropriate golden accounting rules. Here, Real account and Personal account rules are applicable.

Thus, ensure to follow the above guidance in the article.