Journalize here means recording the financial transactions as they occur

The record in which accounting transactions are documented is called Journal. There are different types of Journal books. Purchase Journal, Sales Journal, Returns Inward Journal, Returns Outward Journal, and General Journal are some of the Journal books.

Now, the concept of Journal books has become redundant.

In other words, those are being replaced with Ledgers due to the advancement in the accounting ERP packages.

From the above, we got a good understanding of the topic “Journal.”

Let’s move on to understand how to journalize transactions.

Firstly, we need to focus on understanding the nature of the Transaction. This can be done by answering the following questions:

- What are being purchased or sold?

- Does that an expense or Income?

- Based on the above questions, we need to determine the nature of the purchases. Think and figure out where such purchases or sales will fall (Current asset or Fixed asset or hits Equity)

- What’s the Financial Impact? (Amount involved in the Transaction)

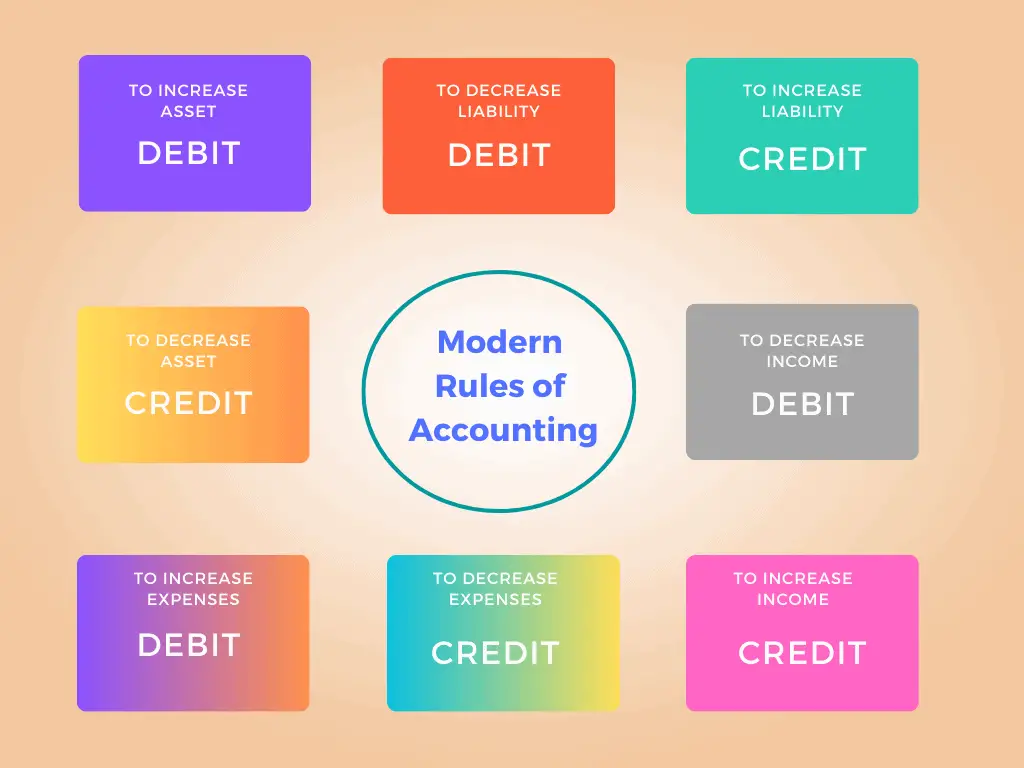

Then, learn the Modern rules of accounting listed below.

High Five!

You are all set with the details of all prerequisites to journalize transactions.

Nothing seems easy unless an example accompanies it.

Doesn’t it?

Here we go with an example.

Journalize transaction Example

Raju & Ravi have been in the Printing Visiting Cards business for ten years. They are always future-looking entrepreneurs. So, they created the unique idea of creating the E-visiting card App, which shares the contact card with all the major messaging apps.

This requires an investment of $100,000 on the Application and recurring monthly expenses of $1,000. Payments happened through the “TTT Bank” Account. Their efforts started showing good results, and they received numerous contracts. Raju & Ravi are delighted, and our happy story ends there!

How do we account for this Transaction?

Roll up your sleeves!

As an accountant, we got some work here….!

Let’s try to answer the above questions.

- Raju & Ravi invested in an Intangible Asset (E Visiting Card Application).

- There is a recurring monthly maintenance expense.

- The first Transaction is a Fixed asset (Intangible Asset). The second one hits the Equity as it reduces the profit.

- The Amount involved are Assets worth $100,000 and Maintenance expenses worth $1,000.

We reached the finish line of the first part.

So, it’s time to level up to the final part of recording the journal entry with the help of accounting rules.

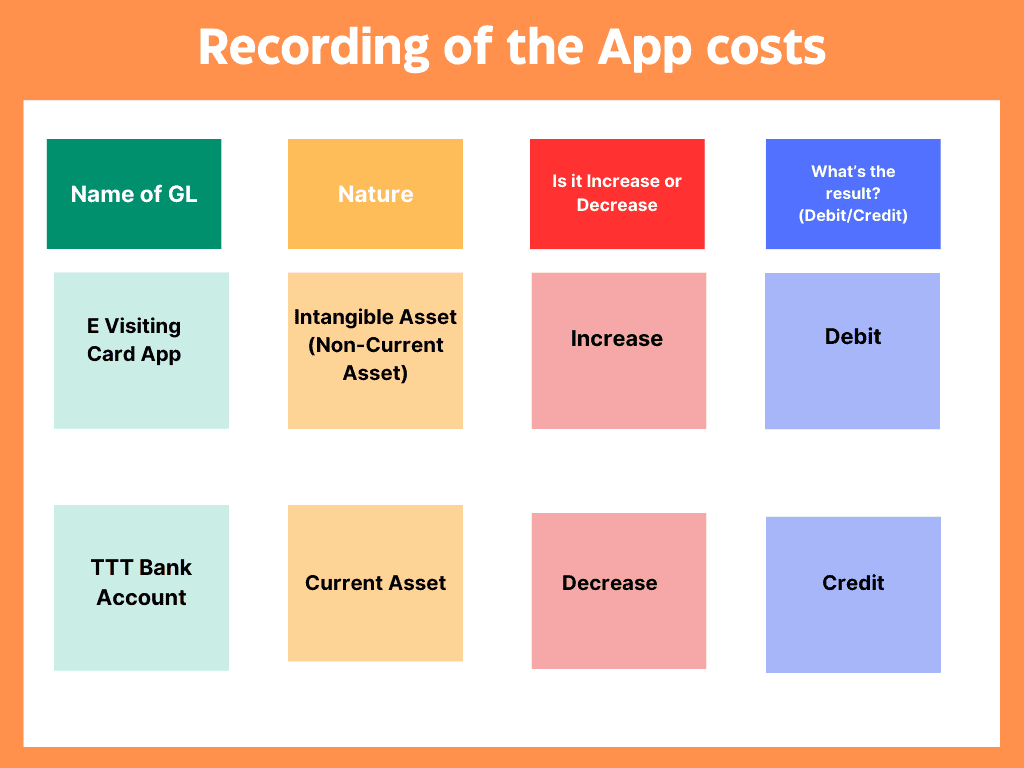

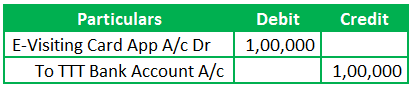

Recording of the App costs

Bank balance decreases as business needs to pay for the Intangible asset. Every forgoing benefit will have an incoming benefit. So, business pays cash to purchase a intangible asset.

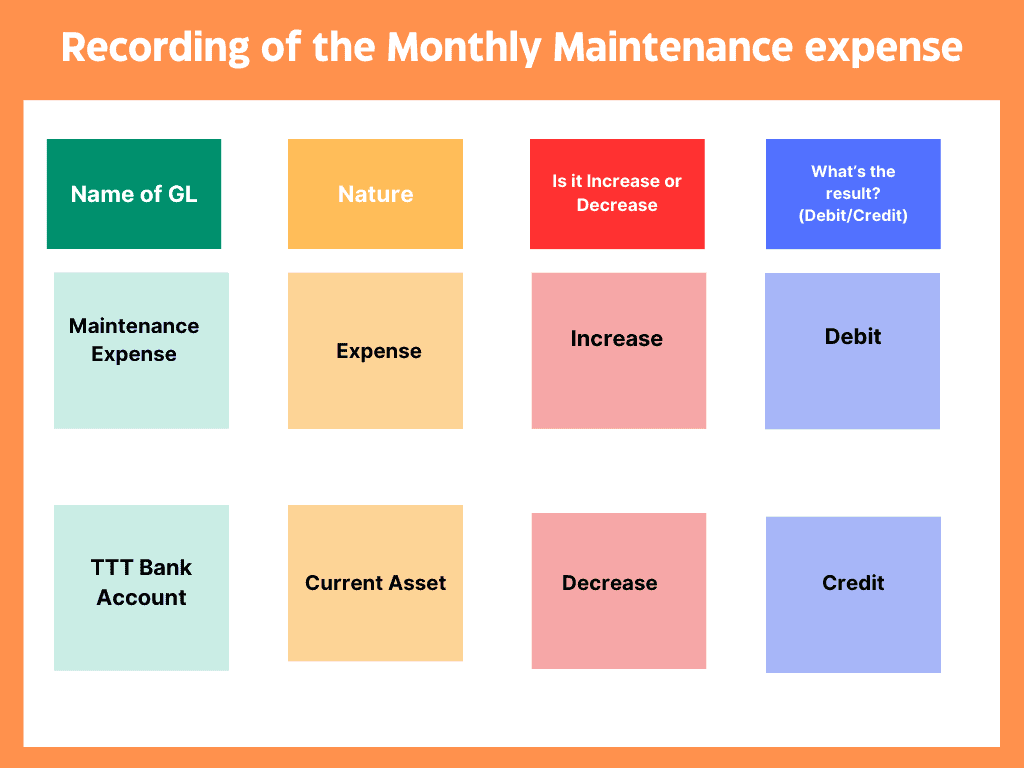

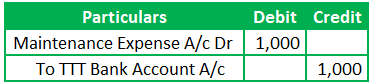

Recording of the Monthly Maintenance expense

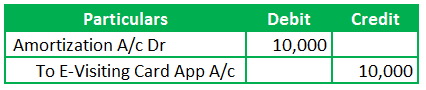

What’s more interesting stuff about recording the Intangible assets?

Recording of the Fixed Assets doesn’t end with mere accounting of its costs and payment. We need to record the additional entries each year as depreciation or Amortization. Depreciation or Amortization is a type of expensing the asset value throughout its useful life. This is to match the expense with its Income from the same month. So, the entry will be as follows, with an assumption that the useful life of its asset is ten years.

Note: Determination of Useful Life shall have a reasoning. The reasons can be the Legal validity, historical usage and Industry standards (for assets like Plant & Machinery). Sometimes, it requires involvement of specialist and obtaining their analysis for estimating the useful life.

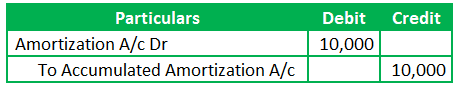

Another way of recording this amortization expense is through the accumulated Amortization GL account.

The purpose of this additional GL is to track the total expensed portion of the assets on a particular date, whereas amortization GL is an expense of the current year.

The Accumulated Amortization will be part of respective Fixed asset account as offsetting contra asset.

Further, we have listed any business entity’s most frequently applicable accounting transactions. These articles comprise an understanding of the background, examples, Journal entries, and Conclusions. Read on to gain an in-depth of the concept of journalizing transactions.

- NSF Check Journal Entry

- True up Journal Entry

- Outstanding Expenses Journal Entry

- Contra Entry

- Topside Entry

Journalize Transactions Summary

Recording the Journal entries requires a

- Clear understanding of the nature of the transactions and

- Identifying the GL accounts (Assets, Liabilities, Expenses, and Income) which increase or decrease

- Learning the Modern Rules of accounting and applying those

The best way to be ready to Journalize transactions is to answer the above questions mentioned in the Introduction section and have your inputs ready for recording the journal entry. Thus, there isn’t an easy way or shortcut to understanding bookkeeping. Therefore, Continue Practicing about understanding and recording of the Journal entries with the help of the above steps.

For more journal entries, we can look in the Accounting Category.