Machinery Purchased Journal Entry

Machinery is a Fixed asset.

It helps in achieving business objectives.

Of course, Profits too!

We does not you to keep scrolling for the entry.

Machinery Purchased Journal Entry

We can record the Journal entry in two approaches.

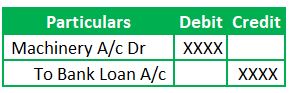

1) Credit Purchase

Generally, business entities purchase machinery in the form of periodical installments from the non-current and non-trade creditors. In such case, we need to credit the liability account instead of bank loan GL.

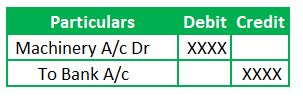

2) Cash Purchase

Estimated reading time: 4 minutes

Table of contents

Runnerz Points

1) All the expenses incurred for the Purchase of Fixed assets need to be capitalized.

Examples: Installation Costs, Labor Charges, Transport charges (assuming these are out-of-pocket expenses for the buyer), taxes, etc.

2) Machinery Account will fall under a Fixed asset, and Bank Loan will be part of non-current liability.

Related Article: Installation of Machinery Journal entry

Journal Entry Analysis Tree

We will understand the Journal Entry in the form of a tree analysis.

Root Question:

Identify what the GL accounts are part of this transaction?

Machinery and Bank or Bank Loan

Branch Question:

Under which category do these GL accounts fall?

Machinery GL and Bank GL Fall under Fixed Asset and Current Asset, respectively (Real Account)

Bank Loan GL Falls under Non-Current Liability (Personal Account)

What are the applicable Golden Rules of Accounting?

Real Account: Debit what comes in and Credit what goes out

Personal Account: Debit the receiver and Credit the Giver

Fruit Question:

What’s the Journal entry?

Debit the Machinery Account

Credit the Bank GL or Bank Loan as per the transaction

Machinery Purchased Journal Entry Example

Raj Traders Purchased Packing Machinery worth $10,000 from MVK Machinery Suppliers. The installation cost is $300. MVK Suppliers offered an AMC Contract for the Machinery at a discount price of $500 for two years.

Raj Traders wanted to take advantage of the offer. So, they paid for the offer along with Machine Cost.

MVK Suppliers reimburse Transportation Charges worth $200.

As Raj Traders is a new entity with no accounting department, it needs your help to record these journal entries.

Solution

Facts: We understood that the Machinery is worth $10,000 from the above facts.

The point we need to analyze is how to record the installation charges, transportation charges, and AMC Charges.

Also Read: Contingent Assets

Per GAAP, “All the expenses incurred concerning an asset need to be capitalized till the asset is put to use.”

Analysis:

- The MVK Suppliers pay transportation charges. So, that’s free of cost for Raj traders. Thus, we need not record it.

- AMC Contract is a contract for the next two years. We need not capitalize it as AMC does not help in bringing the asset in workable condition. Therefore, the amount paid for it is a prepaid expense.

- Installation is a prerequisite for the functioning of Machinery. As such, we need to capitalize the value and depreciate the $300 over the asset’s useful life.

Related Article: Sold Machinery for cash Journal entry

Machinery Purchased Journal Entry FAQs

Which account will be credited when Machinery is purchased?

Machinery Purchase results in crediting the Bank account in case of Cash payment. However, Supplier (Liability) GL is credited for credit transactions.

What is the journal entry for goods purchased?

Goods Purchases will result in a debit of the Purchases GL and a credit of the Supplier GL. Refer to this article for a better understanding of this entry

Is purchase of Machinery recorded in cash book?

Yes, Machinery Purchases will be part of the cash book in case of immediate payment.

Is Machinery a debit or credit?

Machinery will be on the debit side of entry when purchased.

Is purchases credit or debit?

Purchase of goods requires debiting the Purchase GL.

Machinery Purchased Journal Entry Summary

Machinery is a non-current asset that helps in achieving business objectives. However, it can still be a current asset or, more precisely, an inventory.

Based on the nature of the entity business, we can call it inventory. For example, the entity is into manufacturing and selling sewing machines.

Considering Machinery as a Fixed asset, the journal entry will be debited to the Machinery and credited to Bank GL or Suppliers (non-current and non-trade Liability). If the Machinery is a kind of inventory, then the journal entry will as the same as

Recommended Article: Accounting for Repair and Maintenance Journal entry