Purchased Building Journal Entry

The building is a fixed asset

It’s a medium wherein business operational activities are carried on.

What’s the Purchased Building Journal Entry?

We can record this building purchase in two approaches.

The building can be purchased either by

– Cheque (Cash/Bank) or

– Borrowing funds from banks or financial institutions.

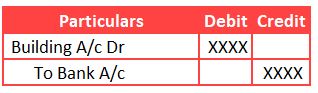

Approach 1

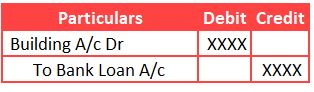

Approach 2

Note: The building can also be purchased from the suppliers (non-current) itself on a credit basis. If that’s the case, it results in a credit of Liability.

Estimated reading time: 4 minutes

Table of contents

Example

What’s the entry of purchase building for cash Rs. 5000?

Purchase of building for Cash or Bank results in a debit to the building GL and credit to the Cash or Bank GL for Rs.5,000

Purchased Building Journal Entry Analysis

Journal Entry Analysis Tree – We will understand the Journal Entry in the form of a tree analysis.

Root Question

What are the GL accounts in this transaction?

Building GL and Bank or Loan from Bank GL

Branch Question

Under which category do these GL accounts fall?

Building GL and Bank GL Fall under Fixed Asset and Current Asset, respectively (Real Account)

A loan from Bank GL Falls under Non-Current Liability (Personal Account)

Also Read: Contingent Assets

What are the applicable Golden Rules of Accounting?

Real Account: Debit what comes in and Credit what goes out

Personal Account: Debit the receiver and Credit the Giver

Fruit Question

What’s the Journal entry?

Debit the Building Account

Credit the Bank GL or Bank Loan as per the transaction

Purchased Building Journal Entry FAQs

How do you account for the purchase of a building?

The purchase of a building results in creating an asset for the business. These fall into the category of a non-current asset. Said differently, the benefits arising from such assets long last. Therefore, we will recognize it as an asset and depreciate a portion over its useful life.

Accounting treatment: Debit the building and credit the Liability assuming funds are borrowed from the bank or financial institution.

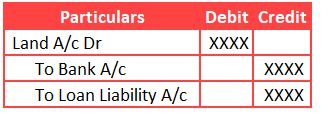

How do you record the purchase of Land in accounting?

The Land is also a fixed asset that lasts forever.

It does not have any fixed life.

In other words, it exists for an indefinite period.

The Journal entry is as follows:

Fixed assets are of higher value, and entities will only be able to pay some of the purchase prices at once through Cash/bank. So, there will be some down payment and balance with the help of a loan. As such, there are two credits in the journal entry. However, if the purchase transaction is through Cheque or Liability, then there will be only one GL account on the credit side.

Runners Point:

There will be no depreciation for the Land. That’s because there is nothing to worn out or decline in the value.

In other words, the usage of machinery results in wear and tear. So, the value of the machine declines. But it doesn’t applicable to Land.

What’s the Purchased building journal entry?

Debit the Building GL and Credit the Bank Loan GL.

Is a building debit or credit?

The building is an asset and will have a debit balance. The exact answer depends on the context. We need to debit when purchased. However, if there is a transfer to another component within the same entity or sold off, it will be on the credit side.

Is land purchase an expense?

Yes, Land purchase is an expense.

But the economic benefits arising from it last for more than a year.

So, we call it capital expenditure.

Purchased Building Journal Entry Summary:

The purchased building journal entry is to record a capital expenditure that is recognized as an asset. We will debit the building and credit the Liability or bank for recording the journal entry. Apart from the initial recording of assets, there will be an annual depreciation expense journal entry.

We must recognize and capitalize all the incidental expenses until the asset is used. So, if there are expenses like registration charges, stamp duty, etc., then recognize them as an asset. The logic here is that those expenses are inseparable from the asset and would not have been incurred in case of no purchase of an asset.