Advertisement helps in marketing.

Its a core indirect expenditure.

What’s the purpose of ads?

- Promote business and

- Maximize customer reach

Thanks for the new digital era!

The advertising medium has drastically changed these days due to digital marketing.

This paid advertisement journal entry is to record the advertisement expenses.

There will be no change in the accounting treatment for advertisements in Print, Visual, or Digital media.

Estimated reading time: 4 minutes

Table of contents

- How to record the Paid for an advertisement journal entry?

- FAQs relating to Paid for advertisement journal entry

- Conclusion:

How to record the Paid for an advertisement journal entry?

The advertisement journal entry includes two GL accounts –

- Advertisement A/c

- Bank A/c or Advertisement Payable GL account.

We need to record the Liability GL account only if there is any delay in payment. However, it’s become a common accounting practice to record the liability first and then pass payment entry even though the payment occurs immediately.

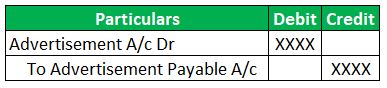

The liability Journal entry is

(Being advertisement expenses incurred)

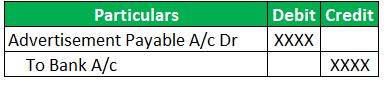

Payment Journal entry is

(Being payment for advertisement expenses done)

Therefore, we can sum up that the net journal entry is to debit advertisement account and credit the bank account.

Runners Insight

Advertisement Payable is a type of accounts payable. So, the grouping will be current liabilities.

FAQs relating to Paid for advertisement journal entry

Is advertising paid an expense?

Advertising paid is expenditure on the business. However, if the benefits from such expenses relate to more than one year, these advertising expenses will be like capital. We need to record such expenses as fictitious assets on the balance sheet and will be charge against profits. Such charge will be in equal amounts throughout the benefit period. Refer to this article for further understanding of the fictitious asset.

Is advertising a debit or credit?

Advertising expense is a nominal account. Therefore, the nominal account rule is to debit all the expenses & losses and credit all the gains & losses. Hence, advertising expenses will be on the debit side of the journal entry.

Runners Insight

Instead of Advertisement Expenses GL, we can use Marketing expenses GL as these two words have the same meaning. So, advertisement and marketing expense GL are interchangeable terms.

Is prepaid advertising an asset or expense?

Prepaid advertising is the charges incurred for the subsequent period in the current year. So, we will record it as an asset on the balance sheet.

How about an example to understand the prepaid advertising?

For example, Consider a company Tricycle, entering into a contract with XYZ Media for advertising on July 1st by paying the total amount in advance. The contract period is 12 months from the date of the agreement. Tricycle Company’s financial year is from Jan to Dec. In this scenario, Jan to June of next month will fall into the prepaid expenditure. So, it’s an asset.

Paid for advertisement journal entry

Advertisement Journal entry is recorded by debiting the advertisement and crediting the bank. So, it results in increase of advertisement expense and decrease of bank account.

Is advertising a capital expenditure?

Advertising is a revenue expenditure. However, if the benefits relate to more than one year, it is a capital expenditure recognized as assets.

What type of account is advertising expense?

Advertising expenses are a nominal account and form part of indirect expenditure (Profit and Loss account). As it’s not a direct expense, it will be not a part of the trading account

Now the concept of trading and profit & loss account does not exist anymore. So, we need to group this as operating expenses in the statement of profit or loss.

Is advertising a current liability?

Generally, Advertisement Payable falls under Current Liability as the expenses are expected to be settled within 12 months.

Conclusion:

Advertisement expenditure is for promoting the business, and it helps reach the business globally. In other words, its nothing but a type of marketing expenditure. We will record such an entry by debiting it and crediting the liability account in the journal entry. The liability account will get nullified on payment of the advertisement expenses. So, the net entry will be debit to advertisement and credit to the bank account.