Staff Welfare Expenses (SW) are the expenses incurred for the benefit of employees of the entity.

These expenses are not in nature of direct payments to employees working for the business.

SW expenses can be in the form of non-monetary value like Gifts, Refreshments, reimbursements to employee on incurring the expenses like gym membership, arranging for team dinners, free medical tests etc.

Generally, the type of expenses which qualify for reimbursement depends on the respective entity policy.

Estimated reading time: 5 minutes

Examples List:

Listing of Staff Welfare (SW) expenses are below to help in getting a sense of understanding the nature of this expense

- Well-being expenses. These days entities started focusing more on well-being of their employees. As such, providing employees with varied range of eligible expenses under this category. These expenses are generally provided as reimbursement to employees on incurring the eligible expenses.

How about some examples here?

Expenses incurred towards Gym Equipment, Meditation Classes, Membership for learning Music/Musical Instruments etc.

- Petty gifts on special occasion (like Chocolates on Entity Milestone years)

- Employees Gym Membership

- Subsidized meals/snacks (to the extent of subsidy qualifies for staff welfare expenses)

- Refreshments like Snacks, beverages

- Employee Team Lunch

- Birthday and Festival Celebrations at office

- Fitness Challenges among coworkers (For example, Weight loss Challenge, 100 Push ups Challenges within 15 mins)

- Doctor on Call Facility (Including Medicines)

- Games Facility at Office (Indoor Games like Chess/Table Tennis, Badminton etc.)

Therefore, all these expenses are not generally provided through Cash Payments.

Instead of Cash Payment, Entity provides these facilities through, “benefits in kind”.

Said differently, entities/management want to ensure that the end use of these expenses is to benefit the customer without a direct payment in cash.

How about an example here?

For example. the entity has concern regarding their employees health. If the entity gives a cash allowance of Rs.15,000 per year for subscribing to a gym membership then its not a conclusive thing that employees are spending the amount for said purpose.

Instead, if the entity adopts a approach of reimbursement of gym membership only upon submission of bills in the name of employee then its helps entity to ensure the achievement of real objective. So, the second approach proves that the employees are actually spending the said money for the stated purpose.

Understanding the Staff Welfare Expenses:

What’s the purpose of these Welfare expenses?

The answer to this question is very logical. Let’s understand the background of this first.

Business thrives based on the employees’ efforts. So, the success of business is dependent on employee’s work. The biggest motivating factor for any employee is the rewards and benefits.

The Increase in net profits or earnings of business might not motivate the employee unless their benefits are dependent on those (Example – Employee rewards are based on certain percentage on earnings). The regular rewards/salary benefits by entities are like – You work I Pay. Therefore, entities want to show their concern on their employees by providing benefits which are beyond the regular Paychecks/Salary.

What’s the accounting treatment for SW Expenses?

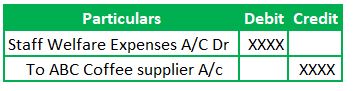

SW Expense is no different in accounting treatment when compared to other expenses. Debit the SW Expenses GL and credit the Bank GL or Liability GL.

(Being Expenses incurred for Coffee/Tea machines)

The Later entry will be a debit to the supplier account with corresponding credit to the Bank Account. So, the subsequent entry is a bank payment journal entry.

Note: It’s also appropriate treatment of directly crediting to the Bank instead of hitting the Liability. This recording of Liability GL and then hitting Bank GL is very common as accounting practice.

Frequently Asked Questions:

Are Staff Welfare Expenses in the nature of personal expenses?

These are the expenses incurred for the benefit of entity employees and workers beyond the regular salary. As such, these expenses indirectly support the business operations. So, SW expenses are not personal expenses.

Is the SW Expense a direct expenditure?

No, Staff Welfare expenses is an indirect expenditure. These expenses are not incurred for the purpose of manufacturing or trading or relates to the primary business operations. Therefore, SW expenses does not fall under the category of direct expenses.

Are Staff Welfare expenses are allowable for tax purpose?

SW expenses are appropriate business expenses as the end use of those expenditure is to advantage of the employees. So, these expenses are allowable for tax purpose.

Is staff welfare expenses fixed or variable?

Employee welfare expenses are not fixed costs. These vary based on the nature of expense. For example, company provides free access to Yoga courses for its employees. This is not mandatory requirement for each employee to utilize it.

Well, it depends on person to person. Some employees might not be willing to. So, company incurs expense for employees who only choose it.

So there is high chances that its a variable expenses.

Conclusion:

Staff Welfare expenses are incurred for the benefits of entity employees. Those are to improve the office culture, Employee health benefits and Employee positive attitude towards entity or its business. So, these expenses indirectly help in succeeding in business operations. As such, these are allowable expenses and not in the nature of personal expenses.

Recommended Articles:

Stationery Purchases Journal Entry

Audit Fees Accrual Journal entry

Bank Transaction Fees Journal Entry

Cheque Dishonour JE